Taxation

Taxation Section: 2022 Washington, D.C. Delegation

April 25 – 26, 2022

- Delegation Chair: Kevan P. McLaughlin (kevan@mclaughlinlegal.com)

- Delegation Co-Chair: Annette Nellen (Annette.Nellen@sjsu.edu)

About the Delegation

For over 30 years, the Taxation Section (first as part of the California Bar Association, and now part of the California Lawyers Association) has sent an annual delegation to bring California tax lawyers and their ideas to Washington, D.C. Just prior to the American Bar Association Tax Section Meeting held in Washington, D.C., a group of selected delegation members from the Taxation Section of the California Lawyers Section will share their ideas and engage in lively discussions with key tax officials and staff members from the following government offices, depending on availability and interest:

- Internal Revenue Service

- National Taxpayer Advocate

- Treasury Department

- House Ways and Means Committee

- Joint Committee on Taxation

- Senate Finance Committee

- United States Tax Court

- The Department of Justice Tax Division

The Delegation serves a variety of functions. The most important is to make a substantive contribution to the federal tax laws. The Delegation also familiarizes government officials with the experience and concerns of California tax lawyers. Past Delegations have raised the awareness of government tax officials of the California bar and have enhanced our ability to play a significant role in federal tax policy.

Through the Delegation, we hope to encourage tax officials in Washington, D.C. to consider the California bar and its members as a useful resource. In addition, the Delegation benefits the individual Delegation members. It provides insight into how the government functions and the issues that concern those who formulate the tax laws and regulations, as well as an opportunity to develop relationships with government staffers who work in the respective member’s areas of practice.

Finally, and possibly most noteworthy, are the facts that the papers have been published both in national and state-wide tax journals, as well as online in Tax Notes Today, and a number of the proposals have been adopted. Please note that publication is not guaranteed.

Deadlines

The 2022 Washington D.C. Delegation is currently planned for April 25 – 26, 2022. The following deadlines will apply:

| Date | Action Item(s) | Description |

| December 10, 2021 | Paper Topics Proposal | Paper proposals in proper format (see 5) to be submitted to the Taxation Section Executive Committee no later than December 10, 2021. |

| January 7, 2022 | Inform Authors of Selected Papers | Authors will be informed by the Taxation Section Executive Committee if their papers are approved, rejected, or require additional development. Papers that are not rejected or approved will be given an independent timetable to resubmit for additional consideration. |

| January 31, 2022 | First Draft Executive Summary | Authors will submit a first draft of their Executive Summary to the Taxation Section Executive Committee and their reviewers no later than January 31, 2022. |

| February 25, 2022 | First Draft Paper | Authors will submit a first draft of their full paper to the Taxation Section Executive Committee and their reviewers no later than February 25, 2022. |

| February 28, 2022 | U.S. Supreme Court Group Admission Application | The D.C. Delegation has arranged for an optional U.S. Supreme Court group admissions ceremony on April 27, 2022. Unfortunately, we only have 12 available spots. The deadline for the application is Monday, February 28, 2022. If you are interested in participating in the group admissions ceremony, please let Kevan McLaughlin know ASAP. |

| March 18, 2022 | Government Contact Information | Authors will submit names and contact information of any government contacts for coordination to the Taxation Section Executive Committee. |

| March 25, 2022 | FINAL PAPERS | Authors will submit final versions of their full paper (see 12) to the Taxation Section Executive Committee no later than March 25, 2022. |

| April 24, 2022 | Reception Dinner (location TBD) | Delegates are expected to attend a dinner on the evening of April 24, 2022. |

| April 25, 2022 | Delegation Day 1 | Schedule TBD |

| April 26, 2022 | Delegation Day 2 | Schedule TBD |

| April 27, 2022 | (Optional) U.S. Supreme Court Swearing-in Ceremony |

Paper Topic Proposals and Format

So that we may ensure quality and control the limit of papers to a manageable number, members wishing to be considered for participation in the 2022 Washington, D.C. Delegation are required to submit a written proposal no longer than three pages in length. Each written proposal must include the following:

- An outline of the substance of the proposed topic with appropriate detail of the subject matter to be covered.

- A discussion of the current law, and the reason for the proposed change, together with an explanation of the proposed change in sufficient detail to permit technical evaluation.

- “Problems Addressed” section should identify the problems addressed by the proposal; indicate why the problem is sufficiently important and widespread to merit attention; and state whether other proposals have been advanced to address the same problem.

- A “Merits of the Proposal” section, noting the proposal’s advantages and disadvantages for various categories of taxpayers or transactions, both as compared to current law and as compared to other proposals for changing the law.

- A discussion of any important collateral consequences the proposal may have with respect to other tax laws.

- An explanation of why the proposal is feasible – politically and economically.

- The names of the tax officials in Washington, D.C. with whom you have discussed the proposal and a brief summary of their responses/feedback, if any.

- A statement whether the author has a matter involving the issue pending before the Internal Revenue Service or any court.

- The names of two suggested reviewers (neither reviewer can be a member of, employed by, or otherwise associated with the writer’s company or firm).

When formulating your proposal, draft or review papers, consider asking yourself the following:

- Why should the government take any action on this issue?

- What makes it important enough to incur the costs of changing the current rules?

- Why should action be taken now?

- Have there been any new developments, such as a new case, a new position by the IRS, or economic changes?

- What are the problems with the current law?

- How widespread are the problems? On a macro level, possible problems include cost, complexity, administrability and horizontal inequity. On a micro level, for whom or what is the current regime a problem? Consider both categories of transactions and categories of taxpayers. Be as particular as possible in identifying the problems and reasons for change.

- What are the advantages of your proposal?

- Whom would it help and how?

- If you are carving out a category for special treatment when there are others arguably similarly situated, what justifies the special treatment?

- What are the disadvantages of your solution? (Ask yourself the questions a government official would ask)

- Whom would it hurt? Consider groups other than your own clients; small business vs. large; individual taxpayers; fiscal year taxpayers; taxpayers subject to AMT; particular industries; particular transactions, etc. Do not forget the government’s interest. Discuss your ideas with the staffers at Treasury and IRS responsible for the area.

- Would your proposal open loopholes? How can you guard against abuse and avoid complicating the proposal?

- What analogies to your proposal exist in the current law?

- Do they argue in favor or against your solution?

- Have they been developed for situations and problems that are similar to or different from your problem?

- Why should action be taken at the level you propose (legislation vs. regulation vs. revenue ruling)?

- If you are proposing administrative action, does Treasury have the authority?

- Are there other proposals to address the issue already on the table (possibly from other bar groups, the ALI or AICPA, trade associations, academia or state legislation)?

- How do they compare to your proposal?

- What are the advantages and disadvantages of each of those alternatives?

- If your first choice were to be rejected, do you have an alternative proposal?

- Have you discussed the relevant legislative or administrative history?

- What was the stated purpose for adopting the current rule? Have you thoroughly addressed those concerns?

- Might there be other, unexpressed (for example, political) reasons for the current law? Does your proposal address these concerns?

- What are the collateral consequences of your proposal for other tax laws?

- Might your proposal affect laws and rules outside of tax? Why should the problem be addressed through the tax laws?

- Is your paper as short as possible? Your paper should be thoughtful and thorough, but to the point.

- Do you have an accurate, brief and inviting title for the paper?

Proposals for D.C. Delegation papers must comply with the following template:

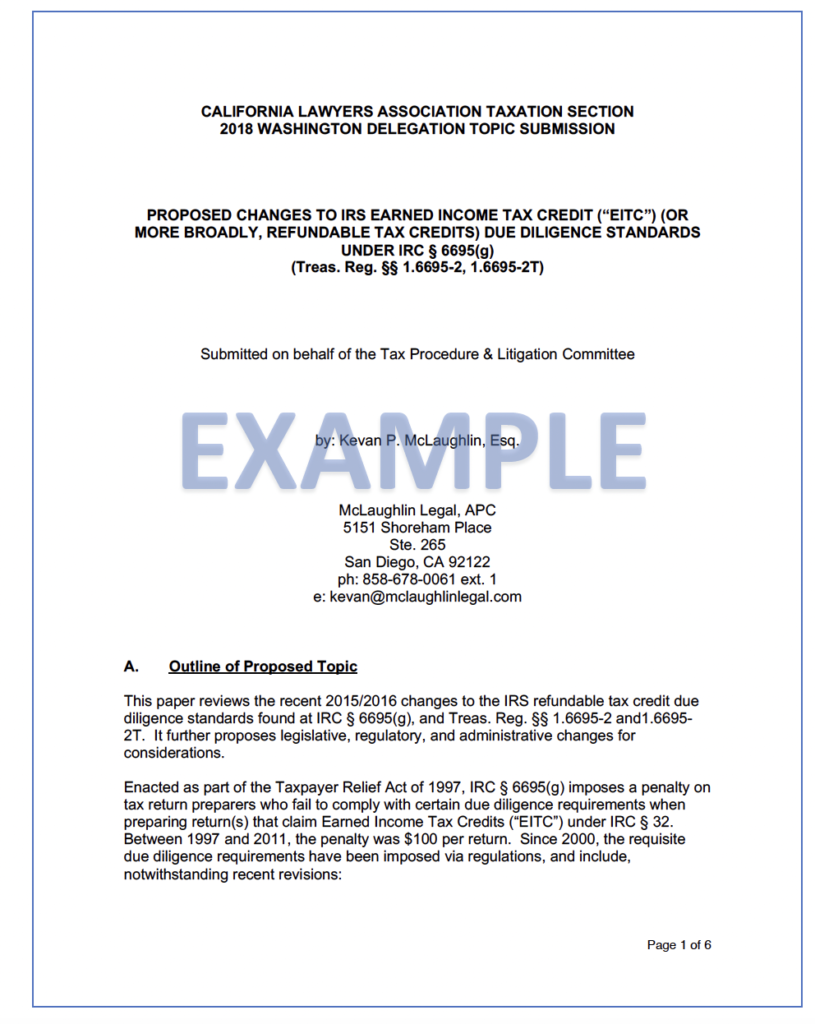

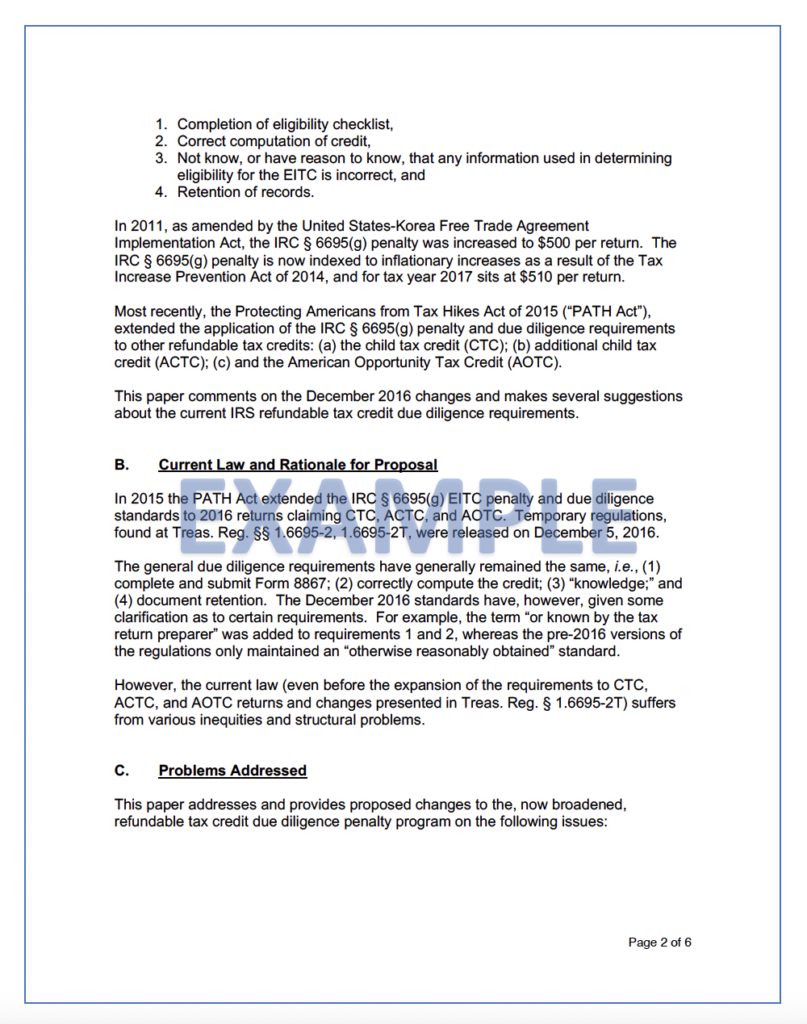

Following the initial page, formatted as detailed above, each proposal must next include the following sub-parts, as detailed in the following example:

A. Outline of Proposed Topic

1. Sub-Parts should follow 1., 2., 3., etc. formatting.

a. Followed by a., b., c., etc. formatting.

B. Current Law and Rationale for Proposal

C. Problems Addressed

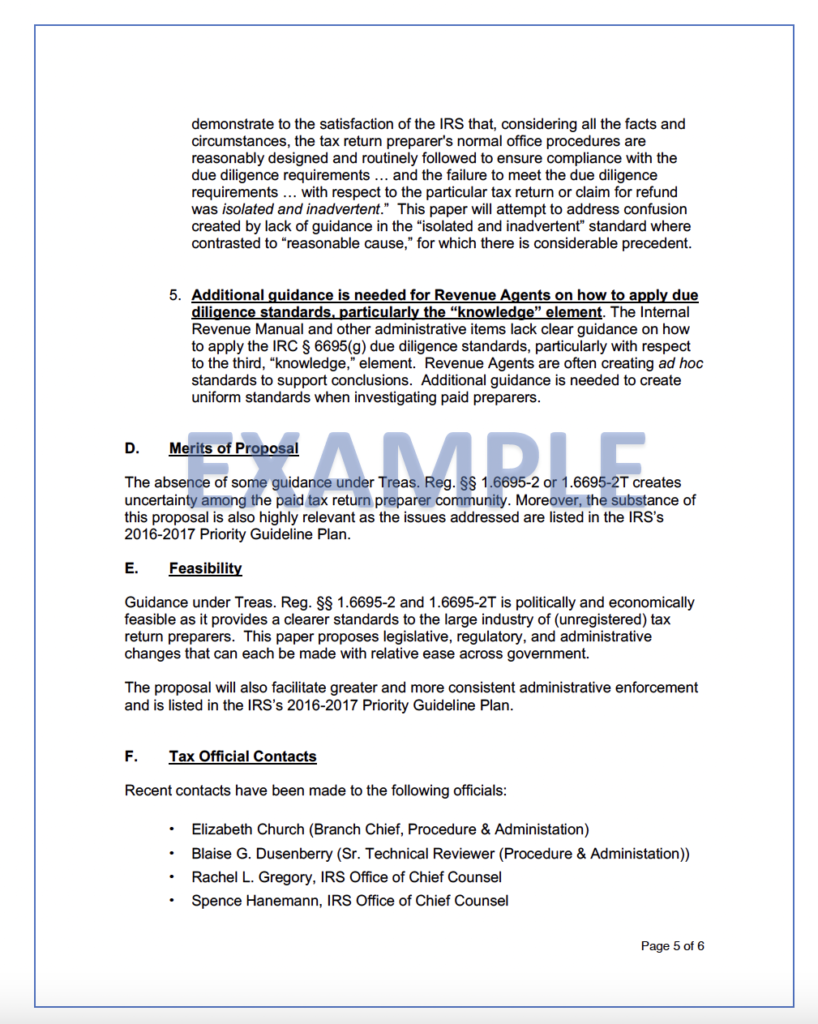

D. Merits of Proposal

E. Feasibility

F. Tax Officials Contacted

G. Required Statement

F. Suggested Reviewers

Paper Style and Formatting Guide

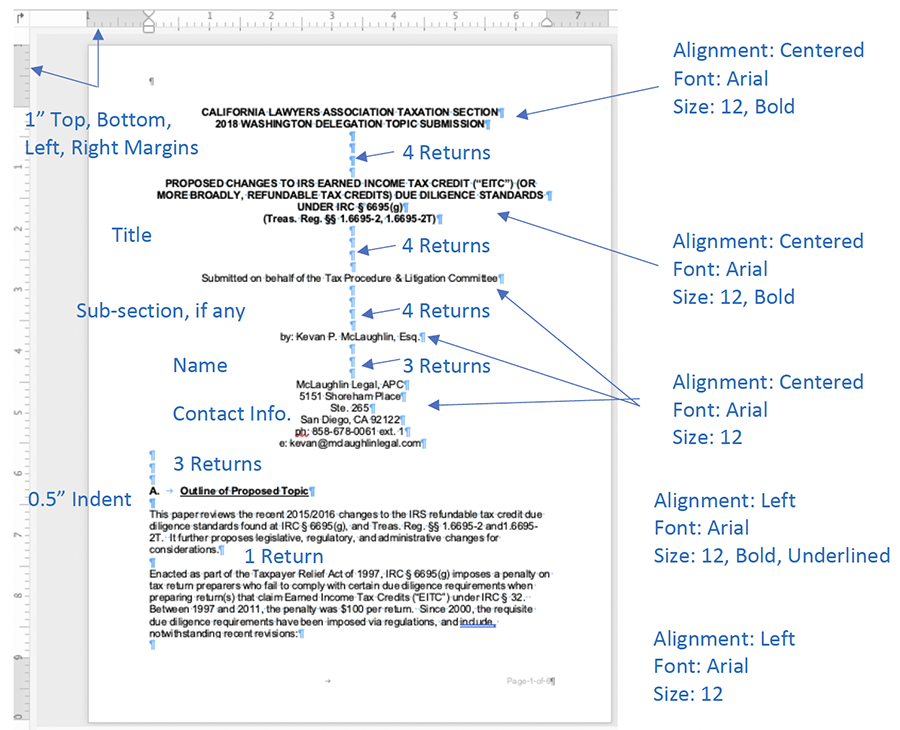

Final D.C. Delegation papers must comply with the following formatting guidelines. The first page of your final paper will be its TITLE PAGE with the following formatting guidelines:

Modifications should be made to reflect the California Lawyers Association rather than the State Bar of California.

Immediately following the cover page, each paper must have an EXECUTIVE SUMMARY, intended to be one page or less, as follows:

Following the EXECUTIVE SUMMARY, papers will proceed with the DISCUSSION using the following numbering format:

DISCUSSION

I. HEADER ONE

A. Sub-Header One

B. Sub-Header Two

- Sub, Sub-Header One

- Sub, Sub-Header Two

- Sub, Sub, Sub-Header One

- Sub, Sub, Sub-Header Two

II. HEADER TWO

FAQ’s

Q Are there any COVID-19 protocols?

Yes. Although the D.C. Delegation will not occur for months, and the future requirements are unknowable, we want to be proactive and inform our government contacts what steps we are prepared to take to keep everyone safe. It is possible – if not certain – that Delegates will need to provide proof of full vaccination in order to participate in the 2022 Delegation.

Q Do the Taxation Section Standing Committees play a role in the D.C. Delegation?

Yes. Standing Committee Chairs have important roles in several phases of the Delegation. They are strongly encouraged to serve as facilitators and editors of the papers. To assist the Standing Committee members in selecting and developing topics, Committee Chairs should consider consulting the current IRS Priority Guidance Plan.

Q Where can I get ideas for suggested topics?

We have found that legislative proposals, especially those that would reduce tax revenues or require legislative change, face much resistance. Nevertheless, certain government officials, including the Joint Committee on Taxation, generally want to hear about legislative issues or papers on technical corrections to existing statutes. Participants who have submitted regulatory and administrative proposals generally have found much greater receptiveness.

To the extent a topic is not listed on the IRS’s Priority Guidance Plan, any participant proposing an administrative topic must first contact the appropriate IRS and/or Treasury person to determine whether a guidelines project has been opened and, if so, its status and anticipated timetable.

The D.C. Delegation is not the proper forum in which to lobby on behalf of a particular client, group of clients, or organization. If any of the CLA Executive Committee members believe that a delegate is engaged in such behavior, that delegate and his or her paper may be excluded from some or all of the Delegation events. Such removal may occur just prior to or during a scheduled presentation.

As previously noted, we strongly encourage participants proposing administrative topics to select a topic from the IRS’s Priority Guidance Plan. A delegate proposing a legislative topic must first contact the legislative staffs to determine whether a similar proposal has been advanced, its sponsor(s) (whose staffs should be contacted) and whether a revenue estimate has been made for the proposal.

Prior year delegates are the best source of Washington, D.C. contacts and subject areas that may be of special interest to those officials. You can also find contact information for Chief Counsel attorneys by consulting the IRS Code and Subject Matter Directory (available online). If you need help in identifying the appropriate governmental officials to contact, please reach out to Kevan McLaughlin or Annette Nellen. Start early as it may take several days and a series of telephone calls to contact the appropriate governmental official.

Q Are these firm deadlines?

Yes. In order to plan a successful event, the Taxation Section Executive Committee needs each Delegate to meet each deadline. If a Delegate cannot meet any one of the deadlines outlined herein, please reach out to Kevan McLaughlin and Annette Nellen as soon as possible.

Q Will any of my costs be reimbursed?

Sort of. Each delegate is encouraged to obtain reimbursement from his or her firm for travel and other expenses associated with the trip because actual expenses will exceed any amount reimbursed by the Taxation Section. For the 2022 D.C. Delegation, the CLA has agreed to reimburse a maximum of $1,000 per author, up to a maximum of $1,500 per paper.

Accordingly, if more than two presenters for a particular paper travel to Washington, D.C., those presenters must share the $1,500 reimbursement. Unreimbursed travel costs of the presenter(s), and all travel costs of spouses, companions or children accompanying participants, will be the responsibility of the participant.

Prior Papers

2021 D.C. Delegation

| Author(s) | Title | Description |

| Lorraine Cohen & Karen Beznicki | U.S. Composite Income Tax Reporting for Non-Resident International Business Travelers/Employees and Payroll Identification Number | International employees routinely travel into the United States on business for short periods of time and often provide services for entities in a related entity group. Many companies actively track business travel and can identify when US employer withholding and reporting tax responsibilities exist, but do not have an effective mechanism to remit taxes. The proposal is to allow an employer to obtain a payroll reporting identification number for nonresident international business traveler employees providing services in the US that can be used to remit payroll withholding taxes. The proposal is to further create a mechanism where a US affiliate employer can file on a composite basis on behalf of specific US nonresident employees of a related entity group in lieu of W-2 reporting and individual tax return filing. |

| Annette Nellen | Suggestions for Improving Tax Compliance Through Greater Tax System Transparency and Accountability | This paper will explain the importance of transparency and accountability to taxpayers. In addition, several suggestions will be offered that can be implemented by the IRS or enacted into law by Congress. These ideas include an easy access to a taxpayer receipt, greater explanation of tax rules in forms rather than only how to find the number that goes on a particular line of a tax form. Many of these suggestions are low cost so can be implemented. Problems Addressed: Two important principles of good tax policy are described by the AICPA as follows: (1) Transparency and Visibility. Taxpayers should know that a tax exists and how and when it is imposed upon them and others, (2) Accountability to Taxpayers. Accessibility and visibility of information on tax laws and their development, modification and purpose, are necessary for taxpayers. Most tax rules do not meet these principles primarily due to the public’s lack of understanding of tax systems and specific tax rules. For example, most people cannot list all the taxes they pay and the amount. They likely are unaware of the differences in the rules for deducting interest on a home mortgage versus student debt. Also, they have not been given sufficient information by lawmakers to know why differences exist or why these deductions are even part of the federal income tax. |

| Elisabeth Sperow | Making Z Connection: How the IRS Can Reach and Educate A New Generation of Taxpayers | This paper advocates for ways the Internal Revenue Service (“IRS”) can help members of Generation Z become better informed and equipped to address their rights and responsibilities as taxpayers through the creation of an interactive mobile application. It is the culmination of work by students and faculty at California Polytechnic State University, San Luis Obispo. |

| Saba Shatara & Michael Day | Solidifying the Exclusion for Cancellation of Indebtedness Income Related to Home Loan Reductions: A Petition to Make Permanent IRC Section 108(a)(1)(E) | This proposal recommends that Congress consider making Section 108(a)(1)(E) a permanent provision. This proposal is in recognition of the fact that Section 108(a)(1)(E) is necessary to protect taxpayers who are forced to engage in loan modification or are facing potential foreclosure and, as noted in Babin v. Commissioner,” is premised on the belief that it is inequitable ‘to kick someone when he is down.’” The authors suggest that this is a timeless sentiment and not one suited for regular discussion for renewal. Finally, this proposal will attempt to demonstrate how making Section 108(a)(1)(E) permanent is consistent with the policies inherent to Section 108’s exceptions, as well as the general policy considerations contained in the code. |

| Richard S. Kinyon | Proposed Revision of the Income Tax “Grantor Trust Rules” (IRC sections 671- 679) | The purpose of this paper is to examine the way in which the income (including capital gains) of a domestic trust is taxed for federal income tax purposes during the lifetime of the U.S. resident settlor or grantor of the trust, and in particular to determine whether some or all of the so-called “grantor trust rules” in Subpart E of Subchapter J of the Federal Income Tax Law (IRC Sections 671 through 679) and related provisions should be modified or repealed, in whole or in part. Primarily as a result of the compression of the income tax rate brackets applicable to estates and trusts and the so-called “kiddie tax” in IRC Sections 1(e) and 1(g), respectively, enacted about 30 years ago, it is submitted that the bulk of those grantor trust rules are no longer needed to prevent the avoidance of income taxes, and ironically they are now utilized by taxpayers to avoid gift and save estate taxes. |

| A. Lavar Taylor & Rami M. Khory | Proposal to Establish Administrative Procedures for the Internal Revenue Service and the Department of Justice to Deal with Situations Where Court- Ordered Criminal Restitution Payable to the Internal Revenue Service Significantly Exceeds the Actual Tax Liability to Which the Restitution Relates | The paper proposes an administrative procedure for dealing with situations where the amount of criminal restitution in favor of the IRS as ordered by the District Court greatly exceeds the actual tax liability to which the restitution relates, as later determined by the IRS itself or by a court in a civil proceeding brought to determine the amount of taxes owed. Under existing law, taxpayers may not seek a reduction of court – ordered criminal restitution for which there is final court order, even though the IRS later agrees, or a court later determines in a civil proceeding , that the amount of taxes owed for civil purposes is significantly lower than the amount of criminal restitution relating to that tax liability as ordered by the District Court. This new procedure will permit taxpayers to avoid having to pay taxes, interest and penalties to the IRS where the IRS later agrees (as the result of the civil audit), or a court determines, that the amount owed as the result of the civil audit is less than the amount of criminal restitution ordered by the District Court for a given tax period. Under this procedure, taxpayers will be required to provide to the IRS proof that the taxpayer has paid to the IRS all amounts owed under Title 26 for a particular tax period, as agreed to by the IRS. |