Antitrust and Unfair Competition Law

Competition: Spring 2020, Vol 30, No. 1

Content

- California and Federal Antitrust Law Update: Procedural Developments

- California Antitrust and Unfair Competition Law Update: Substantive Law

- Chair's Column

- Criminal Antitrust Enforcement: Recent Highlights, Policy Initiatives, and What's To Come

- Editor's Note

- Fireside Chat With U.S. Doj Antitrust Division Chief of Technology & Financial Services Section Aaron Hoag

- In re: Korean Ramen Antitrust Litigation: a Panel Discussion With Trial Counsel

- In the Clash Between the Venerable Per Se Rule and the Constitution, the Constitution Shall Prevail (In Time)

- Keynote Address: a Conversation With Justice Ming W. Chin

- Managing Antitrust and Complex Business Trials—a View From the Bench

- Masthead

- Promoting Competition In Competition Law: the Role of Third-party Funding In Overcoming Competitive Barriers In Private Antitrust Enforcement Practice

- The Road To Acquittal: Takeaways From U.S. V. Usher, Et Al.

- An Economic Treatment of Pass Through In Indirect Purchaser Antitrust Litigation

AN ECONOMIC TREATMENT OF PASS THROUGH IN INDIRECT PURCHASER ANTITRUST LITIGATION

By Armando Levy and David Sunding1

In order to be certified as a class action, indirect purchasers in Illinois Brick repealer states carry the burden of showing antitrust impact through common proof on a classwide basis. In this article, we describe the most recent results in the economics and marketing literature regarding retail pass through.

I. INTRODUCTION

Illinois Brick Co. v. Illinois, 431 U.S. 720 (1977), established a doctrine that only direct purchasers of product and services suffering from antitrust injury have standing to sue under federal antitrust law.2 However, indirect purchaser plaintiffs have been able to establish standing under state laws in the so-called Illinois Brick "repealer" states since California v. ARC America Corp., 490 U.S. 93 (1989). In ARC America, the Supreme Court held that Illinois Brick interpreted only federal antitrust law and states could allow indirect purchasers to seek damages under state law.3 Many states and the District of Columbia reaffirmed an indirect purchaser’s right to recover damages by passing Illinois Brick repealer statutes that expressly allow for indirect purchaser actions.4

For these cases, in addition to proving an overcharge to the direct purchasers, it is necessary to calculate a "pass-through" rate of the overcharges from direct purchasers to the indirect purchasers (end users). The pass-through rate is the percentage of wholesale price changes that appear in the retail price. Depending on the product and market, the product may pass through several hands before finally arriving to the end-user indirect purchasers. Hence, a pass-through analysis necessitates examination of the institutional details of the supply chain and the market structure at each of its levels. In fact, it is this additional burden (among others) that is cited among the justifications for the Illinois Brick doctrine.5

Pass-through analyses form an essential part of work an economist expert would perform in an indirect purchaser antitrust litigation matter. Although indirect purchaser antitrust litigation is not exclusively brought as a class action, class actions form the great majority of indirect purchaser cases. Several recent decisions on class certification for purported classes of indirect purchasers have turned on the failure of the plaintiffs’ experts to establish pass through for all or virtually all class members.6

[Page 149]

As we discuss below, economic theory is generally inclined to view positive pass-through rates as consistent with the behavior of profit-maximizing firms. The rate itself may vary greatly depending on the structure of wholesale and retail markets, but the fact of pass through (that is, whether or not it is positive) is a standard feature of most conventional microeconomic models. However, the literature on marketing and merchandising focuses on tactics meant to drive cross-product sales for multi-product retailers such as grocery and "big box" retail stores. These tactics include so called "loss-leader" sales, "focal" pricing or "pricing on the Nines," "everyday low pricing," and "high/low pricing." These tactics serve the strategy of maximizing store profits, but depending on how the tactics are implemented, they may suspend pass through for a period of time for certain products. Hence, empirical investigations based on statistical models of the relationship between retail and wholesale prices are often carried out on the relevant product markets to determine if this is the case.

This article describes the economic and marketing theory for retailer pricing and its relation to the pass-through of wholesale costs. The next section lays out the standard for class certification, while the following section discusses the economic and marketing theories of pass-through. The final section concludes.

II. CLASS CERTIFICATION REQUIREMENTS

In order to certify a class, the plaintiffs must meet the requirements Rule 23 of the Federal Rules of Civil Procedure. Specifically, plaintiffs must satisfy each aspect of Rule 23(a), which reads:

a) Prerequisites. One or more members of a class may sue or be sued as representative parties on behalf of all members only if:

(1) the class is so numerous that joinder of all members is impracticable;

(2) there are questions of law or fact common to the class;

(3) the claims or defenses of the representative parties are typical of the claims or defenses of the class; and

(4) the representative parties will fairly and adequately protect the interests of the class.

The plaintiffs must also show that the class action fits within at least one of the three types of class actions described in Rule 23(b). For damages actions, the plaintiffs’ proposed state-law damages classes must satisfy Rule 23(b)(3)’s predominance and manageability requirements. Rule 23(b)(3) reads:

[Page 150]

(3) the court finds that the questions of law or fact common to class members predominate over any questions affecting only individual members, and that a class action is superior to other available methods for fairly and efficiently adjudicating the controversy. The matters pertinent to these findings include:

(A) the class members’ interests in individually controlling the prosecution or defense of separate actions;

(B) the extent and nature of any litigation concerning the controversy already begun by or against class members;

(C) the desirability or undesirability of concentrating the litigation of the claims in the particular forum; and

(D) the likely difficulties in managing a class action.

In the context of an antitrust claim brought by members of a purported indirect purchaser class, the plaintiffs bear the burden of showing that all or nearly all members of the class suffered antitrust injury. Hence the fact of pass through is necessary to establish the antitrust standing of purported class members whereas the size of pass through is relevant to the size of damages to indirect purchasers.

With the new more rigorous environment for the class certification process, courts often require a more rigorous showing of damages methodology at the class certification stage. Indirect purchasers do not buy directly from the defendants. Depending on the product at issue, there may be more than one path by which the products travel from the defendant producers to the retailers who sell to the members of the class. At the class certification stage, an economist will examine the details of the supply chain to determine if wholesale cost changes are passed through to retail prices and whether or not the determination requires individualized inquiries. In our discussion below, we focus on retail pass-through, where finished products are sold by retailers.7

III. THE ECONOMIC FUNDAMENTALS OF PASS THROUGH

As a matter of economic principle, retailers must recover their short-run variable costs when they price their products for the market. Hence, in deciding the retail price, a retailer must cover the wholesale cost of the goods from their supplier and the costs of stocking and tracking the inventory before it is sold to customers. On top of the short-run variable costs of the good in question, the retailer must also cover a portion of their fixed costs (such as rent) and allow for (accounting) profit. The pass-through rate can be related to the markups that retailers use. The ratio of retail price to the retailer’s variable cost is the markup ratio.8 The markup ratio minus one gives the proportion by which the retail price exceeds variable cost. For example, if a retailer pays $1 for a product wholesale and then sells it for $1.50, the markup ratio is 150 percent and the markup is 50 percent. The pass-through rate is the proportion of a wholesale cost increase that the retailer passes on to its customers. Because a retailer knows what the wholesale price of the good is and has a less precise sense of the per-unit stocking and inventory costs, retailers may adopt a simple constant markup over wholesale cost as a pricing rule.9 With a constant markup, the pass-through rate and the markup ratio coincide with each other.

[Page 151]

In a perfectly competitive market, firms price at marginal cost and when marginal costs increase, the cost increases are passed through to the consumer 1:1 or at a 100 percent pass-through rate.10 The grocery retail business is known to be highly competitive and to be characterized by thin profit margins.11 Hence, from a purely theoretical perspective, a 100 percent pass-through rate is a reasonable starting point for grocery retail. The general retail business is also known to be competitive.

When a market is characterized by imperfect competition where retailers have some market power and face downward sloping demand, the pass-through rate may be different from 100 percent.12 As a general matter, the pass-through rate will be determined by the relative elasticities of supply and demand for the firm.13

For purposes of establishing that a wholesale overcharge resulted in class-wide impact, it is necessary that the pass-through rate is greater than zero. If the rate is greater than zero, any overcharge in wholesale prices will impact indirect purchasers. This is the key hurdle for class certification. From the point of view of economic theory, although different market structures imply different rates of pass through, a positive rate of pass through is a general finding. However, in the marketing literature there is a more of a tactical treatment of retail pricing. We discuss some of this literature below.

IV. RETAILER PRICING TACTICS THAT MAY IMPACT PASS THROUGH

Economic fundamentals dictate that in the long run retail prices for retail goods must cover their variable costs. However, retailers may diverge from a static markup rule to try to increase store traffic, promote particular brands in a retail category, or to signal low prices to customers generally. For instance, a grocery store may periodically put milk on sale (even at a loss) to draw customers into their stores and make up their losses on sales of other products such as tissue paper or bread. Exactly how this sale is implemented may be important to whether or not there is pass-through during those sales. We discuss the most common retail pricing strategies that appear in the literature below.

[Page 152]

V. LOSS-LEADER STRATEGIES

In certain instances, retailers may lower the retail price of a selected item to near (or even below) cost to entice customers into the store to increase traffic in the hopes that they will buy more profitable items along with the featured loss-leader product.14 This pricing strategy is usually combined with advertising such as weekly store "flyers" that are included with local newspapers.15

In order to prevent a "bait and switch" problem with retailers quickly running out of stock of advertised items, in 1971 the FTC implemented the "Unavailability Rule" for retail food stores. The rule "prohibits retail food stores from advertising prices for food, grocery products, or other merchandise unless the stores have the advertised product in stock and readily available at or below the advertised price."16 Hence sales of loss leaders cannot be de minimis and thus escape relevance as the exception to "all or nearly all" class members. It is common for retailers to use loss-leader strategies on perishable goods which cannot be stocked up at home or bulky items that take up space to store. Indeed, a number of academic papers that study the loss-leader strategy suggest that the most popular products chosen are soft drinks, paper towels, eggs, and milk.17

Although named a "loss-leader," loss leaders are usually not sold at a price below their purchase cost. This is because the reduced price episodes are often executed in conjunction with the producers who reimburse the retailers for the sale through a short-term deep trade promotional discounts.18 Hence, wholesale price and retail price move together even during the period of deep discount.

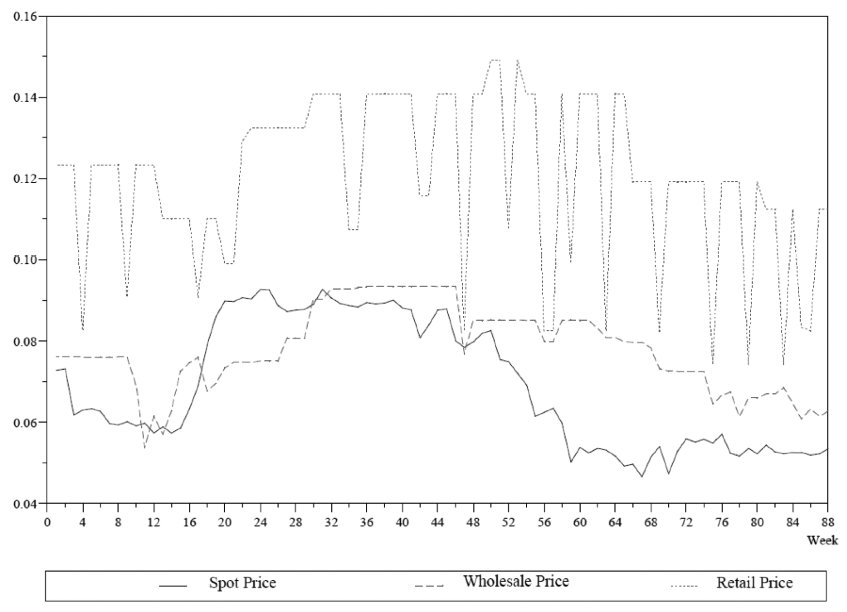

Figure 1 below shows wholesale and retail prices for a grocery store from the Dominick’s chain that runs loss leaders on their orange juice product. The figure is taken from Dutta, Bergen and Levy (2002).19 As can be seen in the figure, retail prices drop near wholesale prices periodically. Some of the sales are unsupported by wholesale price discounts (such as week 4) and other sales (such as week 47) coincide with temporary drops in the wholesale price. Generally, wholesale prices were higher in the middle period (weeks 32-46) and lower at the beginning and end. "Regular" retail prices followed this same pattern. Prices began near 12.5 cents per ounce, climbed to 14 cents per ounce and then declined to under 12 cents per ounce albeit with periodic sales throughout. Similarly, sale prices were also low at the beginning (weeks 4 and 9) and end (weeks 75, 79 and 83) and higher in the middle (weeks 34 and 42). Hence the level of loss leader sales price appears related to the level of wholesale prices. However, as is apparent from Figure 1, wholesale and retail prices do not move in lockstep (note the highest retail prices occur when wholesale prices had started to decline).

[Page 153]

Statistical models can be fit to the data to estimate the systematic relationship between wholesale and "regular" retail price and "sale" retail prices. Often product-specific (SKU level) price scanner data is available directly from retailers or from third-party marketing firms such as Nielsen or IRI. When this is the case, empirical estimates can be made of the relationship between wholesale and retail prices using regression analyses.

Figure 1: Retail and Wholesale Price of Orange Juice

Image description added by Fastcase.

Source: Shantanu Dutta, Mark Bergen and Daniel Levy, Price Flexibility in Channels of Distribution: Evidence from Scanner Data, 26 Journal of Dynamics and Control 1845, Fig. 1b (2002).

[Page 154]

VI. PRICE POINTS

A common tactic employed in retail pricing, and commonly as part of a loss-leader strategy, is to target a particular retail price point (such as $.99) that seems inexpensive or is likely to be remembered by consumers. The use of price points has the effect of discretizing or imposing a grid of prices that are chosen by retailers and wholesalers. As we discuss below, price points are part of the execution of a "high/low" or an "Every Day Low Pricing" strategy. However, a strategy to stick to a particular price point in spite of wholesale cost changes is the unicorn of "no pass through." The foremost example of this tactic is the Costco hot dog. Costco has famously maintained a $1.50 price point for a hotdog and soft drink at their snack bar since the 1980s.20 Costco has also maintained the price of its rotisserie chicken at $4.99 since 2009.21

VII. EVERY DAY LOW PRICING AND HI/LO PRICING STRATEGIES

Two approaches to retail pricing that have emerged are the use of Every Day Low Pricing (EDLP) or a high/low pricing strategy. In the former model, retailers set and maintain a constant lower margin on a product in order to build trust with the customer and negate the need to comparison shop between retail stores.22 For example, Walmart is known to employ an EDLP approach to pricing its products. This strategy is more prevalent with big box club-style stores such as Walmart, Costco and Trader Joe’s.

By contrast to EDLP, the "high/low" strategy is popular among chain grocery stores. Under this strategy, retailers frequently put items on aggressive promotion for a short period of time in order to attract customers and then return to the standard price (e.g., see Figure 1 above). In this approach consumers may be thought to infrequently update their sense for the price level at a store and so a sale price may cause customers to establish the habit of frequenting a particular store. The Dominick’s grocery store chain used this strategy with many products during the 1990s. In practice, the high/low strategy is closely related to the loss leader approach described above but may involve less severe discounting.

VIII. SOME RECENT LITERATURE OF PASS-THROUGH ANALYSIS

A couple of papers demonstrate two approaches to estimating retail pass through in the academic literature. The first paper uses what is called a reduced form model to estimate the general relationship between wholesale and retail prices. This paper calculates markup ratios of manufacturers and retailers using scanner data from the same Dominick’s Finer Food chain as used by Dutta, et al. (2002) above. Dominick’s carried national branded and private label products. The retailer’s markup ratio for national branded canned tuna products was estimated to be 1.15 on average, while the markup ratio on private label tuna products was a bit higher at 1.22.23 Other grocery products showed somewhat higher markups.

[Page 155]

The second paper by V. Midrigan fits a structural model of retailer behavior to scanner data from the same retail chain (Dominick’s).24 This paper differentiates between the analyses of low-frequency changes in "regular" prices versus the high-frequency price changes from sales promotions. The paper describes a structural model of retail pricing using the Dominick’s retail data that incorporates equilibrium with frequent discounting from a regular price in the presence of small costs to changing prices. This paper finds the retailer’s optimal price is a constant markup over unit costs, with a markup ratio of 1.5.25 This would imply a pass-through rate of 150 percent.

IX. CONCLUSION

In summary, whether or not an indirect purchaser class is suitable for class treatment will depend on the facts of the particular case and whether or not all or virtually all class members had wholesale cost changes passed on to retail prices. Economic theory is supportive of pass through but tends to be more abstract then the more granular studies in marketing which may imply periods of no pass through. Examples also exist in plain sight. Costco hot dogs are an extreme form of focal pricing which show zero retail pass through for decades. In practice for a particular case, statistical models can be employed to estimate whether positive pass through uniformly exists using detailed wholesale and retail sales data.

[Page 156]

——–

Notes:

1. Armando Levy is a Principal of The Brattle Group. David Sunding is the Thomas J. Graff Professor of Agricultural and Natural Resource Economics at University of California at Berkeley and a Principal of The Brattle Group. The views expressed here are solely those of the authors and not of The Brattle Group.

2. The recent Supreme Court ruling on Apple Inc. v. Pepper, 139 S. Ct. 1514, 1519 (2019), has expanded the definition of what constitutes a "direct purchaser," but the doctrine remains in place. See Kobayashi and Wright (2019), What’s Next in Apple Inc. v. Pepper? The Indirect-Purchaser Rule and the Economics of Pass-Through, 2018-2019 Cato Sup. Ct. Rev. 249, for a discussion.

3. California v. ARC America Corp., 490 U.S. 93 (1989).

4. Nearly thirty states authorize indirect purchasers to recover damages under state antitrust laws through legislations or judicial decisions. Five states limit their repealer laws to claims asserted by their attorneys general on behalf of indirect purchasers.

5. Richard A. Posner and William M. Landes, Should Indirect Purchasers Have Standing to Sue under the Antitrust Laws? An Economic Analysis of the Rule of Illinois Brick, 46 U. Chi. L. Rev. 602 (1979).

6. See In re Processed Egg Prod. Antitrust Litig., 312 F.R.D. 124 (E.D. Pa. 2015); In re Optical Disk Drive Antitrust Litig., 303 F.R.D. 311 (N.D. Cal. 2014); In re Lithium Ion Batteries Antitrust Litig., No. 13-MD-2420 YGR, 2018 WL 1156797 (N.D. Cal. Mar. 5, 2018).

7. Hence we set aside the problem of a manufacturer passing through a single component cost increase to a final good that has many components.

8. In practice, there are many markups that appear in GAAP financials, but we are defining the markup from an economist’s perspective.

9. "In the retail trades, a conventional pricing rule is to seek some standard percentage margin—for example 40%—of price less cost over price. Knowing the wholesale price W of an item, one finds the retail price by calculating W/(1-.4). The 40% margin must cover all selling and overhead expenses." Frederic M. Scherer and David R. Ross, Industrial Market Structure and Economic Performance 262 (3d Ed., Houghton Mifflin 1990).

10. Pierpaolo Benigno and Ester Faia, Globalization, Pass-Through and Inflation Dynamic (Mar. 2010), available at http://www.nber.org/papers/w15842 (last accessed Feb. 14, 2020); Frank Verboven and Theon van Dijk, Cartel Damages Claims and the Passing-On Defense, 57 J. Indus. Econ. 457 (Sept. 2009); Gregory J. Werden, Luke M. Froeb, and Steven Tschantz, The Effects of Merger Efficiencies on Consumers of Differentiated Products, 1 European Comp. J., 245-264 (Oct. 2005).

11. See CNBC, What’s Behind the Rush into the Low-Margin Grocery Business (June 6, 2013), available at https://www.cnbc.com/id/100794988; Porte Brown Grocery & Food Service Quarterly Industry Report (March 2018).

12. For example, in a simple symmetric Cournot environment with n firms, the pass-through rate would be n/(n+1) x 100%. See Jean Tirole, The Theory of Industrial Organization, Ch. 5 (MIT Press 1988).

13. E. Glen Weyl and Michael Fabinger, Pass-Through as an Economic Tool: Principles of Incidence under Imperfect Competition, 121 J. Political Econ. 528 (2013).

14. See James D. Hess and Eitan Gerstner, Loss Leader Pricing and Rain Check Policy, 6 Marketing Science 358 (1987); Rajiv Lal and Carmen Matutes, Retail Pricing and Advertising Strategies, 67 J. Bus. 345(1994).

15. J. Barry Mason and Morris L. Mayer, Modern Retailing Theory and Practice (5th ed. BPI/Irwin 1990).

16. Federal Register Vol. 79, No. 227 (November 25, 2014), available at https://www.govinfo.gov/content/pkg/FR-2014-11-25/pdf/2014-27881.pdf. The rule was amended in 1989 to provide an exception for disclosures that "supplies are limited" and four defenses: (1) stock is kept to "reasonably meet demand," (2) the issuance of "rain checks," (3) offer comparable products at comparable prices, or (4) offer compensation equal to the advertised value.

17. Rockney G. Walters and Scott B. MacKenzie, S.B., A Structural Equations Analysis of the Impact of Price Promotions on Store Performance, 25 J. Mktg. Research 51 (1988).

18. Robert C. Blattberg and Scott A. Neslin, S.A., Sales Promotion: Concepts, Methods and Strategies (Prentice Hall 1990).

19. Shantanu Dutta, Mark Bergen and Daniel Levy, Price Flexibility in Channels of Distribution: Evidence from Scanner Data, 26 J. Dynamics and Control 1845 (2002).

20. See https://www.cnn.com/2018/10/04/business/costco-food-court-prices/index.html.

21. See https://www.cnn.com/2019/10/13/business/costco-rotisserie-chicken-facts/index.html.

22. See Stephen J. Hoch, Xavier Drèze and Mary E. Purk, EDLP, Hi-Lo, and Margin Arithmetic, 58 J. Mktg. 16 (1994), for a discussion.

23. Robert B. Barsky, Mark Bergen, Shantanu Dutta and Daniel Levy, What Can the Price Gap between Branded and Private-Label Products Tell Us about Markups?, Scanner Data and Price Indexes, Chp. 7, 165-228 (Feenstra and Shapiro eds., U. Chi. Press 2003).

24. Virgiliu Midrigan, Menu Costs, Multiproduct Firms, and Aggregate Fluctuations, 79 Econometrica 1139 (2011).

25. The markup ratio is given by the ratio Y/(Y-1), with Y taken as the elasticity of demand for grocery products as given by reference to Nevo (1997), Barsky, et al. (2003) and Chevalier, et al. (2003). See Aviv Nevo, Demand for Ready-to-Eat Cereal and Its Implications for Price Competition, Merger Analysis and Valuation of New Brands, Ph.D. Dissertation (Harv. U. 1997); Robert B. Barsky, et al., What Can the Price Gap between Branded and Private-Label Products Tell Us about Markups? Scanner Data and Price Indexes, Chp. 7, 165-228 (Feenstra and Shapiro eds., U. Chi. Press 2003); Judith A. Chevalier, Why Don’t Prices Rise During Periods of Peak Demand? Evidence from Scanner Data, 93 Am. Econ. Rev. 15 (2003).