Taxation

2023 Washington, D.C. Delegation and U.S. Supreme Court Group Swearing-in Event

For a PDF version, click here.

May 15-18, 2023

- Delegation Chair: Annette Nellen (Annette.Nellen@sjsu.edu)

- Delegation Vice Chair: Natascha Fastabend (nfastabend@law.uci.edu)

- Delegation Adviser: Kevan P. McLaughlin (kevan@mclaughlinlegal.com)

Website with past papers – https://calawyers.org/section/taxation/washington-dc-delegation/

About the Delegation

For over 30 years, the Taxation Section (first as part of the California Bar Association, and now part of the California Lawyers Association) has sent an annual delegation to bring California tax lawyers and their ideas to Washington, D.C. Delegates are members from the Taxation Section of the California Lawyers Section who share their ideas and engage in lively discussions with key tax officials and staff members from the following government offices, depending on availability and interest:

- Internal Revenue Service

- National Taxpayer Advocate

- Treasury Department

- House Ways and Means Committee

- Joint Committee on Taxation

- Senate Finance Committee

- United States Tax Court

- The Department of Justice Tax Division

The Delegation serves a variety of functions. The most important is to make a substantive contribution to the federal tax laws. The Delegation also familiarizes government officials with the experience and concerns of California tax lawyers. Past Delegations have raised the awareness of government tax officials of the California bar and have enhanced our ability to play a significant role in federal tax policy.

Through the Delegation, we hope to encourage tax officials in Washington, D.C. to consider the California bar and its members as a useful resource. In addition, the Delegation benefits the individual Delegation members. It provides insight into how the government functions and the issues that concern those who formulate the tax laws and regulations, as well as an opportunity to develop relationships with government staffers who work in the respective member’s areas of practice.

Finally, the papers are often published both in national and state-wide tax journals, such as Tax Notes or The California Tax Lawyer (CLA journal),and a number of the proposals have been adopted. Please note that publication is not guaranteed.

Typically, this event is held the same week as the American Bar Association Tax Section May Meeting held in Washington, D.C. (but this will not be the case for 2023).

Deadlines

The 2023 Washington D.C. Delegation is currently planned for May 15 to 17, 2023. The following deadlines apply:

Submissions of proposals, draft papers and final papers by the dates noted below should be sent to Annette.nellen@sjsu.edu, member of the Taxation Section Executive Committee.

| Date | Action Item(s) | Description |

| Before November 1, 2022 | If you plan to submit a proposal AND participate in the U.S. Supreme Court swearing in ceremony on May 15, 2023, get your application started well before November 1. See Appendix for information. | If you’re attending the CLA Tax Section Annual Conference on November 2 to 4, you’ll have an opportunity to get the required two “wet signatures” from sponsors attending this event. You must have page one of your application complete (typed) and printed, and your Letter of Good Standing from the highest court of your state of admission (California Supreme Court, for example). See details in the appendix of this packet. Paper proposals in proper format (see 5) are due to the Taxation Section Executive Committee no later than December 5, 2022. |

| December 5, 2022 | Paper Topics Proposals | Paper proposals in proper format (see 5) are due to the Taxation Section Executive Committee no later than December 5, 2022. |

| December 20, 2022 | Inform Authors of Selected Papers | Authors will be informed by the Taxation Section Executive Committee if their papers are approved, rejected, or require additional development. Papers that are not rejected or approved will be given an independent timetable to resubmit for additional consideration. |

| January 23, 2023 | Your complete U.S. Supreme Court admission application must be at the CLA Office (if you plan to also participate in the group swearing-in event on May 15). | See U.S. Supreme Court swearing-in information in this packet for details. Reminder: There are requirements for this application which necessitate a minimum of three weeks to complete. See Appendix in this document. |

| February 20, 2023 | First Draft Executive Summary | See U.S. Supreme Court swearing-in information in this packet for details. Reminder: There are requirements for this application which necessitate a minimum of three weeks to complete. See Appendix in this document. Submit a first draft of your Executive Summary to the Taxation Section Executive Committee and your reviewers no later than February 20, 2023. |

| February to April | Travel arrangements | Be sure to make air and hotel arrangements. Information on hotel to be provided by the CLA Tax Section. |

| March 6, 2023 | Government Contact Information | Submit names and contact information of any government employees you may have been in contact with, for coordination by the Taxation Section Executive Committee. |

| March 20, 2023 | First Draft Paper | Submit a first draft of your full paper to the Taxation Section Executive Committee and your two reviewers no later than March 20, 2023. Ask your reviewers to send comments to you within 7 to 10 days. |

| April 10, 2023 | FINAL PAPERS | Submit the final version of your complete paper (see 12) to the Taxation Section Executive Committee no later than April 10, 2023. |

| May 14, 2023 | Reception (location TBD) | Delegates must attend this reception for reminders of events of May 15 to 17 and to deliver a 2- to 3-minute summary of your paper to other delegates and others participating in the Supreme Court swearing-in ceremony. |

| May 15, 2023 | (Optional) U.S. Supreme Court Swearing-in Ceremony | See U.S. Supreme Court information in this packet (Appendix) and additional details to be provided by early May. |

| May 15, 2023 | Dinner meeting for all delegates (mandatory for at least one presenter per paper to attend); review of delegation agenda and 2 – 3 minute presentation of paper | Hamilton Restaurant 7 pm |

| May 16, 2023 | Delegation Day 1 Reception with DC delegates. Gov’t officials we meet with are also invited. | Schedule TBD |

| May 17, 2023 | Delegation Day 2 | Schedule TBD |

| May 18, 2023 | (Optional) U.S. Supreme Court Swearing-in Ceremony [applications due to CLA office by January 23] and lunch | See U.S. Supreme Court information in this packet (Appendix) and additional details to be provided by early May. |

Paper Topic Proposals and Format

So that we may ensure quality and control the limit of papers to a manageable number, members wishing to be considered for participation in the 2023 Washington, D.C. Delegation are required to submit a written proposal no longer than three pages in length.

Each written proposal must include the following:

- An outline of the substance of the proposed topic with appropriate detail of the subject matter to be covered.

- A discussion of the current law, and the reason for the proposed change, together with an explanation of the proposed change in sufficient detail to permit technical evaluation.

- A “Problems Addressed” section should identify the problems addressed by the proposal; indicate why the problem is sufficiently important and widespread to merit attention; and state whether other proposals have been advanced to address the same problem.

- A “Merits of the Proposal” section, noting the proposal’s advantages and disadvantages for various categories of taxpayers or transactions, both as compared to current law and as compared to other proposals for changing the law.

- A discussion of any important collateral consequences the proposal may have with respect to other tax laws.

- An explanation of why the proposal is feasible – politically and economically.

- The names of the tax officials in Washington, D.C. with whom you have discussed the proposal and a brief summary of their responses/feedback, if any.

- A statement whether the author has a matter involving the issue pending before the Internal Revenue Service or any court.

- The names of two suggested reviewers (neither reviewer can be a member of, employed by, or otherwise associated with the writer’s company or firm).

When formulating your proposal, draft or papers, consider asking yourself the following:

- Why should the government take any action on this issue?

- What makes it important enough to incur the costs of changing the current rules?

- Why should action be taken now?

- Have there been any new developments, such as a new case, a new position by the IRS, or economic changes?

- What are the problems with the current law?

- How widespread are the problems? On a macro level, possible problems include cost, complexity, administrability and horizontal inequity. On a micro level, for whom or what is the current regime a problem? Consider both categories of transactions and categories of taxpayers. Be as particular as possible in identifying the problems and reasons for change.

- What are the advantages of your proposal?

- Whom would it help and how?

- If you are carving out a category for special treatment when there are others arguably similarly situated, what justifies the special treatment?

- What are the disadvantages of your solution? (Ask yourself the questions a government official would ask)

- Whom would it hurt? Consider groups other than your own clients; small business vs. large; individual taxpayers; fiscal year taxpayers; taxpayers subject to AMT; particular industries; particular transactions, etc. Do not forget the government’s interest. Discuss your ideas with the staffers at Treasury and IRS responsible for the area.

- Would your proposal open loopholes? How can you guard against abuse and avoid complicating the proposal?

- What analogies to your proposal exist in the current law?

- Do they argue in favor or against your solution?

- Have they been developed for situations and problems that are similar to or different from your problem?

- Why should action be taken at the level you propose (legislation vs. regulation vs. revenue ruling)?

- If you are proposing administrative action, does Treasury have the authority?

- Are there other proposals to address the issue already on the table (possibly from other bar groups, the ALI or AICPA, trade associations, academia or state legislation)?

- How do they compare to your proposal?

- What are the advantages and disadvantages of each of those alternatives?

- If your first choice were to be rejected, do you have an alternative proposal?

- Have you discussed the relevant legislative or administrative history?

- What was the stated purpose for adopting the current rule? Have you thoroughly addressed those concerns?

- Might there be other, unexpressed (for example, political) reasons for the current law? Does your proposal address these concerns?

- What are the collateral consequences of your proposal for other tax laws?

- Might your proposal affect laws and rules outside of tax? Why should the problem be addressed through the tax laws?

- Is your paper as short as possible? Your paper should be thoughtful and thorough, but to the point.

- Do you have an accurate, brief and inviting title for the paper?

Proposals for D.C. Delegation papers must comply with the following template:

Following the initial page, formatted as detailed above, each proposal must next include the following sub-parts, as detailed in the following example:

A. Outline of Proposed Topic

1. Sub-Parts should follow 1., 2., 3., etc. formatting.

a. Followed by a., b., c., etc. formatting.

B. Current Law and Rationale for Proposal

C. Problems Addressed

D. Merits of Proposal

E. Feasibility

F. Tax Officials Contacted

G. Required Statement

F. Suggested Reviewers

Paper Style and Formatting Guide

Final D.C. Delegation papers must comply with the following formatting guidelines.

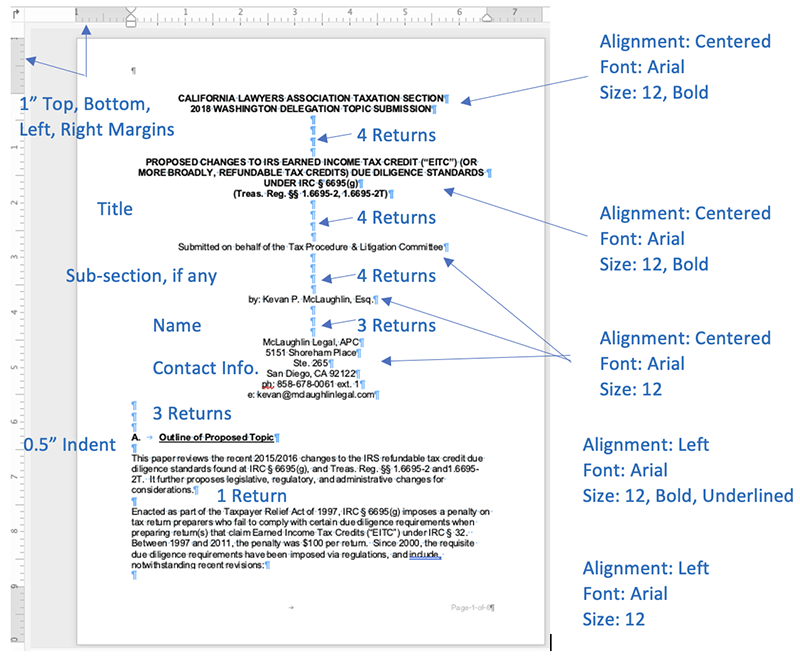

The first page of your final paper will be its TITLE PAGE with the following formatting guidelines:

Modifications should be made to reflect the California Lawyers Association rather than the State Bar of California.

Immediately following the cover page, each paper must have an EXECUTIVE SUMMARY, intended to be one page or less, as follows:

Following the EXECUTIVE SUMMARY, papers will proceed with the DISCUSSION using the following numbering format:

DISCUSSION

I. HEADER ONE

- A. Sub-Header One

- B. Sub-Header Two

- 1. Sub, Sub-Header One

- 2. Sub, Sub-Header Two

- i. Sub, Sub, Sub-Header One

- ii. Sub, Sub, Sub-Header Two

II. HEADER TWO

FAQ’s

Are there any COVID-19 protocols for the trip to Washington, D.C.?

Yes. Although the D.C. Delegation will not occur for months, and the future requirements are unknowable, we want to be proactive and inform our government contacts what steps we are prepared to take to keep everyone safe. It is possible – if not certain – that Delegates will need to provide proof of full vaccination to participate in the 2023 Delegation.

Will all meetings be in person?

The plan is for all 2023 meetings with government offices will be in person. But, we cannot guarantee this because of possible changes in COVID-19 protocols and many offices are allowing employees to work from home. If any of the meetings are only virtual, we will arrange to do them as a group from a conference room at the Sofitel (recommended hotel for the delegation).

Do the Taxation Section Standing Committees play a role in the D.C. Delegation?

Yes. Standing Committee Chairs have important roles in several phases of the Delegation. They are strongly encouraged to serve as facilitators and editors of the papers. To assist the Standing Committee members in selecting and developing topics, Committee Chairs should consider consulting the current IRS Priority Guidance Plan.

Where can I get ideas for suggested topics?

We have found that legislative proposals, especially those that would reduce tax revenues or require legislative change, face much resistance. Nevertheless, certain government officials, including the Joint Committee on Taxation, generally want to hear about legislative issues or papers on technical corrections to existing statutes. Participants who have submitted regulatory and administrative proposals generally have found much greater receptiveness.

To the extent a topic is not listed on the IRS’s Priority Guidance Plan, any participant proposing an administrative topic must first contact the appropriate IRS and/or Treasury person to determine whether a guidelines project has been opened and, if so, its status and anticipated timetable.

The D.C. Delegation is not the proper forum in which to lobby on behalf of a particular client, group of clients, or organization. If any of the CLA Executive Committee members believe that a delegate is engaged in such behavior, that delegate and his or her paper may be excluded from some or all of the Delegation events. Such removal may occur just prior to or during a scheduled presentation.

As previously noted, we strongly encourage participants proposing administrative topics to select a topic from the IRS’s Priority Guidance Plan. A delegate proposing a legislative topic must first contact the legislative staffs to determine whether a similar proposal has been

advanced, its sponsor(s) (whose staffs should be contacted) and whether a revenue estimate has been made for the proposal.

Prior year delegates are the best source of Washington, D.C. contacts and subject areas that may be of special interest to those officials. You can also find contact information for Chief Counsel attorneys by consulting the IRS Code and Subject Matter Directory (available online). If you need help in identifying the appropriate governmental officials to contact, please reach out to Annette Nellen. Start early as it may take several days and a series of telephone calls to contact the appropriate governmental official.

Are these firm deadlines?

Yes. In order to plan a successful event, the Taxation Section Executive Committee needs each Delegate to meet each deadline. If a Delegate cannot meet any one of the deadlines outlined herein, please reach out to Annette Nellen or Natasha Fastabend as soon as possible.

Will any of my costs be reimbursed?

Sort of. Each delegate is encouraged to obtain reimbursement from his or her firm for travel and other expenses associated with the trip because actual expenses will exceed any amount reimbursed by the Taxation Section. For the 2023 D.C. Delegation, the CLA has agreed to reimburse a maximum of $1,000 per author, up to a maximum of $1,500 per paper. Accordingly, if more than two presenters for a particular paper travel to Washington, D.C., those presenters must share the $1,500 reimbursement. Unreimbursed travel costs of the presenter(s), and all travel costs of spouses, companions or children accompanying participants, will be the responsibility of the participant.

Are 2023 Delegates required to also participate in the group swearing-in event at the U.S. Supreme Court?

No, but it is highly encouraged as a wonderful and fun opportunity and event. The DC Delegation has been scheduled to tie to the group swearing-in date the Tax Section was assigned by the Court. This is a wonderful opportunity to become a member of the Court. If you are already a member, you cannot participate. If you are not interested in becoming a member, that is fine. All delegates need to be in DC by late afternoon on Sunday May 14, 2023 for a reception. Delegation meetings may be scheduled for the afternoon of May 15. As of September 2022, the Court is not allowing guests to attend the swearing-in event.

Topics of Prior Delegation Papers

Website with past papers – https://calawyers.org/section/taxation/washington-dc-delegation/

2022 DC Delegation

| Author | Title | Summary |

| Andrew Gradman | Suggestions for IRS Examination of Promoted Transactions Which Purport to Apply the Installment Method to Equity-Like Positions | Intermediary Installment Sales are marketed transactions involving a Seller of an appreciated Asset; a Buyer; and an Intermediary who is formally independent, but practically speaking is a paid agent of Seller. The paper argues that the IRS should broaden this guidance to not just focus on M453 transactions, but to also curb abuses in Intermediary Installment Sales more generally. |

| Annette Nellen | Proposal for a Tax Form for Ease and Transparency of Reconciling Information Reports on Form 1040 | A reconciliation form to be filed with Form 1040 when needed, helps inform taxpayers that they should be taking a careful look at their information reports to be sure they are correct. The form also provides a clear and standard method to let the IRS know of the error and obtain the taxpayer’s explanation. The use of a new form should improve tax compliance and administration and reduce the number of notices sent to taxpayers by allowing individuals to reconcile and explain on the original return. |

| Jason Galek; Minna Yang; Simon LeBleu; and Miranda Freeman | Proposed Changes to Treatment of Apprpriateive Water Rights as an Undivided Interest in Property Eligible for Charitable Deduction under IRC 170 | Current federal tax law has not addressed appropriative water rights as a separate property right from the land for purposes of a charitable deduction under Internal Revenue Code section 170, which is only available for an undivided interest in property. IRC §§ 170(f)(3)(B)(ii), 2055(e)(2), 2522(c)(2). The closes decisional authority concerns mineral rights, which are inseparable from the land and cannot be gifted separately from the land for purposes of the charitable deduction under section 170. See, e.g., Rev. Rul. 88-37; GCM 39729. The only option for taxpayers wishing to make a charitable gift of water rights in the absence of clear guidance has been to pursue a qualified conservation contribution, which allows deductible charitable contributions of partial interests in property. IRC § 170(f)(3)(B)(iii); Treas. Reg. § 1.170A-14(a). Such conservation contributions must be used exclusively for conservation purposes and severely restricts the donee’s ability to transfer the property subsequently. IRC § 170(h)(1)(C); Treas. Reg. §1.170A-14(a), (c)(2). |

| Patrick Martin | The Need for Federal Tax Regulatory Guidance to Clarify “Resident Alien” for Non-Citizens who Have Lost Their “Lawful Permanent Residency” Immigration Status as a Matter of Law; Hence Their Right to be in or Enter into the United States | Congress amended IRC Section 7701(b) in 1984 to modify the definition of who is a “resident” for U.S. individual income tax purposes. The definition specifically includes those with “lawful permanent residency” (“LPR”) status. Later, Section 7701(b)(6) was modified in 2008 effecting certain individuals with LPR status. The Treasury Regulations that were adopted in 1992, addressing LPR status, were never modified after the 2008 statutory amendments to address how and when these individuals retain their U.S. person status (as a “resident alien”) for U.S. income tax purposes. The definition of who has “lawful permanent residency” for U.S. income tax purposes is based, in large part (but not exclusively), upon U.S. immigration law. The Immigration and Nationality Act (the “Act” or “INA”) defines permanent resident status as being lawfully accorded the privilege of permanently residing in the United States as an immigrant. Furthermore, for immigration law purposes, this lawful permanent residency status requires that the person physically reside in the territory of the United States in a permanent form. Although a person may have multiple residences, residence in the United States must be a permanent one. If a lawful permanent resident permanently leaves the United States and takes up permanent residency in their home country, or any other country outside of the United States, he or she will generally no longer have the lawful privilege (for immigration law purposes) of returning and residing permanently in the United States. Nevertheless, Treasury Regulation Section 301.7701(b)-1(b) have not been amended and seem to provide that these individuals retain their “United States person” status (as a “resident alien”) for U.S. income tax purposes. Under the existing regulatory rules, these individuals seem to be taxed on their worldwide income. |

| Robin Klomparens | Inter-vivos Trusts | Paper proposes that if a beneficiary has a current right to receive discretionary income and principal distributions, that the present interest requirement to obtain the annual exclusion is met without the necessity of sending a Crummey notice. All gratuitous inter-vivos transfers of property are potentially subject to gift tax. A donor, however, can receive an annual exclusion of up to $15,000 of gifts made to any person during a calendar year, in 2020. There are some notable exceptions. For example, paying someone’s tuition, or medical expenses, are not treated as gifts for purposes of the gift tax, if certain requirements are met. These payments are considered “qualified transfers” and are excluded, in addition to the annual $15,000 gift tax exclusion, in determining the total amount of a donor’s gifts in any calendar year But, the annual exclusion will only be allowed for a gift of a present interest in property. A present interest is defined as “[a]n unrestricted right to the immediate use, possession, or enjoyment of property or the income from property (such as a life estate or term certain).” If the gift is not a present interest, the Service will deny the exclusion as under Internal Revenue Code (“IRC”) §2503 and the Treasury Regulations thereunder, it is clear that if the gift is composed of a future interest in property, then the annual exclusion will not be allowed. |

| Creech, Leonard, Miller | Crypto including a voluntary disclosure program; elevating FAQs |

2021 D.C. Delegation

| Lorraine Cohen & Karen Beznicki | U.S. Composite Income Tax Reporting for Non-Resident International Business Travelers/Employees and Payroll Identification Number | International employees routinely travel into the United States on business for short periods of time and often provide services for entities in a related entity group. Many companies actively track business travel and can identify when US employer withholding and reporting tax responsibilities exist, but do not have an effective mechanism to remit taxes. The proposal is to allow an employer to obtain a payroll reporting identification number for nonresident international business traveler employees providing services in the US that can be used to remit payroll withholding taxes. The proposal is to further create a mechanism where a US affiliate employer can file on a composite basis on behalf of specific US nonresident employees of a related entity group in lieu of W-2 reporting and individual tax return filing. |

| Annette Nellen | Suggestions for Improving Tax Compliance Through Greater Tax System Transparency and Accountability | This paper will explain the importance of transparency and accountability to taxpayers. In addition, several suggestions will be offered that can be implemented by the IRS or enacted into law by Congress. These ideas include an easy access to a taxpayer receipt, greater explanation of tax rules in forms rather than only how to find the number that goes on a particular line of a tax form. Many of these suggestions are low cost so can be implemented. Problems Addressed: Two important principles of good tax policy are described by the AICPA as follows: (1) Transparency and Visibility. Taxpayers should know that a tax exists and how and when it is imposed upon them and others, (2) Accountability to Taxpayers. Accessibility and visibility of information on tax laws and their development, modification and purpose, are necessary for taxpayers. Most tax rules do not meet these principles primarily due to the public’s lack of understanding of tax systems and specific tax rules. For example, most people cannot list all the taxes they pay and the amount. They likely are unaware of the differences in the rules for deducting interest on a home mortgage versus student debt. Also, they have not been given sufficient information by lawmakers to know why differences exist or why these deductions are even part of the federal income tax. |

| Elisabeth Sperow | Making Z Connection: How the IRS Can Reach and Educate A New Generation of Taxpayers | This paper advocates for ways the Internal Revenue Service (“IRS”) can help members of Generation Z become better informed and equipped to address their rights and responsibilities as taxpayers through the creation of an interactive mobile application. It is the culmination of work by students and faculty at California Polytechnic State University, San Luis Obispo. |

| Saba Shatara & Michael Day | Solidifying the Exclusion for Cancellation of Indebtedness Income Related to Home Loan Reductions: A Petition to Make Permanent IRC Section 108(a)(1)(E) | This proposal recommends that Congress consider making Section 108(a)(1)(E) a permanent provision. This proposal is in recognition of the fact that Section 108(a)(1)(E) is necessary to protect taxpayers who are forced to engage in loan modification or are facing potential foreclosure and, as noted in Babin v. Commissioner,” is premised on the belief that it is inequitable ‘to kick someone when he is down.’” The authors suggest that this is a timeless sentiment and not one suited for regular discussion for renewal. Finally, this proposal will attempt to demonstrate how making Section 108(a)(1)(E) permanent is consistent with the policies inherent to Section 108’s exceptions, as well as the general policy considerations contained in the code. |

| Richard S. Kinyon | Proposed Revision of the Income Tax “Grantor Trust Rules” (IRC sections 671-679) | The purpose of this paper is to examine the way in which the income (including capital gains) of a domestic trust is taxed for federal income tax purposes during the lifetime of the U.S. resident settlor or grantor of the trust, and in particular to determine whether some or all of the so-called “grantor trust rules” in Subpart E of Subchapter J of the Federal Income Tax Law (IRC Sections 671 through 679) and related provisions should be modified or repealed, in whole or in part. Primarily as a result of the compression of the income tax rate brackets applicable to estates and trusts and the so-called “kiddie tax” in IRC Sections 1(e) and 1(g), respectively, enacted about 30 years ago, it is submitted that the bulk of those grantor trust rules are no longer needed to prevent the avoidance of income taxes, and ironically they are now utilized by taxpayers to avoid gift and save estate taxes. |

| A. Lavar Taylor & Rami M. Khory | Proposal to Establish Administrative Procedures for the Internal Revenue Service and the Department of Justice to Deal with Situations Where Court-Ordered Criminal Restitution Payable to the Internal Revenue Service Significantly Exceeds the Actual Tax Liability to Which the Restitution Relates | The paper proposes an administrative procedure for dealing with situations where the amount of criminal restitution in favor of the IRS as ordered by the District Court greatly exceeds the actual tax liability to which the restitution relates, as later determined by the IRS itself or by a court in a civil proceeding brought to determine the amount of taxes owed. Under existing law, taxpayers may not seek a reduction of court – ordered criminal restitution for which there is final court order, even though the IRS later agrees, or a court later determines in a civil proceeding , that the amount of taxes owed for civil purposes is significantly lower than the amount of criminal restitution relating to that tax liability as ordered by the District Court. This new procedure will permit taxpayers to avoid having to pay taxes, interest and penalties to the IRS where the IRS later agrees (as the result of the civil audit), or a court determines, that the amount owed as the result of the civil audit is less than the amount of criminal restitution ordered by the District Court for a given tax period. Under this procedure, taxpayers will be required to provide to the IRS proof that the taxpayer has paid to the IRS all amounts owed under Title 26 for a particular tax period, as agreed to by the IRS |

Appendix – U.S. Supreme Court Admission / Application Information

- Eligibility to be sworn in:

- Must have been admitted to practice in highest court of a State, Commonwealth, Territory or Possession, or the District of Columbia for a period of at least 3 years immediately before date of application.

- Must not have been subject of any adverse disciplinary action pronounced or in effect during that 3-year period.

- Must appear to the Court to be of good moral and professional character.

- Must have application timely submitted as a Group with $200 fee per applicant (check must be dated May 15, 2023). To submit as a group, you will need to have your completed application, Certificate of Good Standing and $200 check to the CLA office by January 23, 2023 (more details later).

- Why be admitted to the U.S. Supreme Court?

- Application Details

- 2-page Bar Admissions Form and Instructions (review these items carefully) – see links here – https://www.supremecourt.gov/filingandrules/supremecourtbar.aspx

- The application must be signed by 2 sponsors who are members of the U.S. Supreme Court and know the applicant personally and are not related to the applicant. Sponsors also list their contact information.

- Must have wet signature of sponsors on the application. Must all be on same application form.

- If you are attending the CLA Tax Section Annual Conference on November 2 – 4, if you bring your typed application, and Certificate of Good Standing from the CA Supreme Court, there are members who will be available to sign as your sponsor. If you plan to do this, please let Annette know by October 24 (Annette.nellen@sjsu.edu) so you can get the office information of the sponsors typed in first.

- We are working on getting a list of Tax Section members who are members of the Court and willing to sign for applicants.

- A Certificate of Good Standing from state supreme court or highest court (not from the state bar) must accompany your application. This certificate must be less than one year old. It will likely take two to three weeks to obtain this.

- For a template letter and instructions for the CA Supreme Court, email Annette.nellen@sjsu.edu.

- Be sure you have followed all instructions for your application – https://www.supremecourt.gov/bar/UpdatedAdmissionInstructions.pdf

- Costs

- $200 fee by check payable to the Supreme Court of the United States dated May 15, 2023 (submitted to CLA along with your application).

- To help cover costs of a photographer, a reception and some incidentals, applicants will be required to make a payment to the CLA Taxation Section (amount TBD, but likely $100 to $150) by January 23, 2023.

- Travel costs – 2023 DC Delegates will receive $1,000 to help cover costs; maximum of $1,500 per paper.