The Business Law News is the official publication of the Business Law Section, and is sent automatically to all members of the Business Law Section. To subscribe, simply join the Section. If you’re a member, you can view articles here.

Want to be a contributor? Click here for the Submission Guidelines.

Call for Law Student Submissions

The Business Law News of the California Lawyers Association invites California law students to submit articles on topics of interest to the business law community. Submissions are subject to the BLN’s submission guidelines.

General Submissions

Please direct submissions to: Editor-in-Chief, Daniel Lev at dlev@sulmeyerlaw.com, and Vice Chair, Zev Shechtman at zs@danninggill.com.

Business Law News 2025, Issue 3

Business Law News 2025, Issue 2

Business Law News 2025, Issue 1 (annual review)

Business Law News 2024, Issue 2

Business Law News 2024, Issue 1 (annual review)

Business Law News 2023, Issue 3

Business Law News 2023, Issue 2

Business Law News 2023, Issue 1 (annual review)

Business Law News 2022, Issue 3

Business Law News 2022, Issue 2

Business Law News 2022, Issue 1 (annual review)

Business Law News 2021, Issue 3

Business Law News 2021, Issue 2

Business Law News 2021, Issue 1

Business Law News 2020, Issue 4

Business Law News 2020, Issue 3

Business Law News 2020, Issue 2

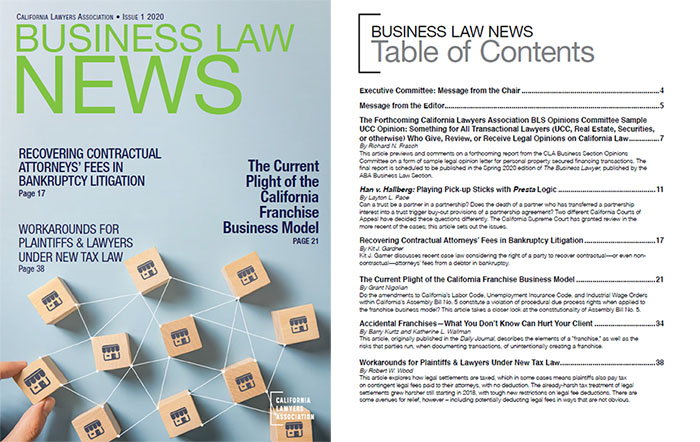

Business Law News 2020, Issue 1

Business Law News 2019, Issue 4

Business Law News 2019, Issue 3

Business Law News 2019, Issue 2

Business Law News 2019, Issue 1

Business Law News 2018, Issue 4

Business Law News 2018, Issue 3

Business Law News 2018, Issue 2

Business Law News 2018, Issue 1

Business Law News 2017, Issue 4

Business Law News 2017, Issue 3

Business Law News 2017, Issue 2

Business Law News 2017, Issue 1

Business Law News 2016, Issue 4

Business Law News 2016, Issue 3

Business Law News 2016, Issue 2

Business Law News 2016, Issue 1

Business Law News 2015, Issue 4

Business Law News 2015, Issue 3

Business Law News 2015, Issue 2

Business Law News 2015, Issue 1

Business Law News 2014, Issue 4

Business Law News 2014, Issue 3

Business Law News 2014, Issue 2

Business Law News 2014, Issue 1

For older publications, please email the web staff to receive a copy of your request.

For more information about the Business Law News, including how to submit articles and otherwise become involved, see Editorial Board for Business Law News and the Annual Report.

Tables of Contents of Older Issues

Issue Number 4, 2015

- Executive Committee: Message from the Chair

By Robert G. Harris - BLN Editorial Board: Message from the Issue Editors

By Everett L. Green - Morris Hirsch Receives Business Law Section’s Lifetime Achievement Award

By Mark Moore - Resolving the Finders’ Dilemma: California Clarifies the Role of Finders in Securities Laws Transactions

By Julie Ryan

Finders—generally understood under California law to mean persons who merely introduce parties to each other, without negotiating on behalf of either party and without providing any information on which either party may rely upon in negotiations—are often critical to the ability of start-ups and smaller-cap companies to access needed capital. Yet until recently, finders provided their services in gray area. This article discusses a new law that provides long-awaited clarification of the role and scope of permitted activities of finders in securities laws transactions in California. - Keeping the Keys to the Kingdom: Agreements a Business Should Not Be Without

By Charles L. Crouch, III

The departure of an owner or a key employee can negatively affect the value and competitive position of a business. This article addresses three types of agreements often overlooked by business owners that, if put into place prior to the departure of an owner or employee, can significantly mitigate potentially catastrophic consequences. - Chapter 12 Bankruptcy Alternative for Family Farmers

Jason “Jake” Rios and Jennifer E. Niemann

The Bankruptcy Code allows family farmers the opportunity to solve their financial problems by reorganizing under a special chapter. This article discusses the unique provisions of chapter 12. - MCLE Article: The No Contact Rule Actually DOES Apply to Transactional Lawyers

Neil J Wertlieb and Nancy T. Avedissian

California Rules of Professional Conduct Rule 2-100, known as the No Contact Rule, prohibits communications between an attorney and a represented party without the consent of the party’s attorney. Few cases and interpretive opinions apply the No Contact Rule to transactional representations, but where a violation creates an unfair advantage for one party, discipline or disqualification is a real possibility. This article discusses the prohibition on such communications, paying particular attention to issues commonly faced by transactional attorneys.

Issue Number 3, 2015

- Executive Committee: Message from the Chair

By Robert V. Hawn - BLN Editorial Board: Message from the Issue Editors

By Samire Elhouty and David A. Saltzman - The Consumer Financial Protection Bureau’s Enforcement Activities: 2014 Year In Review

By Jennifer A. Duncan and Alicia H. Tortarolo

This article provides an overview of the Consumer Financial Protection Bureau’s (CFPB’s) 2014 enforcement actions in various consumer financial services markets. - Regulate or Be Regulated: The Impact of Landmark Groundwater Legislation on Local Agencies

By Kenneth J. Price and Lauren D. Layne

This article highlights key elements of and deadlines set by the Sustainable Groundwater Management Act. It also explores how landowners and existing and new public agencies, along with their legal counsel, are going to have to adapt to increased state oversight. - MCLE Article: The Rules of Professional Conduct DO Apply to In-House Lawyers

By Neil J. Wertlieb and Adam S. Bloom

Many attorneys who work in-house are unaware of the extent to which their activities remain subject to the California Rules of Professional Conduct. This article advises that in-house attorneys–even those who are not members of the California bar–are subject to the CRPC, and explains the application of the CRPC to several situations in which in-house counsel may easily find themselves.–And, you can get MCLE credit by taking the on-line exam at the link provided at the end of the article! - ORAP Liens and Bankruptcy Law: Protecting the Interests of Judgment Creditors With Secret Liens

By Michael Gomez

This article discusses the “ORAP” lien that attaches to all of a judgment debtor’s nonexempt property upon service of an order to appear for examination, and explains how, in a bankruptcy case, the lien can work to the advantage of the creditor to whose benefit it runs. - Test Your Knowledge: Recent Developments in Insolvency Law

By Paul J. Pascuzzi and Thomas Phinney

This article tests significant recent developments in the area of insolvency law. The authors survey ten leading cases and developments, provide a summary of the facts and issues in each case, and then ask you to choose the answer(s) that reflect(s) the holding of the court. MCLE credit is available for this article, as well. - Stay No More: The CFPB’s Proposed Amendments To Servicing Rules Undermine The Clarity Of The Automatic Stay

By Brian Burke Farrell

This article describes pending changes to rules governing both oral and written communications with borrowers by mortgage servicers in the context of a borrower’s bankruptcy filing. The author explains how the new rules compare both to existing law and to existing bankruptcy case law, and result in uncertainty regarding communications with bankrupt consumer mortgage borrowers. - Sharing Economy: An Interview with California Insurance Commissioner Dave Jones

By Armand Feliciano

Current chair of the State Bar Insurance Committee Armand Feliciano conducts a question-and-answer session with California Insurance Commissioner Dave Jones about the sharing economy (exemplified by Uber, Lyft, Airbnb, and Airpnp, among others), how it is affected by existing insurance law and available insurance products, and how the issues that it raises have been, are being, and can be, addressed by stakeholders.

Issue Number 2, 2015

- Executive Committee: Message from the Chair

By Robert V. Hawn - BLN Editorial Board: Message from the Issue Editor

By Kenneth Minesinger - Health Law Basics for Business Lawyers

By Charles B. Oppenheim

There are numerous federal and California laws that apply in the healthcare field, and every business lawyer who is ever involved in a deal that relates in any way to healthcare should be at least somewhat familiar with the basics. This article provides a brief overview of certain key areas that arise commonly in healthcare deals, to help general business lawyers spot issues and avoid problems. - Navigating Due Diligence in Health Care Transactions: Sensitive Information and Pitfalls

By Amy Joseph, Sandi Krul, and Ben Durie

This article provides an overview of the considerations to keep in mind with respect to sharing sensitive information and related issues in the health care transaction due diligence process. - The Decay of California’s Prohibition of the Corporate Practice of Medicine

By Craig B. Garner

In 2006, the North Carolina State Board of Dental Examiners issued more than 47 cease-and-desist letters to parties whitening teeth without degrees in dentistry. The United States Federal Trade Commission took exception to these letters and filed an administrative complaint, alleging anticompetitive and unfair tactics in violation of the Federal Trade Commission Act. The Supreme Court’s decision on review affected far more people than those concerned with tooth color, and it undermined most if not all authority held by professional organizations in California. - What is the Meaning of Meaningful Use? How to Decode the Opportunities and Risks in Health Information Technology

By Rick Rifenbark and Leeann Habte

The article discusses key issues involving electronic health records (EHR), including an overview of the Medicare and Medicaid “meaningful use” programs, practical guidance for responding to meaningful use program audits, and legal issues regarding the donation of EHR technology. - In the Absence of Agreement: California Courts Define Pricing for Non-contracted Medical Services

By David D. Johnson

Disputes frequently arise regarding the rates at which health plans must reimburse providers for services provided to health plan members when the plan and the provider do not have a pre-existing contract. California courts have recently clarified that non-contracted providers must be compensated at the market value for their services, and that evidence for market value includes all rates the providers actually accept, not just the rates on their fee schedules. - The Abyss of Managed Care and its 40-Year Impact on Payer/Provider Relations

By Craig B. Garner

The recent decision in Children’s Hospital Central California v. Blue Cross of California has been seen by many as the culmination of conflict between providers and payers within the managed care system. This article focuses on events preceding the Children’s Hospital Central California decision, how the managed care system of private payers has evolved over the past 40 years, and the challenges faced by payers and providers simply trying to coexist. - Using Statistics to Determine Whether Causation is Adequately Proven in Medical Malpractice Actions Involving Multiple Events Preceding the Injury

By H. Thomas Watson and Peder K. Batalden

This article addresses the standard of proof applicable to medical malpractice claims. It provides guidance as to the meaning of “probable causation,” and addresses how to meet that standard when applying statistical probabilities to sequential events, as well as techniques for the examination or cross-examination of expert witnesses.

Issue Number 1, 2015

- Executive Committee: Message from the Chair

By Robert V. Hawn - BLN Editorial Board: Message from the Editor

By Jerome A. Grossman - Introducing the Sample Venture Capital Opinion

By Douglas F. Landrum

The Article discusses the background against which the Sample Venture Capital Opinion was drafted. It explains the legal issues that the drafting committee considered, including (i) the practice of including a general qualification based on the schedule of exceptions to the stock purchase agreement, (ii) use of “performance” in the duly authorized, the no consents and approvals, and the non-contravention opinions and (iii) opinions based on laws other than California law, such as Delaware corporate law. - Legal Ruling 2014-01: The FTB’s House of Cards

By Rachelle H. Cohen

The Franchise Tax Board, in Legal Opinion 2014-01, held that out-of-state members of California limited liability companies are subject to California tax obligations. In this Legal Opinion, the Franchise Tax Board failed to adequately distinguish limited liability companies from limited partnerships, for which there is case law contradicting the Franchise Tax Board’s position. - Case Note: The Rosolowski Case and the Implications for the Future Application of CBPC Section 17529.5 to Commercial Email Advertisements

By John Rosenthal

A recent decision by the Second Appellate District, denying the appeal of plaintiff in the matter Rosolowski v. Guthy-Renker LLC, could have significant ramifications regarding the content of commercial e-mail messages and the ability of litigants to sue advertisers under California Business & Professions Code §17529.5. In its decision, the Rosolowski Court held that the “header” of a commercial e-mail messages is not materially false or misleading under §17529.5, as long as the body of the e-mail message accurately discloses the identity of the “sender”. - Corporate Deals, Tax Deductions, and the Wisdom of Solomon

By Robert W. Wood

Most legal fees paid by businesses are tax deductible, but not where they relate to consummating a merger or acquisition, where they must be capitalized. Robert W. Wood writes about the many benefits of dividing legal fees to enhance and document tax deductions. - Patterson v. Domino’s Pizza, LLC: The California Supreme Court Examines Franchisor Liability for Tortious Conduct of Franchisee Employees

By Paul A. Schiffin

In Patterson v. Domino’s Pizza, LLC, the California Supreme Court delivered good news for Domino’s and franchisors across California. The decision held that absent substantial and significant control over a franchisee’s management of employees and daily operations, the implementation of a comprehensive marketing and operational plan does not automatically leave a franchisor vicariously liable for the tortious acts of its franchisee’s employees. - Traditional Franchise and Beer Distribution Relationships: A Legal Comparison

By Barry Kurtz and Bryan H. Clements

State statutes designed to protect distributors in beer distributions relationships have been patterned after, and closely resemble, the relationship statutes some states have passed to protect franchisees in traditional franchise relationships. In their article, Traditional Franchise and Beer Distribution Law: A Legal Comparison, Barry Kurtz and Bryan H. Clements examine the origins of modern beer distribution statutes and franchise relationship laws and discuss their similarities and differences by comparing and contrasting their territorial, transfer, termination, and dispute resolutions protections.

Issue Number 4, 2014

- Executive Committee: Message from the Chair

By Robert V. Hawn - BLN Editorial Board: Message from the Editor

By Jerome A. Grossman - Practice Tips Under Alternative A (the New Driver’s License Rule)

By John R. Engel

This article provides some practical advice concerning a change in how an individual debtor is to be identified on a financing statement under the California Uniform Commercial Code. - CEBblog™

An introduction to the CEBblog, managed by Julie Brook for the California Continuing Education of the Bar. We provide a sampling of three blogs addressing matters of interest to business lawyers: one about illegal contracts, and two about IP issues that arise in M&A transactions. - Lessons from Litigating Technology Service Agreements.

By Blaine Green and Michael Murphy

Technology-based service relationships have become an essential part of the modern corporation’s operating fabric, but implementations continue to generate a high level of dissatisfaction and potential for disputes. Drawing on the authors’ combined experience in negotiating, litigating and restructuring many large, missioncritical contracts, this article discusses certain contract terms that are commonly overlooked in negotiations but that can significantly affect the outcome in litigation or arbitration. - Equitable Subordination: What a Secured Lender Should Know

By Jennifer Hildebrandt

A successful equitable subordination claim against a secured lender can result in that secured lender’s claim being subordinated and/or its lien avoided – each of which would be disastrous in a bankruptcy of the borrower. This article discusses the type of inequitable conduct that can result in the equitable subordination of a secured lender’s claim and also the circumstances in which the secured lender can be deemed an insider of the borrower. This article concludes with some tips for secured lenders to mitigate the risk of a successful equitable subordination claim. - Using LLCs in Fiscal Sponsorship: An Update on “Model L”

By Steven Chiodini and Gregory L. Colvin

In 2011, the authors first outlined the possibility of using a single-member limited liability company as a substitute for existing primary models of 501(c)(3) fiscal sponsorship (where a charity essentially brings an outside project under its aegis and raises money for its purposes). With a subsidiary LLC, the charity serving as the fiscal sponsor could combine many of the advantages of these models while insulating itself from some of their potential disadvantages. In the current article, the authors further explore this new variant of fiscal sponsorship that uses an LLC and address certain practical issues with the model that have become apparent.

Issue Number 3, 2014

- Executive Committee: Message from the Chair

By Charles E. McKee - BLN Editorial Board: Message from the Editor

By Robert Brayer - Test Your Knowledge: Recent Developments in Insolvency Law

By Tom Phinney and Paul Pascuzzi

This article tests your knowledge of ten significant recent cases covering a range of business and consumer issues in the area of bankruptcy and insolvency law. You are given a summary of the facts and issues, and then you can test your knowledge by selecting from multiple choice answers, or skip right to the commentary that explains the holding. Good luck! - The Interest Tail Wags the Profit Dog

By David Cook

Interest is the low hanging fruit in any contract. Like they say in the movies, interest, for lack of a better word, is good. Interest compels parties to pay on time. Interest increases the pain quotient of a default. Interest compensates the impatient while waiting for payment. Interest is part of the price. Interest is the razorblade for the razor. Interest is a moneymaker. Interest, low interest, or high interest is a deal point, sales point, or sharp stick in the eye. Interest is an expectation. Interest is the baby in the bassinet at the door of the defaulting party. Why leave money on the table? Nail an interest clause to every term that requires payment of money. - Ponzi Schemes and Poker–Is Recovering Gambling Losses a Winning Hand?

By Cory R. Weber and Steve Gubner

Claims to recover gambling losses as fraudulent transfers present unique issues, including whether the opportunity to win money at poker games constitutes “value” to a debtor, and whether poker players participating in games outside of casinos take winnings in good faith. Steve Gubner and Corey Weber litigated claims to avoid and recover gambling losses in a high-profile bankruptcy case involving a Ponzi scheme. This article explores the key issues leading to a winning hand. - Executive Benefits Ins. Agency v. Arkison (In re Bellingham Ins. Agency, Inc.): United States Supreme Court Defines the Statutory Boundaries of Article I Bankruptcy Judges after Stern v. Marshall

By Donna Parkinson

Historically, bankruptcy judges have had the limited powers of a legislative branch court even though they are embedded within the structure and procedures of the judicial branch of government. The United States Supreme Court has been refining the boundaries of those limitations in Stern and, recently, in Executive Benefits. This article explores the Constitutional and statutory authority for both the Stern and Executive Benefits decisions and how the history of bankruptcy in this country and under old English law set the stage for both of these decisions. - Troubled Waters: Navigating the Tax Issues of LLCs with Bridge Debt

By William Skinner

Skinner discusses some of the tax traps associated with making convertible or “bridge” loans to an LLC taxed as a partnership. Specifically, if the Company fails to repay the loans and is wound up, this will generate Cancellation of Indebtedness (COD) income that may be fully taxable to the members of the LLC in the absence of receipt of any cash. At the same time, members who have made such loans may be limited in their ability to utilize a loss from the write-off of such loans for tax purposes. This article discusses certain strategies to mitigate these adverse tax consequences, including the use of an instrument that is taxed as preferred stock.

Issue Number 2, 2014

- Executive Committee: Message from the Chair

By Charles E. McKee - BLN Editorial Board: Message from the Editor

By Robert Brayer - California Legislature to Consider Amendments to UCC Article 9 Regarding Name of Individual Debtor

By Neil J. Rubenstein

This article discusses a proposed amendment to Uniform Commercial Code Article 9, about individual debtor names on UCC financing statements, which is currently pending in the California legislature. It presents a different perspective to that expressed by Harry Sigman in his article published in Issue No. 4, 2013 of Business Law News. - The Driver’s License Rule Is Not Needed in California

By Harry C. Sigman

This article provides a rebuttal to the positions asserted in the article in this issue by Neil Rubenstein, which urges that California enact the “driver’s license” name rule for debtor identification in financing statements filed under UCC Article 9. Adoption of this rule, which would be exclusive and mandatory–get it perfectly right or be unperfected–would dramatically depart from the rule that has successfully operated in California for the last five decades, would require lenders, sellers and lawyers to adopt new practices and would introduce new issues entailing years of doubt until resolved by litigation. Moreover, as this article explains, California has one of the best filing and searching systems in the country; therefore, whatever arguments might be made for change in other states, there is no need for change in California. There is no reported case involving a loss by a lender under the current rule as a result of ‘guessing wrong’ about a debtor’s name in a filing in California.Harry C. Sigman has specialized in commercial law, and particularly in Article 9 and filing matters, for almost 50 years. He is past Chair and perpetual member of the Business Law Section’s Commercial Transactions Committee (formerly the UCC Committee), and he has been a member of the national Drafting Committees that have prepared Article 9 for the past 20 years. He has taught commercial law at USC and UCLA Law Schools as well as at law faculties around the world. His e-mail address is hcsigman@aol.com. - Michael Jackson Tax Case is a Thriller

By Robert W. Wood

This article examines the federal estate tax dispute roiling the Jackson estate. The IRS is still collecting income taxes attributable to the pop star’s earnings, and has proposed a big estate tax too. Tax and valuation issues are particularly knotty where, as here, where there are intellectual property and image rights. The subjective nature of valuating such assets can lead to messy disputes, especially with illiquid assets.Robert W. Wood is a tax lawyer with a nationwide practice (www.WoodLLP.com). The author of more than 30 books including Taxation of Damage Awards & Settlement Payments (4th Ed. 2009 with 2012 Supplement, www.TaxInstitute.com), he can be reached at Wood@WoodLLP.com. This discussion is not intended as legal advice, and cannot be relied upon for any purpose without the services of a qualified professional. - Protecting Tax Refunds of Consolidated Tax Filers in Bankruptcy

By Jennifer E. Niemann and Paul J. Pascuzzi

This article analyzes principles from recent case law regarding the ownership of tax refunds of consolidated tax filers in bankruptcy and provides concrete suggestions for counsel to consolidated tax filers when drafting a written tax sharing agreement (“TSA”) to protect consolidated filers if a bankruptcy case is filed.Recent decisions involving bankrupt bank holding companies analyze whether a TSA creates a debtor-creditor or principal-agent relationship among the filing entities. While the presumptive relationship is a principal-agent relationship, a TSA can establish a debtor-creditor relationship among the parties to the TSA. Most recent decisions have determined that the TSA creates a debtor-creditor relationship, resulting in the tax refunds belonging to the bankruptcy estate and not to the non-filing entities.Courts typically consider three key factors in analyzing whether a TSA creates a debtor-creditor relationship: the specific terms used in the TSA; the requirements, or lack thereof, for segregation of tax payments and refunds; and the amount of discretion given to the filing party over the preparation of the returns and making elections affecting the refunds. Counsel should consider possible bankruptcy implications when drafting a TSA. If the TSA is intended to maintain a principal-agent relationship, the TSA should state expressly that the presumptive principal-agent relationship is preserved and nothing in the TSA is intended to alter that relationship. The article also discusses certain language and provisions courts have interpreted to find that a TSA creates a debtor-creditor relationship.Jennifer E. Niemann is counsel at Felderstein Fitzgerald Willoughby & Pascuzzi, LLP in Sacramento. Her practice focuses on all aspects of business bankruptcy and insolvency law. Her email address is jniemann@ffwplaw.com.Paul J. Pascuzzi is a partner at Felderstein Fitzgerald Willoughby & Pascuzzi, LLP in Sacramento. His practice focuses on all aspects of business bankruptcy and insolvency law. His email address is ppascuzzi@ffwplaw.com. - Enforcement of Non-Debtor Releases in International Insolvency Proceedings

By Reno F.R. Fernandez III and Uzzi O. Raanan

Two cases represent conflicting approaches to the enforcement of non-debtor releases in foreign plans of reorganization under Chapter 15 of the Bankruptcy Code. In re Vitro, S.A.B. de C.V., 701 F.3d 1031 (5th Cir. 2012) applied a strict approach to a Mexican plan, and In re Sino-Forest Corp., 501 B.R. 655 (Bankr. S.D.N.Y. 2013) applied a more flexible approach to a Canadian plan.The Vitro court determined that non-debtor releases would not be available under the Bankruptcy Code because the plan provided creditors with a reduced recovery, cut off creditors’ ability to pursue guarantors, allowed shareholders to retain valuable interests, grouped adverse interests into a single voting class and allowed insiders to control the vote. The court appeared troubled by certain bad facts and apparent conflicts and declined to enforce the non-debtor releases.The Sino-Forest court applied traditional principles of comity, focusing on the procedural fairness of the Canadian proceedings. The court found that the parties had a full and fair opportunity to litigate in Canada and enforced the non-debtor releases without determining whether they would be available under the Bankruptcy Code.The foreign court’s perceived transparency appears to influence the divergent approaches. Inconsistency is likely to cause confusion, encourage forum shopping and frustrate Chapter 15’s goals of certainty and fairness.The U.S. Court of Appeals for the Ninth Circuit has not considered this issue. California bankruptcy courts apply traditional principals of comity in Chapter 15, suggesting that they will follow a flexible approach to non-debtor releases.Reno F.R. Fernandez III is a partner with Macdonald Fernandez LLP, a bankruptcy, turnaround and insolvency litigation firm with offices in San Francisco and Modesto, California. Mr. Fernandez is also a member of the Insolvency Law Committee of the Business Law Section of the State Bar of California. His email address is reno@macfern.com.Uzzi O. Raanan is a partner at Danning, Gill, Diamond & Kollitz, LLC, in Los Angeles, California, and specializes in insolvency, bankruptcy, receivership, and commercial law. He is Co-Chair of the Insolvency Law Committee of the Business Law Section of the State Bar. His email address is uraanan@dgdk.com. - Expanding Whistleblower Protection Under The Sarbanes-Oxley Act (Or, George Clooney, Litigious Babysitters, and Enron At The Supreme Court)

By Shawn M. Larsen

With the Sarbanes-Oxley Act of 2002, Congress sought to prevent the type of rampant corporate fraud that led to the downfall of Enron. One of the primary engines of this reform was the provision of protection for employee whistleblowers. The scope of this protection, however, was ambiguous: not only did it apply to employees of publicly-traded companies, but also to employees of the contractors and subcontractors with whom those companies work. The Supreme Court has finally resolved this question with its decision in Lawson v. FMR, LLC et al. To the delight of workplace advocates, the Court interpreted Sarbanes-Oxley broadly, holding that it shelters employees of private contractors and subcontractors, just as it shelters public company employees. Representatives of the business community have expressed concern that this expansive reading will lead to a rash of unintended and frivolous lawsuits. Nevertheless, the Lawson decision is a clear signal to private sector contractors that they are bound by the same anti-retaliation rules as public companies.Shawn M. Larsen is a founding partner of Larsen Woodard LLP, located in Newport Beach. He specializes in employment law, representing employers across California with both counseling and litigation matters. His email address is slarsen@larsenwoodard.com. - Casenote: The Jolley Case

By William Webb

In 2013, the First District Court of Appeal decided Jolley v. Chase Home Finance, LLC (213 Cal. App. 4th 872 (2013), a case with implications for both construction lenders and borrowers. In Jolley, the lender filed a motion for summary adjudication, arguing (1) that it had not assumed liabilities associated with a loan it acquired through a purchase and assumption agreement with the FDIC, and (2) that as a lender, as a matter of law, it did not owe the borrower a duty of care.The court first engaged in a lengthy discussion as to whether the trial court was right to have taken judicial notice of the purchase and assumption agreement, and held that it was error to have done so in this instance. The court then held that, under certain circumstances, a lender may owe a duty of care to its borrower, and found factual issues that precluded summary judgment as to the borrower’s causes of action for misrepresentation, breach of contract, promissory estoppel, negligence, unfair competition, and reformation.Jolley, the author opines, will enjoy limited vitality in certain cases involving construction lending with irregularities in disbursements and communications. Lenders can avoid its effects by carefully adhering to the governing loan documentation and by avoiding stray comments that may later be construed as waivers or promises to modify the documented loan terms. Borrowers can be counseled by the decision as to how to avoid summary adjudication.William T. Webb is the founder and principal attorney of the Webb Legal Group, based in San Francisco. He focuses on consumer financial services litigation, including the defense of class actions, as well as general corporate and commercial litigation. His email address is wwebb@webblegalgroup.com.

Issue Number 1, 2014

- The 2013 Mortgage Servicing Final Rules

By Denyse JonesOn January 10, 2014, the Consumer Protection Finance Bureau enacted the 2013 Mortgage Servicing Rules to address the abusive practices identified after the 2008 financial crisis. These Rules amend Regulation X that implements the Real Estate Settlement Procedures Act and Regulation Z that implements theTruth in Lending Act. Although the Rules are designed to provide consumers with detailed timely information regarding their mortgages, they require mortgage servicers to disclose more information in less time and will likely drive up servicing costs. The new rules address mortgage servicing transfer disclosures, escrow payments, error resolution procedures, force-placed insurance, early intervention, continuity of contract, loss mitigation procedures, ARM disclosures and periodic statements. This article provides a summary of each rule. Denyse Jones is an attorney at Husch Blackwell LLP and is a resident of its St. Louis office. She specializes in commercial litigation. Her email address is denyse.jones@huschblackwell.com. - Executive Committee: Message from the Chair

By Charles E. McKee - BLN Editorial Board: Message from the Editor-in-Chief

By Robert Brayer - Standing Committee Spotlight: Consumer Financial Services Committee

By Rita Lin - The New Ability-to-Repay and Qualified Mortgage Rules Under Dodd-Frank and Regulation Z: An Overview

By Robert K. Olsen and Jessica NguyenEffective January 10, 2014, the Consumer Financial Protection Bureau (“CFPB”) implemented new “Ability to Repay” (“ATR”) requirements under Regulation Z in response to reckless lending and the 2008 financial crisis. The rule requires a creditor to make a “reasonable and good faith determination” that a consumer will be reasonably able to repay a mortgage loan, without resort to refinancing or sale of the property. One permitted ATR approach is to originate a “qualified mortgage” (essentially a government conforming mortgage), thereby triggering either a safe harbor or presumption of compliance, depending upon the loan’s interest rate. Other approaches are permitted as well, in a regulatory effort to preserve market flexibility. Each compliance method brings its own costs and risks, which creditors should evaluate based on their particular risk appetite and target market. This article briefly summarizes the substance of the new ATR Rule and explores the internal risk and compliance management measures all residential mortgage lenders will need to take to minimize their troubles under the new rule.Robert K. Olsen is a principal of Aldrich Bonnefin & Moore, PLC in Irvine, California and head of the firm’s Consumer Practice Group. He may be reached at rolsen@abmlawfirm.com. Jessica M. Nguyen is an associate of Aldrich Bonnefin & Moore, PLC. She can be reached at jnguyen@abmlawfirm.com. - A Look at the Consumer Financial Protection Bureau’s ECOA “Disclosure and Delivery” Valuations Rule

By Sanford ShatzThe Consumer Financial Protection Bureau’s ECOA Disclosure and Delivery Valuations Rule, effective January 18, 2014, is designed in part to ensure transparent lending to informed consumers. The rule requires that creditors inform credit applicants that they have a right to receive a copy of any property valuation developed in connection with an application for credit that is secured by a first lien on a dwelling, and that the creditor promptly provide a copy of that valuation to the applicant upon completion. The rule is intended to help borrowers uncover invidious discrimination in the preparation of property valuations. The article explores the requirements and operation of the Rule, the loans that are covered by the Rule, the nature of an extension of credit, the definition of an appraisal or other written valuation, and timing requirements in the Rule. The article concludes with practice tips for consumers and creditors. Sanford Shatz is Of Counsel to McGlinchey Stafford and is resident in its Irvine, CA office. He specializes in consumer financial services including litigation of mortgage-related issues, and providing regulatory and compliance advice. His email address issshatz@mcglinchey.com. - The CFPB’s Version of the Home Ownership and Equity Protection Act

By Adam Jaskievic, Esq.On January 10, 2014 the Consumer Finance Protection Bureau (CFPB) implemented substantial revisions to the Homeownership and Equity Protection Act (HOEPA). To accomplish these revisions, the Bureau amended Sections 1026.32 and 1026.34 of the Truth-In-Lending Act (TILA) governing high-cost mortgages as well as Section 1024.20 of the Real Estate Settlement Procedures Act (RESPA) governing homeownership counseling services. One goal of the Bureau’s amendments was to enhance consumer knowledge and understanding of mortgage products through the expansion of homeownership counseling requirements. Under the new amendments, the Bureau now requires that lenders provide all borrowers, regardless of product type or risk level with the contact information of counseling services available in their area. Additionally, the Bureau now effectively requires some borrowers to complete counseling prior to obtaining certain loan products. While some may argue that such changes may be positive, or at the very least, relatively benign, not all of the HOEPA changes were without negative side effects. The amendments to TILA’s high-cost coverage removed a previous, long standing exemption afforded to purchase transactions and home equity lines of credit. The amendments also lowered the APR threshold in one of the tests used to determine whether a loan is considered high cost by 1.5 percentage points, a substantial decrease. This simultaneous expansion of products subject to high-cost tests along with the lowering of the threshold, coupled with creditors’ historic apprehension to offer high-cost loans, renders it almost certain that a subset of borrowers will now see their access to credit dwindle even further. Adam Jaskievic is Counsel at Ocwen Financial Corporation and is based out of its Massachusetts office. He specializes in mortgage banking regulatory compliance. His email address is adam.jaskievic@ocwen.com. - An Overview Of The CFPB’s Higher-Priced Mortgage Loan Escrow Rule

By Kristina A. Del VecchioThe Higher-Priced Mortgage Loan Escrow Rule is among the numerous rules that the Consumer Financial Protection Bureau (“CFPB”) has promulgated affecting the mortgage market. The rule became effective on June 1, 2013 and implemented statutory changes made by the Dodd-Frank Act to amend provisions of Regulation Z that require creditors to establish escrow accounts for higher-priced mortgage loans (HPMLs). This article provides a detailed discussion of the major provisions of the new rule, which (1) lengthens the time for which a mandatory escrow account must be maintained from one year to five years, (2) creates an exemption from the escrow requirement for small creditors operating predominately in rural or underserved areas, and (3) extends an existing exemption from the escrow requirement for insurance premiums for condominium units to other types of properties which are covered by a master insurance policy. The article also address relevant provisions of the CFPB’s new TILA-RESPA rule, which was released on November 20, 2013. It is imperative that creditors thoroughly understand and implement the requirements set forth by rules (along with the myriad other new mortgage-related rules recently promulgated by the CFPB) and work to begin implementing the related disclosure changes set forth in the TILA-RESPA rule. - A Look at the Consumer Financial Protection Bureau’s TILA Rule Regarding Appraisals for Higher-Priced Mortgage Loans

By Sanford ShatzThe Consumer Financial Protection Bureau’s TILA rule regarding appraisals for higher-priced mortgage loans, effective January 18, 2014, is designed to protect lenders from over-loaning on a specific property to avoid catastrophic losses if borrowers default or property values decline. The rule is also designed to promote the informed use of consumer credit by requiring disclosures about its costs and terms.This article explores the Rule’s requirements imposed on lenders who originate higher priced loans, where the annual percentage rate exceeds the average prime offer rate by specified amounts. These requirements include providing additional disclosures, mandating that property valuators meet certain licensing standards, and that the appraisals include an interior inspection of the subject property. The article also discusses the disclosure requirements a lender must meet to comply with the rule.Where properties are resold within a short period of time at a higher price, or “flipped,” the article explains the additional requirements imposed on lenders, including obtaining an additional higher-priced appraisal of the property at no additional charge to the borrower. Finally, this article compares the CFPB’s TILA appraisal rule with the CFPB’s ECOA valuations rule.Sanford Shatz is Of Counsel to McGlinchey Stafford and is resident in its Irvine, CA office. He specializes in consumer financial services including litigation of mortgage-related issues, and providing regulatory and compliance advice. His email address is sshatz@mcglinchey.com.

Issue Number 4, 2013

- Mike Halloran Receives the Business Law Section’s Lifetime Achievement Award

by Steven O. Weise - Executive Committee: Message from the Chair

by Charles E. McKee - BLN Editorial Board: Message from the Editor-in-Chief

by Robert Brayer - When is a Settlement Agreement Litigation by Other Means?

by David J. CookIn litigation, nirvana settlements end the conflict between the parties. Peace in our time. Through inadvertence, error or trickery, some settlements spawn Sisyphean disputes that dump the parties back into court A wishy-washy settlement enables a defendant to litigate through the gaps, holes and traps doors of a poorly drafted settlement agreement. The defendant sings “Free at Last,” while the plaintiff sings the blues. Untangled from the onerous settlement terms, the defendant exits the maelstrom reasonably unscathed.A poorly drafted settlement agreement topples the plaintiff’s settled expectation under agreement. If litigation was dismissed with prejudice in exchange for the signed settlement agreement, but fails to request that the court retain jurisdiction, plaintiff might find itself on the courthouse curb. Settlements bear their own statute of frauds of a writing signed by both parties or orally before the court. Bring a court reporter. Absent the return “E” ticket to court, a party would have to file a new, separate action to enforce the settlement agreement and would face the impediments of the statute of limitations, venue, and other evils of litigation. The nightmare is round #2 of protracted litigation (or arbitration if so agreed). Original trial counsel might even have to be a witness in such an action, as disputes over settlement agreements sometimes revolve around “who said what to whom.” This is very ugly. The prospect that counsel might be a witness could compel the party to hire substitute counsel at enormous expense, and the party might blame the original trial counsel for this turn of events. The article offers oodles of remedies to compel the parties to perform their respective covenants, warranties and promises to ameliorate the risk that the settlement may continue the litigation by other means. Settle for money, and do not settle just to settle. - Corporations for the 99%: California’s New Social Enterprise Corporations Legal Reform in Two Acts

by Spencer W. Weisbroth, Esq.On January 1, 2012, California authorized two new types of corporation: the “Benefit Corporation,” and the “Flexible Purpose Corporation” (FPC). In so doing, California became part of a growing number of states that have authorized hybrid corporations: for-profit corporations with some hallmarks traditionally associated with non-profit corporations. The objective in creating these two new hybrid corporate entities is to allow for-profit corporations who elect to be governed under these statutes to consider criteria in the public good when making corporate decisions. In California, a Benefit Corporation is defined as a stock corporation that has elected to become a Benefit Corporation to pursue “public benefits.” The “benefits” that a Benefit Corporation pursues must be for the general public benefit, meaning, “a material positive impact on society and the environment, taken as a whole, as assessed against a third-party standard, from the business and operations of a benefit corporation.” The FPC allows a corporation to operate as a for-profit while taking into consideration special social purposes or missions traditionally in the realm of non-profit corporations. An FPC is organized for the purpose of promoting positive short-term or long-term effects, or minimizing adverse short-term or long-term effects, of the flexible purpose activities. The ability of a company to consider short-term effects is one of the distinctions between FPCs and Benefit Corporations. For progressive or forward thinking corporations, these new entity forms provide an exciting opportunity to forge a “third way,” freeing corporations to pursue social good, with assurance, transparency and accountability. - Two Steps Forward, One Step Back: Comparing Benefit Corporation Laws in Delaware and California

by Frank Vargas and Michael VargasDelaware recently began allowing companies to incorporate in that state as Benefit Corporations, which in Delaware are called “Public Benefit Corporations.” Interestingly, Delaware chose not to adopt the Model Benefit Corporation Legislation (“MBCL”), which had served as the template for legislation in other states, most notably California and New York. Commentators, especially those supportive of the MBCL, have chastised Delaware’s move as “hedging their bets” and “a watered-down” version of earlier statutes. However, the authors of the article believe the Delaware statute represents more than “hedging their bets” or a “watered-down” version of earlier statutes. It represents a choice between two competing visions for encouraging socially conscious entrepreneurs. California, one of the first states to adopt the MBCL, seeks to promote socially conscious entrepreneurship through a strict statutory and regulatory scheme. By contrast, Delaware’s new law encourages innovation by giving entrepreneurs extensive flexibility and wide latitude to pursue an ever-growing cache of public causes. The article argues that Delaware’s new Public Benefit Corporation statute is an improvement on the MBCL adopted in California by identifying specific provisions that encourage innovation in the Delaware law, but acknowledges that the Delaware statute still leaves a number of important issues unresolved. - Dissociation: A New Concept for a New LLC Act

by Phillip L. JelsmaThe new California Revised Uniform Limited Liability Company Act, which took effect on January 1, 2014, introduced the concept of member dissociation, which was not found in the prior Beverly-Killea Limited Liability Company Act. Previously, if a member died or was adjudged incompetent, the member’s executor, administrator, guardian, conservator, or other legal representatives could exercise all of the member’s rights for purposes of settling the estate or administering the member’s property. This included any power that the member had under the articles of organization or operating agreement to give the assignee the right to become a member. The New LLC Act provides that a member has the power to dissociate at any time either rightfully or wrongfully by express will of the dissociating member. In addition to describing what will trigger a dissociation, the New LLC Act also provides for what happens following dissociation. The new dissociation provisions present an opportunity for drafters of the operating agreement to consider what affect, if any, a bankruptcy, death, or dissolution should have on the member’s status as a member. Practitioners should review the statutory default provisions concerning dissociation to better help clients and their advisors decide whether to keep, modify, or eliminate the statutory dissociation provisions. - Test Your Knowledge: Recent Developments in Insolvency Law

by Tom Phinney and Paul PascuzziThis article uses an engaging format to test your knowledge of significant recent developments in the area of insolvency law. The authors survey seven leading cases on issues such as bankruptcy jurisdiction, relief from the automatic stay, and the “absolute priority rule” in individual chapter 11 cases. The article also discusses legislative developments concerning the naming of individual debtors in UCC-1 financing statements. The authors provide a summary of the facts and issues in each case and then ask you to choose the answer(s) that reflects the holding of the court. The article also provides a short commentary on each holding. Good luck!

- Individual Debtor Names on California UCC Financing Statements (A Bullet Dodged, So Far)

by Harry C. Sigman This article analyzes in depth the rule enacted in California last year, scheduled to become effective on July 1, 2014, with respect to individual debtor names on UCC-1 financing statements, and argues that this rule is better, and, in particular, more appropriate for California, than the driver’s license rule adopted by most other states. In addition, it presents a detailed explanation of how the filing and search practice actually functions in California, which has a modern, low cost and efficiently operated Secretary of State’s UCC filing office. The author asserts that there is no need to depart from the individual debtor name rule that has worked so well in California for many decades, and notes that; unlike the driver’s license rule, the modified rule does not oblige California lawyers to change the naming practice with which they have long been familiar. Harry C. Sigman enjoys an international reputation for his expertise in commercial law. He conducts a consulting practice, specialized in commercial law, in Los Angeles. He can be reached at hcsigman@aol.com.

Issue Number 3, 2013

- Gun Control Legislation: An Interview With Randy Barnett

By Nina A. Ortega

Page 1Business Law News (Issue 3 2013): Gun Control Legislation: An Interview with Randy Barnett. Professor E. Randy Barnett, the Carmack Waterhouse Professor of Legal Theory at Georgetown University Law Center, responds to the legal and personal viewpoints expressed by Dean Erwin Chemerinsky (UC Irvine School of Law) in the interview with Dean Chemerinsky that appeared in Issue 2. Professor Barnett talks to Business Law News Editorial Board Member Nina Ortega, pointing out what he considers to be common misconceptions about the Second Amendment to the United States Constitution and the proper legal interpretation of certain words and phrases regularly appearing in discussions of the Second Amendment. Professor Barnett addresses his own understanding of the meaning of the Second Amendment in historical context and as interpreted by the United States Supreme Court in more recent times; explains why he thinks that the term “assault weapons” is too ambiguous to use as a legal standard and that recent proposals to ban certain types of guns and high-capacity magazines are unconstitutional; and expresses his concern over what he sees as according greater protection to some constitutional rights over others. Nina Ortega is Deputy General Counsel with American AgCredit, located in Santa Rosa California, and can be reached at nortega@agloan.com - Executive Committee: Message from the Chair

By James P. Menton, Jr.

Page 7 - BLN Editorial Board: Message from the Editors-in-Chief

By Robert Brayer and Marianne Man

Page 8 - Interview With Patrick M. Kelly

By James Menton

Page 9James Menton, outgoing chair of the Business Law Section, interviews Patrick M. Kelly, the 88th President of the State Bar, as his one-year term as president comes to a close. Mr. Kelly, a veteran trial lawyer and regional managing partner at Wilson Elser Moskowitz & Dicker LLP, talks about the mission and work of the State Bar (addressing, among other things, how the State Bar works to protect the public–including handling admissions to the Bar, disciplining members, providing continuing legal education and securing funding for Legal Aid); the importance of the State Bar’s Sections in assisting the State Bar to achieve its goals–for example, by undertaking mentoring programs such as the one sponsored by the Business Law Section; his goals and experiences as president for the past year; his love of music and the effect that has had on his legal career; and the benefits he has realized through his service to the Bar. James Menton is a Partner at Peitzman Weg LLP, in Los Angeles. He is a litigation attorney, whose practice is primarily focused on business litigation, bankruptcy and creditor’s rights. His email address isjmenton@peitzmanweg.com. - California Supreme Court Overrules Pendergrass and Permits Evidence of Promises at Variance with the Terms of a Contract

By Kathleen Kizer and Donna Parkinson

Page 17In Riverisland Cold Storage, Inc. v. Fresno-Madera Prod. Credit Ass’n, 55 Cal.4th 1169, 1180-81 (2013), the California Supreme Court reversed long-standing precedent established in Bank of Am. Nat’l Trust and Sav. Ass’n v. Pendergrass, 4 Cal.2d 258 (1935), by holding that evidence of broken oral promises that contradict the express terms of an integrated contract are no longer barred by the parole evidence rule. Courts and commentators have long criticized Pendergrass because of its questionable foundation and rationale, principally because it squarely contradicted the statutory exception to the parol evidence rule permitting evidence of fraud and other matters that call into question the very validity of the contract. In Riverisland, the California Supreme Court analyzed the authorities pro and con, noted its own contrary decisions and the difficulties courts experienced trying to apply Pendergrass‘ rationale, and determined that even in 1932, “Pendergrass was plainly out of step with established California law.” Because it was “ill-considered,” it “should be overruled.” This article explains the parole evidence rule, the fraud exception, the Pendergrass limitation, and the decision overruling Pendergrass, which will likely have a marked impact on business disputes and, in particular, disputes between lenders and borrowers. It concludes with an exploration of the potential effects of the decision. Kathleen S. Kizer is an attorney with DLA Piper LLP (US) in San Francisco. She specializes in resolving complex commercial disputes in state and federal court and in arbitration. Her email address is kathleen.kizer@dlapiper.com.Donna Parkinson is the managing partner of Parkinson Phinney in Sacramento. She represents financial institutions, secured and unsecured creditors, creditors’ committees, trustees in bankruptcy cases and workouts. Her email address is donna@parkinsonphinney.com. - Tax Implications of the Use by Tax Exempt Organizations of Limited Liability Companies in California

By J. Patrick Whaley

Page 23This article explains the federal and California tax consequences of use of an LLC by a tax-exempt entity to hold assets or carry on an activity. The federal income tax implications and many of the California franchise and income tax implications of operating an LLC are relatively well known. However, there are some California tax implications of operating an LLC that are less well known and that can lead to unwelcome surprises.In California, tax-exempt organizations may hold assets or conduct activities through a single-member or multi-member LLC without incurring any state or federal income taxes except on unrelated business taxable income. Such an LLC will also be exempt from California property tax if all its members are exempt under Internal Revenue Code § 501(c)(3) or California Revenue and Taxation Code § 23701d and satisfy the requirements of the welfare exemption. The LLC, however, will be obligated to pay special California $800 annual franchise taxes and California annual fees unless it is a qualifying title-holding entity that is exempt under either Cal. Rev. & Tax Code § 23701h or 23701x. J. Patrick Whaley is a Partner at Musick, Peeler & Garrett LLP in Los Angeles, whose practice is primarily focused on nonprofit, tax-exempt organizations. His e-mail address is p.whaley@mpglaw.com. - Ten Things You Should Know About Setoff and Recoupment in Bankruptcy

By Holly A. Estioko and Paul J. Pascuzzi

Page 29Setoff and recoupment are powerful tools that parties can use in debtor-creditor relationships, both in and out of bankruptcy. This article discusses ten things every business attorney should know about the use of these tools in bankruptcy, including: (1) The right of setoff is preserved in bankruptcy; (2) Creditors must obtain relief from the automatic stay to effect setoff; (3) The strict requirements of Bankruptcy Code section 553 must be met; (4) A creditor with a right of setoff is a secured creditor in the amount of its right of setoff; (5) The right of setoff may be waived or denied; (6) A debtor may set off against a creditor as well; (7) The right of recoupment is recognized in bankruptcy; (8) The Ninth Circuit follows the “logical relationship” test in its recoupment analysis to determine whether relevant claims arise from the “same transaction”; (9) Some of the strict requirements of setoff do not apply to recoupment in bankruptcy; and (10) Common situations in which a creditor may assert a right of setoff or recoupment in bankruptcy. Business attorneys should familiarize themselves with the specific requirements and potential uses of the doctrines of setoff and recoupment for the benefit of their clients in a bankruptcy case. Paul J. Pascuzzi is a partner at Felderstein Fitzgerald Willoughby & Pascuzzi LLP in Sacramento. Mr. Pascuzzi’s practice focuses on all aspects of business bankruptcy and insolvency law. His e-mail address isppascuzzi@ffwplaw.com. Holly A. Estioko is an associate practicing business bankruptcy law at Felderstein Fitzgerald Willoughby & Pascuzzi LLP. Her e-mail address is hestioko@ffwplaw.com. - An Overview of the Process for the Attorney General’s Review of Nonprofit Hospital Transactions

By Charles E. Slyngstad

Page 34This article describes the process by which the Attorney General’s office reviews applications for the sale of assets, such as hospitals, by nonprofit entities. It explains the statutory framework that governs the AG’s review and the core concerns that must be addressed: the effects of such sales on the charitable use of assets and the availability to the community of healthcare services. It explains how those core concerns inform the sales process, and addresses (i) the form that the notice to the AG must take (sections describing the transaction, the fair market value of the assets involved, issues of inurement and self-dealing, the use to be made of the proceeds of sale, the impact of the transaction on health care services and competition, and other public interest factors, as well as a variety of specific information relating to the sale); and (ii) the evaluation process itself. Finally, the article discusses both the availability of judicial review of the AG’s determination and the standard of review that will apply. The author explains the bases for seeking both administrative and traditional mandamus review, but finds the case law to date inconclusive as to which review should apply. He concludes that the AG’s review process has become sufficiently predictable so as to make litigation extremely rare, and is likely to remain unchanged for years to come. Charles E. Slyngstad is a Partner at Burke, Williams & Sorensen, LLP, in Los Angeles. He represents hospitals, healthcare companies and health plans, and public entities, and is certified by the Board of Legal Specialization of the State Bar of California as a specialist in legal malpractice law. His email address iscslyngstad@bwslaw.com.

Issue Number 2, 2013

- Gun Control Legislation: An Interview With Erwin Chemerinsky

By Marianne H. Man

Page 1 - Executive Committee: Message from the Chair

By James P. Menton, Jr.

Page 5 - BLN Editorial Board: Message from the Co-Editors-in-Chief

By Robert Brayer and Marianne Man

Page 5 - Cash is King: Determining the Extent of a Secured Lender’s Liens Over Revenues Generated During a Bankruptcy Case

By Julian I. Gurule

Page 7 - AB 2364 Simplifies Levies on Financial Institutions

By Arnold S. Rosenberg

Page 12 - All Grown Up: The New LLC Law and Fiduciary Duties

By Rachelle Cohen

Page 21 - Jumpstart Our Business Startups Act (Jobs Act): Choices For Foreign Companies

By Young Jun Kim

Page 28 - Spousal Fiduciary Duty And Transactional Control–Whose Problem Is It?

By Kathleen O. Peterson

Page 34

Issue Number 1, 2013

- Happy Anniversary, Business Law Section

By Edith Warkentine and Donna Parkinson

Page 1 - Executive Committee: Message from the Chair

By James P. Menton, Jr.

Page 8 - BLN Editorial Board: Message from the Editors-in-Chief

By Robert Brayer and Marianne Man

Page 9 - Social Media and Employers: Finding the Right Balance With Your Employees

By Michelle Sherman

Page 11 - Go South Without Going South: Key Legal Considerations for Doing Business in Mexico

By Mauricio Leon de la Barra

Page 14 - Voluntary Disclosures: How Markets Increasingly Value Sustainability Information

By Mike Wallace and Michael Berg

Page 22 - Compliance with the SEC’s Final Conflict Minerals Rule

By Curtis M. Dombek

Page 28 - New California Employment Laws and Significant Employment Decisions in 2012

By Charles Barker

Page 36 - Strange Changes – Coverage Reductions in Renewal Policies are Not Enforceable Without Conspicuous, Clear and Specific Notice

By Aneeta Kumar and Randy G. Gerchick

Page 43 - RULLCA Comes to California – Overview

By Phillip L. Jelsma

Page 49 - Do Not Ignore Latest IRS Offshore Account Amnesty

By Robert W. Wood

Page 52

Issue Number 4, 2012

- Lifetime Achievement Award

By Steven O. Weise

Page 2 - Executive Committee: Message from the Chair

By James P. Menton, Jr.

Page 5 - BLN Editorial Board: Message from the Editor

By Peter M. Menard

Page 6 - The U.N. Guiding Principles on Business and Human Rights: The Legal Context and Operational Implications

By John G. Ruggie, Amy K. Lehr and Elizabeth M. Holland

Page 7 - CalSTRS and Corporate Governance

By Anne Sheehan

Page 14 - Human Rights Due Diligence: A New Trend in Federal and State Legislation

By Sarah A. Altschuller

Page 20 - The Effect of Kiobel v. Royal Dutch Petroleum on Doing Business Overseas

By Anne Richardson

Page 25 - Efficiency, Competition, and Capital Formation: Assessing the SEC in Rulemakings

By Daniel J. Davis

Page 29 - Guide to Business Law Section Publications

Page 33 - When a City Files Bankruptcy: Chapter 9 Basics for Business Attorneys

By Jennifer E. Niemann and Paul J. Pascuzzi

Page 35 - Stern v. Marshall: The End of Bankruptcy Courts as we Know Them, or Just a Minor Correction to the Bankruptcy Code?

By Monica Jewett-Brewster and Alan Vanderhoff

Page 41 - Dealing in Data: Business and Legal Considerations Respecting Data Transactions

By Brian Anderson and Rachel Tarko Hudson

Page 46 - Legislative Activities of the Corporations Committee

By Philip W. Peters

Page 52 - Recent Cases of Interest

By Richard Burt

Page 55 - The ABA Business Law Section: Great Legal Minds and Cutting Edge Issues

By Bruce Dravis

Page 60

- Governor’s Reorganization Plan Met With Reservation

By Jill C. Kovar and Keith Paul Bishop

Page 1The California Legislature has approved a plan proposed by Governor Jerry Brown to reduce the number of agencies in the executive branch from twelve to ten. The California Business, Transportation and Housing Agency (BTHA) currently includes both the Department of Corporations (DOC) and the Department of Financial Institutions (DFI). Under the Governor’s plan, the “business” and “housing” parts of BTHA will be absorbed by the newly-created Business and Consumer Services Agency (BCSA), and the “transportation” part will be organized under the new Transportation Agency. DOC and DFI will be merged into a new Department of Business Oversight (DBO) as the Division of Corporations and the Division of Financial Institutions. This article explores the administrative structure of the reorganized entities, the alternate paths available under California law to reorganize the executive branch and the path selected by the Governor, various concerns with the reorganization plan, and the further legislation that will be required to implement the plan.Jill C. Kovar is a senior associate with Aldrich Bonnefin & Moore, PLC where she focuses on consumer lending compliance. She currently serves as the Vice Chair of Programming of the Consumer Financial Services Committee of the Business Law Section of the California State Bar. She may be contacted at jkovar@abmlawfirm.com. Keith Paul Bishop is a partner with Allen Matkins Leck Gamble Mallory & Natsis LLP. He previously served as California Commissioner of Corporations, as Deputy Secretary and General Counsel of the California Business, Transportation and Housing Agency, and as Interim Savings and Loan Commissioner. He may be reached at kbishop@allenmatkins.com. - In Memoriam: Edwin I. Lasman

Page 2 - Executive Committee: Message from the Chair

By Donna Parkinson

Page 8 - BLN Editorial Board: Message from the Editor-in-Chief

By April E. Frisby

Page 9 - BLN Editorial Spotlight

By Megan Callan, Editor

Page 10 - Covenants Not to Compete in Limited Liability Company Operating Agreements May Be Enforceable Without Payment for Goodwill

By Jennifer Redmond, Jessica S. Fairbairn and Eleonor Ignacio

Page 11This article argues that payment of goodwill should not be required for an LLC to enforce a non-compete provision, whether the member’s departure is voluntary or involuntary.Jennifer Redmond is a partner in the Labor and Employment Practice Group of Sheppard Mullin Richter & Hampton LLP in the San Francisco office. She may be reach at jredmond@sheppardmullin.com. Jessica S. Fairbairn is an associate in the Labor and Employment Practice Group of Sheppard Mullin Richter & Hampton LLP in the San Francisco office. She may be reached at jfairbairn@sheppardmullin.com. Eleonor Ignacio is a research attorney at the Superior Court, County of San Mateo. - Rebuttal: LLCs Enforcing Covenant Not to Compete Upon Member Withdrawal Required to Make Goodwill Payment

By Richard C. Darwin

Page 16This article argues that when a limited liability company forces a departing member to sell his or her interests back to the company at a penalty price (i.e., a price that does not take goodwill into account), the company cannot simultaneously attempt to enforce a non-compete provision.Richard C. Darwin is a shareholder in the San Francisco office of Buchalter Nemer. He may be reached at rdarwin@buchalter.com. - The Supreme Court Opens the Road to Healthcare Reform, But Will California Meet the Challenge

By Craig B. Garner and Julie A. Simer

Page 20The U.S. Supreme Court has upheld the constitutionality of the Affordable Health Care Act. This article explores the basis for the Court’s decision that (1) the Act’s individual mandate is constitutional, and (2) although the Medicaid expansion provisions in the Act survive, the federal government is prohibited from penalizing states that choose not to participate in the Medicaid expansion by taking away their existing Medicaid funding. The authors examine the consequences for California of these two provisions of the Act.Craig B. Garner specializes in health care and is an adjunct professor of law at Pepperdine University School of Law. He may be reached at craig@craiggarner.com. Julie A. Simer is a shareholder of Buchalter Nemer. She currently is the Chair of the Health Law Committee of the Business Law Section of the California State Bar. She may be reached at jsimer@buchalter.com. - When Is a Director Not a Director?

By Lisa A. Rundquist

Page 25This article explains the effect of AB 1233 which amends Corporations Code section 5047 to clarify that (1) if a nonprofit corporation’s bylaws provide that a person does not have the right to vote, that person is not a “director” as the term is used in the Corporations Code, and (2) if a person is referred to as being an ex officio director without any stated limitation on voting rights, that person is a director with the right to vote. The author recommends that any non-profit corporation with bylaws that refer to non-voting directors clarify whether such a person is a director and has a vote or is merely an advisor to the board.Lisa A. Runquist is a principal of Runquist & Associates. She may be reached at lisa@runquist.com. - Article 9 — Foreclosure Sales / A Possible Safe Harbor?

By Barry V. Freeman

Page 27This article explores an alternate approach and possible “safe harbor” for a UCC Article 9 foreclosure sale of personal property. The author suggests that a joint sale by the assignee who concurrently conducts the sale of the collateral as assignee in an ABC (assignment for the benefit of creditors) sale and as the sales agent for the secured party, minimizes potential challenges to the sale.Barry V. Freemen is a partner in the Corporate and Bankruptcy Reorganization Group of Jeffer Mangels Butler & Mitchell LLP, and is the past Chair of the Loan Documentation Committee of the Business Law Section of the American Bar Association. He may be reached at bfreeman@jmbm.com. - Three Recent Delaware Cases Address LLC and LP Fiduciary Duties

By Phillip L. Jelsma

Page 30This article discusses three recent Delaware Chancery Court cases that hold that any waiver or elimination of fiduciary duties requires explicit language in the operating agreement or limited partnership agreement.Phillip L. Jelsma is a partner in the San Diego office of McKenna Long & Aldrich LLP where he specializes in tax law, and is the immediate past Chair of the Partnerships and Limited Liability Companies Committee of the Business Law Section of the California State Bar. He may be reached at pjelsma@mckennalong.com.

- The Outer Limits of Buyer Protection in a Section 363 Sale

Richard Brunette

Page 1 - Executive Committee: Message from the Chair

Donna Parkinson

Page 8 - BLN Editorial Board: Message from the Editor-in-Chief

April E. Frisby

Page 9 - BLN Editorial Spotlight

Edwin I. Lasman, Co-Vice-Chair

Page 9 - BLN Editorial Spotlight

Coleman Cannon, Editor

Page 10 - Major Securities Exchanges Require Reverse Merger Companies to Add More Seasoning

Young Jun Kim

Page 12 - Are You FBAR Serious?

Marianne H. Man

Page 18 - Don’t Let the ERISA Train Derail the Deal: 7 Simple Steps to Help Minimize ERISA Liabilities in an M&A Transaction

Sherrie Boutwell

Page 21 - Guide to Business Law Section Publications

- Perfecting and Enforcing a Security Interest in “Realty Paper”

John R. Engel

Page 30 - O’Neil v. Crane: The Supreme Court’s Most Recent Pronouncement Concerning If and When A Manufacturer Is Liable for Components Used In or In Connection With its Product

Efrat M. Cogan and George Stephan

Page 35

Issue Number 1, 2012

- California Corporations Code Provisions Governing Dividends and Distributions Amended and Streamlined with the Passage of AB 571

By W. Alex Voxman

Page 1In September2011, Californiastreamlined and simplified the legal requirements for distributions to shareholders by California corporations and certain so-called quasi-California corporationsin a manner that brings the California Corporations Code more in line with the law in most other states. One of the principal changes is to replace the rigid and formulaic balance sheet and liquidity test that was contained in the prior statute with a new, simpler balance sheet test. The new balance sheet test, in essence, permits a solvent corporation to make a distribution to its shareholders so long as the value of the corporations assets would exceed its liabilities (and, if applicable, preferred stock preferences) after giving effect to the distribution.

W. Alex Voxman is a partner in the Los Angeles office of Latham & Watkinsand serves as the Co-Chair of the Los Angeles office’s Corporate Department. His practice focuses primarily on mergers and acquisitions, private equity and venture capital transactions, and public and private securities offerings.Mr. Voxman is a member of the Corporations Committee of the Business Law Section of the California State Bar.He can be reached at alex.voxman@lw.com. - Executive Committee:Message from the Chair

By Donna Parkinson

Page 6 - BLN Editorial Board: Message from the Editor

April E. Frisby

Page 8 - Banking Agencies Challenge California’s Business Judgment Rule: Will This Expand Officer and Inside Director Liability?

Jonathan D. Joseph

Page 9While there is widespread consensus among the courts justifying the deferential treatmentaccorded decisions by corporate directors defending claims for negligence and breach of care based upon the business judgment rule,the liability standard for non-director corporate officers remains relatively unexplored. In 2011, two federal banking agencies brought civil damage actions in the Central District of California against executive officers of failed financial institutions. The agencies asserted that the deference accordedto directors does not apply to good faith decisions by bank officers that didnt turn out well.These cases touch uponsignificant underlying themes in American society today (e.g., Occupy Wall Street) as to who should be responsible for the tremendous costs of bailing out the largest American banks in 2008 and whether bank executives and directors could have anticipated the global financial meltdown in 2008. In many states, including California, Delaware and New York, there has been little dispute that the business judgment rule applies equally to corporate officers and directors. This article explores these pending Central District cases and explains why any final appellate rulings upholding the position asserted by the banking agencies could have severe unintended consequences including the potential to drive businesses out of California.Jonathan Joseph has focused for over 33 years on regulatory, corporate, securities, and transactional matters for banks and bank holding companies and officers and directors of distressed and failed institutions. He currently serves as the Co-Vice Chair and Secretary of the Financial Institutions Committee of the Business Law Section of the California State Bar (2008 present). He is the founder and managing partner of Joseph & Cohen, Professional Corporation (www.josephandcohen.com) in San Francisco, CA. Mr. Joseph is a member of theCalifornia State Bar, the Washington D.C. Bar and the State Bar of New York. He may be contacted at Jon@josephandcohen.com. - Hot Topics in Insolvency Law: Alter Ego Claims

By Gary M. Kaplan and Thomas R. Phinney

Page 16 - Guide to Business Law Section Publications

- Business Law Section Standing Committees UpdatesCyberspace Committee Update

By Nicole A. Ozer

Commercial Transactions Committee Update

By D.C. Toedt - Just Say No to Bankruptcy: Courts Enforce Provisions in Organizational Documents Restricting Ability to Seek Bankruptcy Protection