Taxation

CLA Taxation Section Delegation Travels to Washington, D.C., Drives Progress on Complex Tax Policy

July 2025

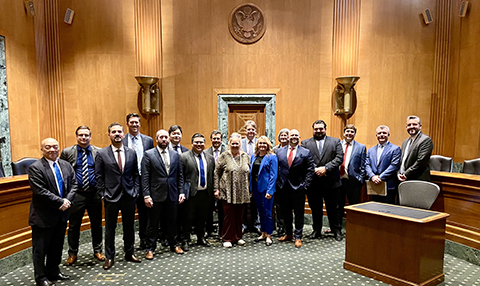

California Lawyers Association’s (CLA) Taxation Section once again brought legal expertise to the forefront of federal tax discussions during its annual Delegation to Washington, D.C. this spring. Among the critical topics raised was a proposal to improve the IRS’s filing compliance procedure, just one of several impactful issues on the agenda.

For over three decades, the Taxation Section has held the Delegation to ensure California tax attorneys have a direct line to federal decision-makers. The initiative is designed to provide meaningful input on federal tax law and policy through direct engagement with top government officials.

During the three-day visit, CLA members met with representatives from the IRS, the U.S. Department of the Treasury, the National Taxpayer Advocate’s Office, the Department of Justice Tax Division, the United States Tax Court, and members of both the House Ways and Means Committee and the Senate Finance Committee. Ahead of the visit, participants submitted carefully crafted position papers outlining current issues and offering recommendations for change.

“It is so important to get in front of the decision-makers,” said Jaclyn Zumaeta, Deputy Chief Counsel at the California Franchise Tax Board. As a member of CLA’s Taxation Section, Zumaeta also volunteered as one of the Delegation’s organizers. “Every person we met with was prepared. They read our papers, asked thoughtful questions, and wanted to hear feasible solutions.”

The trip underscores the importance of building lasting relationships with federal officials. Myriam Bouaziz, Director of the California Office of Tax Appeals and another lead organizer, highlighted the value of these in-person interactions. “We live so far away in California, so establishing and maintaining relationships in Washington, D.C. is really important. We get to visit our federal counterparts and witness their engagement. They get to talk with real practitioners and gain our perspectives.”

Months of preparation precede the Delegation. Proposals are submitted by CLA members and undergo a rigorous review process before being approved by the section’s Executive Committee. Accepted papers are presented during the visit and frequently published in prominent tax law publications such as Tax Notes and The California Tax Lawyer, a CLA journal. Many past proposals have successfully influenced federal policy.

“California is the largest state in the country. We are an economic powerhouse. Our practitioners are on the forefront,” said Bouaziz. Zumaeta added, “It is so meaningful to have a public/private relationship.”

Both attorneys emphasized how personally and professionally fulfilling the experience is and believe it could benefit other CLA sections as well. “I don’t think until you go that you recognize the gravity of it all,” Zumaeta noted. “These are the people making the decisions.”

Over the years, the Delegation has significantly raised the profile of California’s legal tax professionals in Washington and solidified their role in shaping federal tax policy.

CLA’s Taxation Section also holds a “sister” Delegation in Sacramento each year. The 2025 Sacramento Delegation is set for October 24, 2025, in-person, at the Franchise Tax Board. Papers are currently being accepted, and CLA members are encouraged to become involved in state-level issues.

For more information, please visit: https://calawyers.org/section/taxation/sacramento-delegation/