Taxation

SUGGESTIONS FOR IMPROVING TAX COMPLIANCE THROUGH GREATER TAX SYSTEM TRANSPARENCY AND ACCOUNTABILITY

TAX POLICY, PRACTICE & LEGISLATION COMMITTEE

CALIFORNIA LAWYERS ASSOCIATION TAXATION SECTION

2021 WASHINGTON D.C. DELEGATION

This proposal was prepared by Annette Nellen, member of the Tax Policy, Practice and Legislation Committee and Tax Executive Committee of the Taxation Section of the California Lawyers Association.1 The author thanks reviewers Elisabeth Sperow and Beth Hodess for their helpful comments.2

Contact Information:

Annette Nellen, CPA, Esq.

Professor, Accounting & Finance

College of Business

San José State University

One Washington Square

San José, CA 95192-0066

Telephone: (408) 924-3508

e-mail: annette.nellen@sjsu.edu

Executive Summary

Despite the significance of taxes to all individuals―both directly and indirectly, the understanding of taxes among the public is low. This indicates that our tax system does not meet at least two essential principles of good tax policy: transparency and accountability to taxpayers. Not meeting these principles can also lead tax systems to not measure up well against other principles such as simplicity, equity, and neutrality.

Low understanding of the tax system also means that most individuals lack understanding of the components of a basic income tax system. They are likely to think it must include special tax provisions they see on the basic Form 1040. Few individuals know the concept of tax expenditures and their relevance to understanding government spending and budgets.

There are various ways tax agencies and lawmakers can help individuals improve their tax and budget “literacy.” Among other things, this includes inserting explanations into existing published documents such as commonly used individual tax forms, avoiding multiple or incomplete information that can increase confusion. The outcome should be an improved tax system in that increased tax and budget knowledge by taxpayers will help the system to better meet the principles of good tax policy. In addition, increased tax literacy can lead to better understanding of the role of taxes in generating government revenues and appreciation for the role of the tax system in government spending. Improved knowledge in these areas will also enable taxpayers to be more informed in understanding tax law changes and asking questions of elected officials and those running for office.

This paper presents suggestions to help improve tax and budget literacy among the public. The suggestions fall within these categories:

A. Tax returns, instructions and publications.

B. Taxpayer receipt.

C. K-12 education.

D. Celebrate Taxpayers Day.

Implementation considerations are also addressed.

DISCUSSION

I. INTRODUCTION

Individuals pay a variety of taxes at all levels of government and devote some time each year to tax compliance. Yet, the understanding of our tax and budget system by most taxpayers is low. For example, taxpayers are unlikely to be able to:

- State how much they pay to the U.S. Treasury for income taxes, employment taxes and various excise taxes, and their share of corporate income tax.

- Explain the rate structure for the income tax, and the exclusions, deductions, and credits (and the meaning of these terms).

- Explain where their tax dollars go.

- Understand their tax situation in relation to other taxpayers.

- Understand the taxes paid by their employer and other employers (whether for profit or non-profit).

- Know and understand the operation and benefit of various tax preferences provided for health care, housing, retirement savings or higher education expenses,3 and other tax preferences, or know the role and effect of tax preferences in a tax system and within the government system of distributing various benefits.

- Explain the purpose of various tax incentives, or to distinguish between a tax preference (tax expenditure) and a provision that is part of the basic design of a particular tax (such as the standard deduction in the personal income tax).

- Explain how various tax preferences benefit themselves relative to individuals with different income levels or how to appropriately measure and compare the benefits.

- Name any of the Taxpayer Bill of Rights.4

- Know where to get more information about the federal tax structure or budget.

There are various ways that the IRS and other federal offices can assist taxpayers in improving their “tax literacy.” The outcome would be an improved tax system in that increased tax and budget knowledge of taxpayers will help the system to better meet the principles of good tax policy. Increased tax literacy can also lead to better understanding and appreciation of the role of taxes in generating government revenues but also the role of certain tax system features in contributing to government spending.

Improved knowledge in these areas can lead to a more informed and compliant electorate. More taxpayers will understand the tax law and reform proposals helping them to ask good questions of elected officials and those running for office.

II. TAX POLICY

A. Definitions

Various formulations of principles of good tax policy exist. For example, the American Institute of Certified Public Accountants (AICPA) suggests a set of twelve principles of good tax policy.5 These are explained as follows (taken verbatim from the AICPA report):

- Equity and Fairness. Similarly situated taxpayers should be taxed similarly.

- Certainty. The tax rules should clearly specify how the amount of payment is determined, when payment of the tax should occur, and how payment is made.

- Convenience of Payment. Facilitating a required tax payment at a time or in a manner that is most likely convenient for the taxpayer is important.

- Effective Tax Administration. Costs to collect a tax should be kept to a minimum for both the government and taxpayers.

- Information Security. Tax administration must protect taxpayer information from all forms of unintended and improper disclosure.

- Simplicity. Simple tax laws are necessary so that taxpayers understand the rules and can comply with them correctly and in a cost-efficient manner.

- Neutrality. Minimizing the effect of the tax law on a taxpayer’s decisions as to how to carry out a particular transaction or whether to engage in a transaction is important.

- Economic Growth and Efficiency. The tax system should not unduly impede or reduce the productive capacity of the economy.

- Transparency and Visibility. Taxpayers should know that a tax exists and how and when it is imposed upon them and others.

- Minimum Tax Gap. Structuring tax laws to minimize noncompliance is essential.

- Accountability to Taxpayers. Accessibility and visibility of information on tax laws and their development, modification and purpose, are necessary for taxpayers.

- Appropriate Government Revenues. Tax systems should have appropriate levels of predictability, stability and reliability to enable the government to determine the timing and amount of tax collections.

The principles of good tax policy that are the focal point of this paper involve transparency and accountability (#9 and 11 on the AICPA list, respectively).

The AICPA combines transparency with visibility as necessary to allow taxpayers “to know the true cost of transactions.” The Government Accountability Office (GAO) lists transparency as a criterion for a “good tax system” along with equity, economic efficiency, simplicity and administrability. Per the GAO:6

“The transparency of a tax system refers to taxpayers’ ability to understand how their liabilities are calculated, the logic behind the tax laws, what their own tax burden and that of others is, and the likelihood of facing penalties for noncompliance.”

The AICPA states that accountability to taxpayers allows for “broader and more well-informed debate” about tax changes. The AICPA notes that to achieve this principle, taxpayers need “access to information for understanding sources and uses of tax revenues.” The AICPA also suggests that accountability helps improve respect for the tax system.7

Achievement of the principles of transparency and accountability to taxpayers require that adequate and appropriate information be easily accessible and understandable to taxpayers.

B. Benefits of Increased Transparency and Accountability to Taxpayers

When a tax system meets the principles of transparency and accountability to taxpayers, it is more likely to also meet other principles of good tax policy. For example, if individuals better understood the concepts of progressivity and regressivity, they might question lawmakers about deductions, exclusions or exemptions that provide greater benefits to higher income taxpayers relative to lower income taxpayers, and the effect on overall progressivity of the system. They might demand changes that allow the tax system to better achieve principles of good tax policy. They might also seek changes in what government subsidies are provided via direct spending versus the tax system (tax expenditures), and even question and suggest changes as to the design and value of various subsidies.

The GAO notes that lack of transparency coupled with complexity “exacerbate doubts about the current tax system’s fairness.” The GAO further notes that because our tax systems rely on voluntary compliance, low understanding and its side effects can harm compliance.8

Improved transparency and accountability to taxpayers will also improve awareness and understanding of the Taxpayer Bill of Rights. For example, many suggestions offered in this paper tie to the first right to be informed. As explained on the IRS website:9

“Taxpayers have the right to know what they need to do to comply with the tax laws. They are entitled to clear explanations of the laws and IRS procedures in all tax forms, instructions, publications, notices, and correspondence. They have the right to be informed of IRS decisions about their tax accounts and to receive clear explanations of the outcomes.”

III. SUGGESTIONS FOR IMPROVING TRANSPARENCY AND ACCOUNTABILITY TO TAXPAYERS

This section offers suggestions to help our federal tax system better achieve the tax principles of transparency and accountability to taxpayers. Another way to consider the goal of these suggestions is that they should improve an individual’s tax and budget (or fiscal) literacy.

The suggestions are offered within broad categories. The suggestions vary in terms of the party responsible for implementation, execution and maintenance costs, parties reached, and intricacy. Some suggestions are unlikely to work until tax and budget literacy levels have been raised. For example, telling an individual how much they saved in income tax due to various tax preferences is unlikely to have a positive impact until individuals first understand what tax preferences (tax expenditures) are, why they exist, how they are evaluated, and more.

The suggestions address not only the delivery or access approach for the information, but also the types of information that should help improve fiscal literacy.

Categories of suggestions:

A. Tax returns, instructions, publications, and websites.

B. Taxpayer receipt.

C. K-12 education.

D. Celebrate Taxpayers Day.

A. Tax Returns, Instructions, Publications and Websites

1. Modifying Existing Forms, Instructions, Publications and Websites

Tax returns include terminology best understood by someone knowledgeable in taxation. Some individuals may not know terms have special definitions, such as head-ofhousehold or dependent. Given wide access to the Internet, providing an online tax form with explanations that “pop up” when the user scrolls over a line, would be extremely helpful to individuals, rather than only providing an online “static” form. While individuals can look for the instructions to the form, this approach dates to what made sense when we could only look at these items in paper form.

The IRS posts all tax forms on its website for education and access purposes.

Making these forms as user friendly and informative as possible is a good use of technology and for promoting a stronger understanding of tax rules and compliance requirements.

The Internet and web browsing allow for enhanced access to information. For example, when an individual scrolls over “Filing Status” on Form 1040 online, a pop-up (or “mouseover”) could explain the basics and note that for more information, they should scroll over each of the listed options for filing status. Where lines require individuals to insert figures from other forms, the pop-up can let them know where to get that information. The pop-up for “tax due” on the “amount you owe now” line could remind the filer to review their withholding and estimated taxes for the current year to avoid tax due for the current year. Pop-ups could also provide tips for areas where mistakes are common and how to avoid them.

While some lines may require more than a pop-up window, the basic information could be in the pop-up window with a link provided for where more information may be obtained.

In addition, reminders could be given about the need to maintain proper records, the filer’s responsibility for filing a correct return, and where they can get more information to help them with their tax compliance obligations.

The pop-up per line approach to explaining tax return information can also provide information beyond a compliance focus. For example, where appropriate, the pop-up could state at the end, for example, of each filing status, “approximately X% of filers claim the single status.”

The pop-up information approach could remove the need to have separate instructions, although providing them in pdf should still be an option for individuals who want to look at the complete instructions in a single document.

Online publications could also have pop-ups to explain terminology to reduce the need to skip around in the publication. Use of modern technology can make these resource more user-friendly.

Any web-based resource should also be available for viewing on a smartphone as that is how many individuals access information. Consideration must be given to ensuring these website features are ADA-compliant.

2. Limit Confusion and Frustration for Taxpayers and Tax Advisers by Avoiding Repetition of Information, Triple Check for Completeness and Highlight Any Changes Made

Avoid Duplicative Information: The IRS website contains a vast amount of information. This can make it difficult to find complete and accurate information because numerous “hits” are produced from a search. Some items are entirely or partially duplicative which can create confusion and frustration when taxpayers think the items are different, but they turn out to be the same.

A recent example involves the American Rescue Plan Act change to waive the requirement to repay an advance Premium Tax Credit that is larger than what the taxpayer is eligible for based on household income. The explanation from the IRS was provided at these locations:

- IR-2021-84 (4/9/21), IRS suspends requirement to repay excess advance

payments of the 2020 Premium Tax Credit; those claiming net Premium Tax

Credit must file Form 8962. - Website: Suspension of Repayment of Excess Advance Payment of the PTC

(posted 4/9/21). - FS-2021-08 (April 2021), More details about changes for taxpayers who received

advance payments of the 2020 Premium Tax Credit (posted 4/9/21). - COVID Tax Tip 2021-55 (4/22/21), IRS suspends requirement to repay excess

advance payments of the 2020 premium tax credit. This tip also includes links at

the end:

o About Form 8962, Premium Tax Credit

o More details about changes for taxpayers who received advance payments

of the 2020 Premium Tax Credit [this is FS-2021-08 noted above as item

3]

o Suspension of Repayment of Excess

Item 2 above appears to have the most concise and useful information of the four information sites. It begins by noting a change included the American Rescue Plan Act affects tax year 2020. It next offers a brief explanation and then two paragraphs on what to do for filing your 2020 return.

Aim to Avoid Incomplete or Confusing Information: Taxpayer and tax practitioner time is sometimes ineffectively used due to incomplete or confusing information provided on the IRS website or form instructions. No doubt, the law grows more complex with each new law and by new types of transactions. Yet, given the millions of people who rely on the IRS website, publications, forms and instructions, all efforts to be as complete as possible will help reduce compliance errors and lessen disrespect and frustration with our tax system.

Two recent examples follow:

- IR-2021-83 (4/9/21), IRS reminds foreign bank and financial account holders that the FBAR deadline remains April 15. This news release states that FBARs are due April 15 and that the extension for the 2020 Forms 1040 to May 17 does not apply to the FBAR form. This news item as originally released made no mention that FinCEN provides an automatic extension of the FBAR form to October 15. Before the addition of the statement highlighted in red below, the author of this paper saw this topic debated on a tax practitioner website because some worried that something had changed such that the October due date (the effective date given an automatic extension to October 15 that has been existence for several years) was no longer available or some action was now required to get the extra time.

Likely, a second and third review of this news release before it was posted would have uncovered that it should state that despite the May 17 due date for 2020 Forms 1040, the FBAR remains due April 15 but continues to have an automatic extension to October 15.

| IR-2021-83 as originally released [web as originally released per Wayback Machine] | IR-2021-83 as later fixed [web at 4/28/21] |

| WASHINGTON — The Internal Revenue Service is reminding U.S. citizens, resident aliens and any domestic legal entity that the deadline to file their annual Report of Foreign Bank and Financial Accounts (FBAR) is still April 15, 2021. The extension of the federal income tax filing due date and other tax deadlines for individuals to May 17, 2021, does not affect the FBAR requirement. | WASHINGTON — The Internal Revenue Service is reminding U.S. citizens, resident aliens and any domestic legal entity that the deadline to file their annual Report of Foreign Bank and Financial Accounts (FBAR) is still April 15, 2021. The extension of the federal income tax filing due date and other tax deadlines for individuals to May 17, 2021, does not affect the FBAR requirement. However, filers missing the April 15 deadline will receive an automatic extension until October 15, 2021, to file the FBAR. They don’t need to request the extension. |

- The virtual currency question on page one of the 2020 Form 1040, reads: “At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? __Yes __No”

The instructions provide examples of virtual currency transactions (pages 16 to 17). Despite the words “otherwise acquire” in the question, there is no example of a purchase of virtual currency. FAQ 5 added to the IRS website on March 2, 2021 states that if a taxpayer’s only virtual currency transactions in 2020 were purchases of virtual currency using real currency, a yes answer is not required. No explanation is offered of what “otherwise acquired” means and why a “purchase” is not an acquisition. Also, not all taxpayers and tax advisers know to look for an FAQ when the Form 1040 instructions already address a line on the tax form, so are likely to check “yes” for purchase of virtual currency using US dollars. The instructions also state: “Regardless of the label applied, if a particular asset has the characteristics of virtual currency, it will be treated as virtual currency for Federal income tax purposes.” There is no explanation of what this means and no FAQ.

Additional review of crucial information would help taxpayers and tax practitioners. Consideration should be given to using volunteer tax practitioners to assist in this immense effort of providing appropriate compliance information to taxpayers.

Highlight Changes Made to Website Information: As illustrated by the FBAR news release described above, corrections are sometimes made to IRS websites. Another recent example was a posting on March 12, 2021, the day after enactment of the American Rescue Plan Act (P.L. 117-2; 3/11/21). The posting appeared on the website: Post-Release Changes to Tax Forms, Instructions, and Publications. It was labeled “New Exclusion of up to $10,200 of Unemployment Compensation.” The website explained that for 2020 the American Rescue Plan Act excludes up to $10,200 of unemployment compensation (the Act added IRC Section 85(c)). The version posted on March 12 explained that the $150,000 threshold included unemployment compensation. On March 23, a new posting on this topic was made with the same heading but with a revised worksheet where unemployment compensation was not included in the $150,000 threshold amount. No explanation was offered about this change in interpretation of IRC Section 85(c). Also, the March 12 website posting was removed as if it had never been there.

The wording of new Section 85(c) is confusing because it states that adjusted gross income is to be computed without regard to Section 85 so both the inclusion and exclusion are ignored, which is puzzling.

To highlight the law’s complexity, it would be more transparent and provide greater accountability to taxpayers, to note that a website has been updated or modified to correct a mistake or to clarify a point and to note the date of the change. This makes it more obvious to users that what they may have read earlier has indeed changed and the reason for the change.

3. New Tax Forms or Schedules to Promote Tax System Literacy

A few new tax forms or schedules should be considered if they can help improve understanding of how tax systems work.

Tax preferences highlighted: One idea is to have a form that lists all tax preferences so a taxpayer can easily see the tax savings they obtain from these special rules. The form could list the most common preferences such as (a) exemptions for employer-provided health insurance, fringe benefits and tax-exempt interest income, (b) itemized deductions (Schedule A), and (c) tax credits. Instructions could list all such items, which can easily be over 70 items at the federal level. Taxpayers would report the amount of the exemption, deduction, credit or special rate. Instructions would explain what original form (or other source) has the information. The total would be multiplied by the taxpayer’s marginal tax rate to show the tax reduction received, or the tax table can be used to compute the tax savings. Tax preparation software would make this tax preferences form seamlessly simple to prepare.

Another potential benefit of such a form is that it could be used if the federal government implements an across-the-board spending cut such as due to an economic recession. Typically, such a cut only addresses direct spending rather than also tax expenditures. Given that tax expenditures exceed direct, discretionary spending today,10 significant spending escapes cuts and an opportunity to highlight to taxpayers that spending exists in the tax system is missed. The tax preference amounts from the Form 1040 (or Form 1120) could be totaled, multiplied by the taxpayer’s marginal tax rate, and multiplied by the spending cut percentage (such as 5 percent), with that amount added to the taxpayer’s tax liability for the year. This exercise would improve tax and budget literacy to highlight that not all spending is direct spending in agency budgets, but that spending also exists in the tax system.

Elections: Another new form to consider is an Elections form to be used for making all possible elections. Today, there are numerous elections such as under Section 179 (expensing), Reg. 1.263(a)-1(f) (de minimis safe harbor), Rev. Proc. 2019-38 (Section 199A rental real estate safe harbor) and several others. A benefit of this type of form is simplification of the election process by having elections made by checking the appropriate box on the Elections Form. It also helps taxpayers understand the tax system better by listing all elections in one place to reduce the likelihood of overlooking one.

Reconciliation of information returns: Another new form to consider enables taxpayers to easily add a reconciliation to the return to explain an erroneous information report or one that requires adjustment. For example, if an individual receives a 1099-K from a crowdsourcing website but the amount received is a non-taxable gift, the form will allow for the individual to list the amount and to reduce it by the non-taxable portion. Or a taxpayer may have received a Form 1099-C, Cancellation of Debt, but be unaware of possible cancellation of debt exclusions under Section 108. The new form would help remind the filer of this possible exclusion (and could replace the individual’s need to use Form 982, Reduction of Tax Attributes Due to Discharge of Indebtedness).

B. Taxpayer Receipt

A few states and the White House under President Obama11 offered a taxpayer receipt to interested parties who visited the taxpayer receipt website. The California Franchise Tax Board last offered one for 2017.12 Taxpayers entered their California state income tax figure from Form 540 and clicked the button for “Get CA Tax Receipt.” This produced a screen image showing how the tax payment allocated among broad spending categories of the state budget, such as health services, K-12 education, higher education, environmental protection, and government operations.13

This simple taxpayer receipt is good but limited. It could be improved by such changes as:

- Have taxpayers enter all of the federal taxes they pay as shown on their Form 1040 and Forms W-2 (employment taxes). Such taxes can be estimated by the online tool based on income, miles driven (for the gasoline excise tax), certain purchases, such as alcohol, etc.

- Show the taxpayer’s marginal and effective income tax rates.

- Show the tax preferences claimed by the individual and how much they saved due to these rules. The receipt can also include how key preferences are used among different income levels and the “cost” of these tax expenditures. The data on how the expenditures are used should include numerous income levels including the top 1.0, 0.1 and 0.01 percent of individuals with the highest income and the dollar amount and total percent each level uses of the particular tax expenditure. At least the top 20 individual tax expenditures should be included with a link to the entire list and an explanation (such as from the Joint Committee on Taxation website).

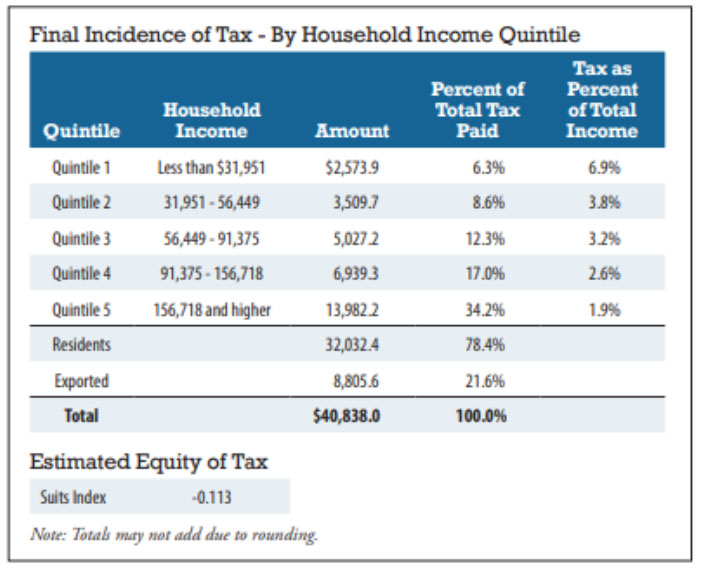

- Include taxes paid indirectly (tax incidence). For example, what is the individual’s share of the corporate income tax and the employer’s share of employment taxes? An explanation of “tax incidence” should also be provided. The Texas Comptroller’s Tax Exemptions and Tax Incidence Report explains taxes collected at the state and local levels, tax expenditures data and explanations, and the incidence of each tax. For example, the report for 2020 shows the incidence of the school property tax by household income quintile. It shows the average amount paid, percent of total tax paid and the tax as a percent of the individual’s income.14

- The above information helps individuals see they pay some taxes indirectly (such as renters indirectly paying property taxes directly imposed on the property owner). Such information provides a better picture of everyone’s tax obligations and contributions. The tax incidence information requires background information on how taxes are paid directly and indirectly (from an economic perspective). Without this background information in layperson terms, the data may only confuse taxpayers. The incidence information showing taxes paid indirectly could be explained and provided on the taxpayer receipt.

- Show what income quintile the taxpayer is in and its dollar size range, among other quintiles.

- Show what the spending breakdown would have been based on the federal budget of five years ago to highlight significant changes.

- Include the names and email addresses of their elected officials so they can ask questions or seek additional information.

To help more individuals know of the receipt option, the URL and brief explanation of the tool and its benefits can be noted on the IRS main website, an email receipt or window provided once a return is e-filed, and listed on the website of a few other government agencies that individuals frequently visit, as well as the websites of members of Congress.15

The receipt could also be “pushed” to individuals such as through email (if the individual included it on their Form 1040). H.R. 1323, Taxpayer Receipt Act (117th Congress), calls for the Treasury Department or IRS to provide “to each individual filing a Federal income tax return for a calendar year, a one-page estimate of how the taxpayer’s money was spent by the Government during the immediately preceding calendar year.”16 It does not state how the receipt is to be provided. Use of the U.S. Post Office should be avoided due to the cost of printing and mailing and because many individuals would prefer to receive the information electronically. H.R. 3855 (114th Congress) suggested that the IRS explore use of modern technologies such as email and interactive programs on its website to enable taxpayers to obtain the receipt. There would still be a need to ensure individuals know of the site, such as via a message sent after e-filing.

Provision of a taxpayer receipt via an “IRS Tax App” (also see Section IV later), based on the current IRS2Go Mobile App, should be a low-cost approach for providing the receipt. Occasional reminder messages could be delivered via the app to remind taxpayers of the opportunity to get a receipt and the benefit of the information to them.

C. K-12 Education

Understanding taxation―a topic that affects everyone, need not wait until a person gets their first job and completes an income tax return. We have all likely heard stories of the high school student or graduate surprised that their first paycheck is less than expected. For a student to study government operations in various grades from 4th to 12th and not know about income and other taxes, is simply wrong. How can someone learn how government functions without knowing where the resources for its operation come from and their role in that funding?

It should be simple to find many places where various tax topics can be included in the curriculum. For example, math problems can include not only calculating a worker’s gross earnings, but their net earnings.

Likely similar to other states, the California Common Core for Grade 7 math includes the following as a focal area:17

“Students extend their understanding of ratios and develop understanding of proportionality to solve single- and multi-step problems. Students use their understanding of ratios and proportionality to solve a wide variety of percent problems, including those involving discounts, interest, taxes, tips, and percent increase or decrease.”

A sample 6th grade math problem from the State of Louisiana involves an individual who earns $6 per hour plus a $30 bonus for the week. If she works 32 hours in the week, how much did she earn.18 This problem (and many like it in many grades) overlooks an opportunity to define “gross earnings” and “net earnings” and to also have students calculate federal and state taxes withheld. The supplements to this simple gross earnings problem would also enable students to use percentages (such as to calculate FICA and Medicare taxes, and state and local taxes), and use tax tables.

Math students could also visit the IRS website for the information they need. A section on the website for teachers and students of various grades could provide basic tax information at the appropriate age level. The information should be suitable for various grade levels and subjects including math, social studies, civics, history, and classes where students may be reporting on current events.

State tax agencies and professional tax organizations (such as state CPA societies, AICPA, and tax practitioner associations) could provide tax problems for various grade levels along with answers and explanations. Perhaps the IRS could serve as a repository for the information with links to organizations that can provide more (such as Junior Achievement, various educational organizations, and community organizations that might promote and create resources through their own means).

Besides promoting tax and budget literacy through math courses, civics courses should include lessons on where government revenues come from, the basics of different taxes, who pays these taxes and how, and an individual’s role and responsibilities in the tax system.

Again, appropriate government agencies and members of Congress could include links on their websites for students with the information appropriate for various specified grade levels.

The IRS has a website, Understanding Taxes,19 with information directed to teachers and students. It includes lesson plans and fact sheets. The information is detailed and clear, including definitions of key terms. Unfortunately, the website is not maintained. For example, the lesson on dependents includes the dollar amount for the dependency exemption for 2014.

This IRS educational website is well-developed and extensive resources likely were devoted to creating it. This is an outstanding foundation for helping educate primary and secondary school students on taxation basics and providing significant resources for teachers. Consideration should be made to finding resources to maintain the site as doing so should help students become more compliant taxpayers and build respect for the tax system by removing a good amount of the mystery that exists due to lack of education about taxes.

D. Celebrate Taxpayers Day

Celebratory events should also be considered, such as making a specific day “Celebrating Taxpayers Day.” The City of Philadelphia Department of Revenue annually, such as on February 28, 2020, honors taxpayers for paying on time. Department of Revenue employees are available, information is displayed, and “fun prizes,” and refreshments are available.20

A 2015 report from the Organization for Economic Cooperation and Development (OECD) describes various educational and celebratory events used in 28 developing countries to build “tax culture” and promote positive tax morale.21 Examples include:

- Nigeria created a soap opera for television called “Binding Duty” that includes well-known actors, scripts with accurate tax information, and “dramatic flair [on] how the old order of inefficient and corrupt tax collection has changed, that it pays to be compliant, and that everyone has a responsibility to contribute to the development of their community and country.”22

- Guatemala uses “tax lotteries” where individuals deposit official VAT receipts with the possibility of winning a prize. The government also produces “tax dramas” featuring honest Simón, a good taxpayer. These dramas are shown on television, YouTube and at public events. Also, since 2008, the country holds annual “Strength Lies in Numbers” festivals each April. The goal is to strengthen a culture of tax compliance and citizenship. The festivals also promote art and culture.23

- Rwanda holds an annual Taxpayers’ Day to celebrate tax compliance and help citizens understand the connection between taxes and economic development. A report is published to help people understand data on tax revenues and challenges facing the tax agency. The president of Rwanda officiates at the celebration.24

While the events described in the 2015 OECD report take place in developing countries, the ideas should not be viewed as relevant only in these countries.25 While a key theme in these locations is to improve tax compliance and understanding of how that helps the country advance, that message is not only relevant in developing countries, but also needed in the U.S. The IRS estimates that the annual federal tax gap is about $441 billion26 and tax gaps exist in every U.S. subnational taxing jurisdiction as well. Also, as noted in this paper, there are numerous tax technical topics where understanding is low, coupled with weak understanding of tax system design (tax policy) and the interaction of tax systems and government budgets. Ideas on how to improve tax and budget literacy, should be considered for celebrate taxpayers day due to the benefits to overall tax compliance and effective tax systems. In addition, occasional thanking of taxpayers for their voluntary compliance should help build and support positive tax morale.27

IV. Implementation Considerations

Some suggestions offered in this report should be made via legislation to ensure adequate funding and greater attention to the effort.

Not all individuals will pursue the tax information from the IRS and elected officials, perhaps thinking they will not understand it, or it isn’t relevant to them. Messaging and delivery format will be important. The IRS current use of social media could be expanded. Non-traditional approaches should garner attention. For example, wording for the tax and budget literacy information could be like:

- “Where do my tax dollars go and how many dollars am I providing?”

- “Why should I care?”

- “How does my marginal and average tax rates compare to those of President Biden?”

- “Which provides the greater tax savings: the earned income tax credit, the tax credit for the purchase of certain hybrid cars, or interest on a $750,000 mortgage?”

While websites are the likely repository to inform transparency, “apps” should also be considered to address the way many individuals access information via their smartphone. In addition, the functionality of a secure app can not only provide information but allow individuals to access their tax information. The app could also push out reminders about estimated tax payments, occasional tax tips pertinent to the app owner, and information on Celebrate Taxpayers Day.

[1] The comments contained in this paper are the individual views of the author who prepared them, and do not represent the position of the California Lawyers Association or its Taxation Section. This paper is based on a similar one presented at the California Lawyers Association Tax Section’s 2018 Sacramento Delegation project and written up in the California Tax Lawyer, Jan. 2020, Vol. 28, No. 3, in an article entitled, “Suggestions for Improved Transparency and Accountability for California Taxes Via Improved Tax and Budget Literacy.”

[2] Although the participants on this project might have clients affected by the rules applicable to the subject matter of this paper and have advised such clients on applicable law, no such participant has been specifically engaged by a client to participate on this project.

[3] A 2015 survey by NerdWallet concluded that Americans earn an “F” in their understanding (or lack thereof) on personal finances related to income taxes. Questions asked in the survey included use of IRAs and other retirement plans, 529 education plans, what qualifies as a charitable contribution deduction. NerdWallet, “Americans Failing on Basic Income Tax Knowledge,” Feb. 24, 2015; https://www.nerdwallet.com/blog/taxes/americans-failing-basic-tax-knowledge/.

[4] This statement refers to the federal Taxpayer Bill of Rights available at IRC section 7508(a)(3) and https://www.irs.gov/taxpayer-bill-of-rights.

[5] AICPA, Guiding Principles of Good Tax Policy: A Framework for Evaluating Tax Proposals, 2017; https://www.aicpa.org/ADVOCACY/TAX/downloadabledocuments/tax-policy-concept-statement-no-1-global.pdf.

[6] GAO, Understanding the Tax Reform Debate: Background, Criteria, & Questions, GAO-05-1009SP, Sept. 2005, pages 4-5; https://www.gao.gov/assets/210/202725.pdf.

[7] AICPA, supra, p. 13.

[8] GAO, supra, p. 1.

[9] IRS, Taxpayer Bill of Rights; https://www.irs.gov/taxpayer-bill-of-rights.

[10] Congressional Budget Office, An Overview of the Economic Outlook: 2021 to 2031, Feb. 2021;

https://www.cbo.gov/publication/56970. The appendix of this report focuses on tax expenditures, noting that for fiscal year 2021, the “value” of over 200 individual and corporate income and payroll tax expenditures totaled $1.8 trillion which exceeds estimated discretionary spending for that year.

[11] Campaign to Cut Waste, Online Tax Receipt;

https://obamawhitehouse.archives.gov/21stcenturygov/tools/tax-receipt. This operated similarly to the Franchise Tax Board receipt. The website asked for the taxpayer’s income, Social Security and Medicare taxes and then produced a “receipt” showing the percentage and dollar amount that was used within broad categories of government direct spending.

[12] FTB, 2017 Income Tax Receipt;

https://web.archive.org/web/20181202012434/https://www.ftb.ca.gov/individuals/taxreceipt/index.shtml.

[13] Transparent.utah.gov provides a taxpayer receipt that requires users to enter their state income tax and state sales tax information. Like the FTB receipt, the Utah receipt shows how the dollars were used among broad expenditure categories. The site appears not to be maintained though as most links go to a website Utah.gov/transparency/ that do not work. See https://www.utah.gov/taxpayer-receipt/.

[14] Texas Comptroller, Tax Exemptions & Tax Incidence, Dec. 2020, page 64;

https://comptroller.texas.gov/transparency/reports/tax-exemptions-and-incidence/2020/96-463.pdf. The Comptroller also reports a “Suits Index” as part of the tax incidence of each tax. This index shows ranges of +1.0 (progressive) to -1.0 (regressive tax), with 0.0 indicating a “perfectly proportional” tax for all income quintiles (see page 44 of the report).

[15] For more on taxpayer receipts, see Nellen, “Transparency for Individual Taxes,” AICPA Tax Insider,

April 14, 2016; https://www.thetaxadviser.com/newsletters/2016/apr/transparency-for-individual-taxes.html.

[16] This bill has been introduced before, such as H.R. 6458 (111th Congress). The taxpayer receipt called for

in this bill includes a table of the ten most costly tax expenditures.

[17] California State Board of Education, California Common Core State Standards – Mathematics, p. 46;

https://www.cde.ca.gov/be/st/ss/documents/ccssmathstandardaug2013.pdf.

[18] Louisiana Dept. of Education, Grade 6 Math Practice Test 2013-2014, p. 13, problem 22;

https://www.louisianabelieves.com/docs/assessment/practice-test-math-grade-6.pdf.

[19] IRS, Understanding Taxes; https://apps.irs.gov/app/understandingTaxes/teacher/index.jsp.

[20] City of Philadelphia, Video: Taxpayer Appreciation Day, March 2, 2020; https://www.phila.gov/2020-03-02-video-taxpayer-appreciation-day/. The event appears to be held at the Department of Revenue office location.

[21] OECD, Building Tax Culture, Compliance and Citizenship: A Global Source Book on Taxpayer Education, 2015.

[22] OECD, supra, p. 143.

[23] OECD, supra, pages 84-86.

[24] OECD, supra, pages 153-154.

[25] Additional reasons for such a day are noted in the author’s blog: “How about making April 30th Celebrating Taxpayers Day? (4/16/19); http://21stcenturytaxation.blogspot.com/2019/04/how-about-making-april-30-celebrating.html.

[26] IRS, The Tax Gap; https://www.irs.gov/newsroom/the-tax-gap. At an April 13, 2021 hearing before the Senate Finance Committee, IRS Commissioner Rettig estimated that the annual tax gap might be as high as $1 trillion. This statement was made about 43 minutes into the hearing in response to a question from Senator Wyden. See hearing video at https://www.finance.senate.gov/hearings/the-2021-filing-season-and-21st-century-irs.

[27] Thank you to taxpayers seem uncommon in the U.S. However, IRS Commissioner Rettig released a message to taxpayers on April 12, 2019 that included thanking taxpayers for filing and paying their taxes and reminding them of the importance of this civic duty. IRS, “IRS Commissioner Chuck Rettig’s Message to taxpayers:

Thank you for filing,” April 12, 2019; https://www.irs.gov/newsroom/irs-commissioner-chuck-rettigs-message-totaxpayers-thank-you-for-filing.