Antitrust and Unfair Competition Law

Competition: SPRING 2023, Vol 33, No. 1

Content

- 133 Years Young: Sherman Act Section Two Keeps Up With Big Tech

- Antitrust Restoration From California Anchored By a New Monopolization Synthesis

- California Should Amend the Cartwright Act To Address Single-firm Monopolization

- Competition Beyond Rivalry: Adapting Antitrust Merger Review To Address Market Realties

- Dormant Commerce Clause: a Potential Brake On State Antitrust Legislation

- Executive Committee

- Message From the Advisors

- Message From the Editor

- Over-prescription Is Bad Medicine: the Case Against a Knee-jerk Revision of Antitrust Injury

- Restrictions On Worker Mobility and the Need For Stronger Policies On Anticompetitive Employment Contract Provisions

- Should California Adopt Revisions Proposed By Congress and the New York State Legislature To Address Single-firm Conduct?

- Table of Contents

- Technological Monopolies, Innovation, and the Personal Freedom To Form Businesses: Like Oil and Water?

- The Adaptable Antitrust Laws

- The Risks of Requiring California-specific Merger Approvals

- Why Has California Waited So Long To Enact Its Own Merger Review Law?

- Updating the Cartwright Act For the Twenty-first Century: Allowing Antitrust Claims For Unilateral Conduct

UPDATING THE CARTWRIGHT ACT FOR THE TWENTY-FIRST CENTURY: ALLOWING ANTITRUST CLAIMS FOR UNILATERAL CONDUCT

By Joshua P. Davis and Julie A. Pollock1

I. INTRODUCTION

California has long been a leader in legal regulation. It sets its own standards for automobile emissions, for example, affecting how manufacturers design and build cars.2 It is often at the forefront of consumer privacy regulation.3 4 That should be unsurprising. Our federalist system encourages states to act as "experimental social laboratories."5

Further, California has a particularly strong claim to adopt its own policies. If it were a nation unto itself, it would have ranked as the fifth largest economy in the world in 2022,6 and it is trending toward fourth, behind only the rest of the United States, China, and Japan.7 Its influence on the law, then, is not out of proportion with its economic influence.

That commensurate relationship applies particularly well to antitrust. As one of the largest economies in the world, California can play a natural role in regulating how market actors compete. The U.S. Supreme Court recognized over forty years ago—in a case in which California was a plaintiff—that states may adopt their own antitrust laws.8 California has done so. Its doctrine varies in important ways from federal law, including, for example, by permitting indirect purchasers to recover damages9 and by condemning vertical price restraints as per se unlawful.10

These two divergences between federal and California law exemplify two ways in which California can contribute to effective antitrust enforcement. California law can enhance compensation and deterrence for conduct that also violates federal antitrust law. Often, indirect purchasers—and end-user consumers in particular—bear the brunt of antitrust violations, but federal law rarely affords them a means to recover their losses. Further, the prospect of liability to indirect purchasers under California law—in addition to legal exposure to direct purchasers under federal law—can help to deter antitrust violations before they occur.

[Page 24]

California law can also permit recovery when federal law would not. Vertical price restraints may inflate prices above competitive levels without sufficient countervailing procompetitive benefits. The costs and difficulties of prevailing under a rule of reason analysis, however, may mean that no one will file litigation challenging the price restraint or, if someone does, the litigation may fail when it should not.

This Article proposes that California chart its own course in an area it has not regulated to date: unilateral anticompetitive conduct. California’s antitrust law, the Cartwright Act, applies to concerted conduct but not to unilateral anticompetitive behavior. In that way, it is narrower than federal antitrust law. The time may have come, however, for that to change.

II. OVERVIEW OF CARTWRIGHT ACT

California’s primary antitrust statute is the Cartwright Act,11 enacted in 1907 "as part of a wave of turn-of-the-century state and federal legislation intended to stem the power of monopolies and cartels."12 In the period leading up to the law’s passage, cartels operated openly in several key California industries—including lumber, baking, ice production, and electrical power—engaging in price fixing and other harmful concerted action.13Historic press reports indicate that Senator Cartwright introduced the legislation to combat the state’s growing trust problem, at a time when existing common law prohibitions were thought to be ineffective.14 In May of 1907, the L.A. Times reported that the anticipated collapse of the "lumber trust" would be the greatest triumph for the new state law.15

It was in this economic context that the Cartwright Act was enacted. The statute in large part resembles Section 1 of the Sherman Act,16 outlawing a wide variety of anticompetitive conduct, including combinations or agreements to restrain trade, prevent competition, or fix prices.17 However, a key difference between the Cartwright Act and federal antitrust law is their approach to unilateral conduct. California’s Cartwright Act addresses anticompetitive conduct only if it is concerted. Federal antitrust law applies to anticompetitive conduct whether it is concerted or unilateral. This Essay suggests it is time for California to extend its antitrust laws to unilateral conduct.

Four historical developments since enactment of the Cartwright Act over a century ago are particularly relevant:

1. Microeconomics. The first is the influence of microeconomics on antitrust doctrine. One might plausibly call it a colonization in that microeconomic theory has come to dominate the doctrine.

2. Empirical Evidence. The second is the recognition (albeit only partial) that empirical evidence should drive microeconomic analysis in antitrust. California could play a leadership role in focusing on market realities—rather than theoretical assumptions—in regulating anticompetitive behavior.

3. Market Power. The third is the increase in recent decades in market power of dominant firms, including among the largest technology companies. Legislators, government regulators, small and medium-sized businesses, and private citizens are all coming to appreciate the economic—and other—harms that dominant firms can cause.

4. Forced Arbitration. The fourth is the U.S. Supreme Court’s love affair with forced arbitration. The Court has read into the Federal Arbitration Act (the "FAA") a policy in favor of pre-dispute mandatory arbitration clauses that robs many plaintiffs of any meaningful ability to enforce their legal rights, including in antitrust cases.18

These historical trends all can provide justifications for California to build on its leadership in antitrust enforcement by prohibiting the unilateral abuse of market power.

[Page 25]

Microeconomics. Beginning in the 1970s, scholars, judges, and scholar-judges19 began to transform antitrust doctrine. It went from a general and somewhat vague prohibition on unfair competition in the market to a relatively structured set of rules promoting efficiency, as economists define it. The limitation of the Cartwright Act to concerted conduct could be understood—if perhaps only ex post—as an effort to focus on particularly harmful actions. We have learned in the more than hundred years since its enactment about the dangers of unilateral conduct. Dominant market actors can use anticompetitive means to generate and profit from market inefficiencies. Just as conspiracies can be harmful, so can be unilateral action.20 It may take two to tango, but it doesn’t take two to deliberately cause economic harms.

Empirical Evidence. For a long time, antitrust analyses assumed that most anticompetitive conduct is difficult to sustain and market power is difficult to acquire and maintain. To a significant extent, they still do. Recent empirical research, however, has shown that market power is common.21 22 Often, it can be detected through direct evidence of anticompetitive effects, including the exclusion of rivals, artificially suppressed output, and artificially inflated prices. This empirical evidence creates new opportunities for preventing and policing unilateral conduct that causes anticompetitive harms.

Market Power. Recent years have also witnessed a rise in market power in the United States and elsewhere. More than 75 percent of U.S. industries have become more concentrated in the past two decades.23 Market concentration has been particularly striking in the large technology companies that constitute the so-called FAANG, that is, Facebook (now Meta), Amazon, Apple, Netflix, and Google (now Alphabet). They have attracted the ire of many Americans in part because of legitimate concerns about the anticompetitive harms they may cause (although also admittedly in part because of a perception in some quarters that they have political biases that they do not appear to possess).

Market concentration has increased with the growth of digital economies, and single technology companies often possess massive shares of digital markets. For instance, Google owns approximately 90% of the search engine market.24 Amazon accounted for 74% of all e-commerce transactions in the United States in the first quarter of 2019.25Google and Facebook together took in 90% of new online advertising dollars in 2016.26 Google and Apple together also own essentially the entire market for smart phone application platforms, with the iOS App Store accounting for 65% of app-based revenue in 2018, and Google Play Store accounting for approximately 36%.27 This increase in market power by a handful of technology companies augments the risk of anticompetitive harms and, with it, the need for antitrust laws that regulate unilateral, anticompetitive conduct.

Moreover, there are some who have been calling for more vigorous merger enforcement as U.S. markets become more concentrated,28 with notable mergers in the technology sector including Google’s 2006 acquisition of YouTube, Facebook’s 2012 acquisition of Instagram, and Microsoft’s 2016 acquisition of LinkedIn.29 Yet in California, where many large technology companies are headquartered, courts have largely eliminated the Cartwright Act’s application to mergers.30 The California Supreme Court determined more than three decades ago that a "combination" for the purposes of the Cartwright Act consists of two independent entities engaging in anticompetitive conduct, and thus does not include mergers.31The California Supreme Court stated that "the Attorney General’s view that the Cartwright Act applies to mergers is not supported."32 This decision has been affirmed by at least one court of appeals, which held that although federal law prohibits anticompetitive mergers, single-firm monopolization is not legally cognizable under the Cartwright Act.33

[Page 26]

California is uniquely situated to play a leadership role in antitrust enforcement in the technology industry. The legislature could amend the Cartwright Act to provide for robust enforcement of all anticompetitive transactions, including affiliations and mergers. By allowing private plaintiffs and the California Attorney General to challenge anticompetitive mergers in both federal and state court, the state could develop its own jurisprudence governing consolidation and contend with problems that may not be adequately addressed by federal antitrust law, such as cross-market and vertical consolidation.34

Forced Arbitration. The importance of California regulating unilateral conduct is all the greater because of the Supreme Court’s interpretation of the FAA.35 On one hand, the Court has been keen to enforce arbitration clauses, and to find they bar class procedures, even if the result is that plaintiffs have no feasible way to vindicate their rights. On the other hand, the direct purchaser rule under federal antitrust law generally requires contractual privity for private litigants seeking damages. That combination means that the private litigants who are subject to onerous arbitration provisions may well be the only ones permitted to seek damages under federal antitrust law. In other words, forced arbitration often deprives direct purchasers of the ability to sue and yet the direct purchasers are the lone private parties permitted to seek damages.

California law could ameliorate this situation. While forced arbitration may prevent direct purchasers from challenging unilateral anticompetitive conduct in court, indirect purchasers may nonetheless be able to file claims for damages.

III. ANTITRUST LAW IS UNDERENFORCED

The historical developments that have occurred since the enactment of the Cartwright Act do not provide the only reason to expand the statute. In addition, substantial empirical evidence suggests that antitrust law in general is underenforced, a problem that would be addressed significantly, although likely insufficiently, by expanded enforcement in California.36

A significant body of research suggests that antitrust litigation results in less recovery, on average, than the actual harm antitrust violations cause, even though plaintiffs in antitrust cases may recover "treble"37damages, multiple plaintiffs may recover damages for the same conduct, and, in some instances, antitrust violators may be liable both civilly and criminally.

Many factors contribute to the underenforcement of antitrust law. First, procedural obstacles cause victims to recover less than single antitrust damages. Damages recovered through antitrust litigation often omit categories of harm caused by violations. Many violations are not discovered and, even if discovered, cannot be successfully proven, including because the violators have destroyed the evidence. Because of these factors, victims of antitrust violations rarely, if ever, recover compensation equal to the full harm they suffer.38By amending the Cartwright Act to address the improper acquisition or maintenance of monopoly power, the California legislature could address the underenforcement problem and expand avenues for recovery for plaintiffs who may bring claims only under state law, such as indirect purchasers seeking damages.

A. ACTUAL RECOVERIES RESULT IN LESS THAN SINGLE ANTITRUST DAMAGES

Empirical evidence suggests that antitrust litigation on average results in recovery of less than the benefits that antitrust violators receive.39 In that way, according to standard microeconomic theory, corporations with market power have financial incentives to violate antitrust laws.40

Consider cartel cases involving horizontal price fixing. They would seem particularly susceptible to overenforcement—rather than underenforcement—as cartelists potentially face both civil and criminal liability. Moreover, the burden of proving a per se antitrust violation in a cartel case is relatively

[Page 27]

modest compared to claims evaluated under the rule of reason. Finally, civil litigation may follow on the heels of criminal litigation and, quite possibly, guilty pleas. If so, defendants may lose on whether they violated the antitrust laws as a matter of issue preclusion. Yet even in cartel cases, the evidence shows that the financial penalties that corporations pay are almost always less than single antitrust damages.41

Litigation dynamics and procedural rules may in part explain this phenomenon.42 Courts have made it progressively more difficult for antitrust plaintiffs to escape mandatory arbitration,43 to survive motions to dismiss,44 to get classes certified,45 and to survive summary judgment.46 For these and other reasons, on average—depending on how one measures—cartelists pay in total between about 19 to 66% of single antitrust damages in settlement of civil and criminal antitrust litigation.47

B. ANTITRUST DAMAGES DO NOT INCLUDE MUCH OF THE HARM CAUSED BY ANTITRUST VIOLATIONS.

There are many categories of harm that are generally not recoverable in antitrust litigation. While plaintiffs can be compensated for antitrust overcharges—i.e., the amount above competitive pricing they paid because of the conspiracy—they suffer many other kinds of harm. First, they lose the use of the extra money they paid from the time of the purchase to the time of recovery, so-called "prejudgment interest." In this way, plaintiffs are forced in effect to give antitrust violators interest-free loans. Second, non-conspirator competitors often react to price inflation by raising their own prices, causing so-called umbrella effects. Plaintiffs rarely pursue or recover umbrella damages in antitrust cases.48 Third, inflated prices discourage some purchasers from buying the good or service subject to the conspiracy, resulting in a so-called dead weight loss. Antitrust plaintiffs rarely, if ever, recover for deadweight loss.

Bob Lande has calculated that, for these and similar reasons, if a court were to award antitrust treble damages, that would amount roughly to single or at most one-and-a-half times actual harm.49 It follows that if a court were to award—or the parties were to settle for—single antitrust damages, that would really amount only to about 33 to 50% of actual harm. These figures together suggest that antitrust violators paying significantly less than the damage they cause, creating—according to standard microeconomic analysis—suboptimal incentives to abide by the antitrust laws. Permitting additional antitrust claims under California law should, all else equal, move deterrence of antitrust violations closer to optimal levels.

C. VICTIMS OF ANTITRUST VIOLATIONS RECOVER LESS THAN THE HARM THEY SUFFER.

When we combine the analysis above, we see the potential for underenforcement of the antitrust laws. The analysis in Section A suggests that cartelists on average pay—and victims receive—between about 19 to 66% of single "antitrust" damages. The analysis in Section B indicates that single "antitrust" damages range from 33 to 50% of actual harm. Combining these points, we can infer that when defendants face litigation for an antitrust violation, they on average pay—and plaintiffs receive—between 7 and 33% of actual harm.50

D. MANY VICTIMS OF ANTITRUST VIOLATIONS NEVER RECOVER AT ALL.

Another reason the victims of antitrust victims may receive inadequate compensation—and antitrust violators face insufficient deterrence—is that antitrust violators escape detection. Further, antitrust enforcers—federal and state governments and the victims of antitrust violations—may discover insufficient evidence to initiate antitrust litigation, even if they discover what they believe is an antitrust violation.

The analysis above discusses cases in which antitrust violators were forced to pay, which will not always be the case. Taking this into consideration, there is

[Page 28]

reason to believe that even in the easiest cases to prosecute—cartels subject to the per se standard—the total financial liability that antitrust violators incur—including government sanctions and private recoveries—is too low. John Connor and Bob Lande calculate that the total monetary sanctions in cartel cases are only 9 to 21% of what they should be to provide optimal deterrence of antitrust violations.51The overall analysis suggests that optimal levels of deterrence and compensation would best be achieved by increasing the total recovery of antitrust victims.

Expanding the Cartwright Act to include single-firm conduct would at least partially fix the problem of underenforcement. Increased enforcement under California law would expand judicial access for antitrust plaintiffs to whom federal laws do not apply, including indirect purchasers seeking recovery of damages.

IV. ANTITRUST ENFORCEMENT OF SINGLE FIRM CONDUCT MATTERS

Two potential criticisms of the proposal to permit claims based on unilateral conduct under the Cartwright Act are worth considering. The first is that private enforcement of the antitrust laws has no meaningful effect. The second is that even if some private enforcement is consequential, efforts to challenge unilateral conduct is not.

On the first point, an empirical study by Joshua Davis (one of the authors of this Article) and Rose Kohles shows that private enforcement through federal antitrust class actions from 2009 through 2021 have recovered just shy of $30 billion.52A separate study suggests that the deterrence effects of private enforcement may be greater than the deterrence effects of Department of Justice enforcement against price-fixing cartels.53 So private enforcement may be suboptimal—whether taken on its own or in combination with public enforcement—but it is nonetheless valuable.

On the second point, private enforcement of antitrust laws proscribing anticompetitive unilateral conduct is both valuable and significant. Section 2 of the Sherman Act prohibits a single firm from illegally acquiring or maintaining monopoly power,54guarding against the use of monopoly to block competition or gain competitive advantage. The public policy concerns with monopoly power have been identified in early Sherman Act jurisprudence;55monopoly power can harm consumer welfare, causing higher prices, reduced output, poorer quality products or services, and, in many circumstances, reduced innovation.56

The principles underlying Section 2 enforcement serve important policy goals. Still, a common belief is that cases brought under Section 2 constitute an insignificant portion of antitrust recoveries in federal court, in part because of the perception that rule of reason cases so rarely succeed that they are not worth bringing.57 While courts have deemed some Section 1 violations as unlawful per se, single firm monopoly conduct under Section 2 is evaluated under the rule of reason, a harder standard for plaintiffs.58 In fact, some studies suggest there is little private enforcement under Section 2 of the Sherman Act,59 but these analyses are easily misconstrued.60

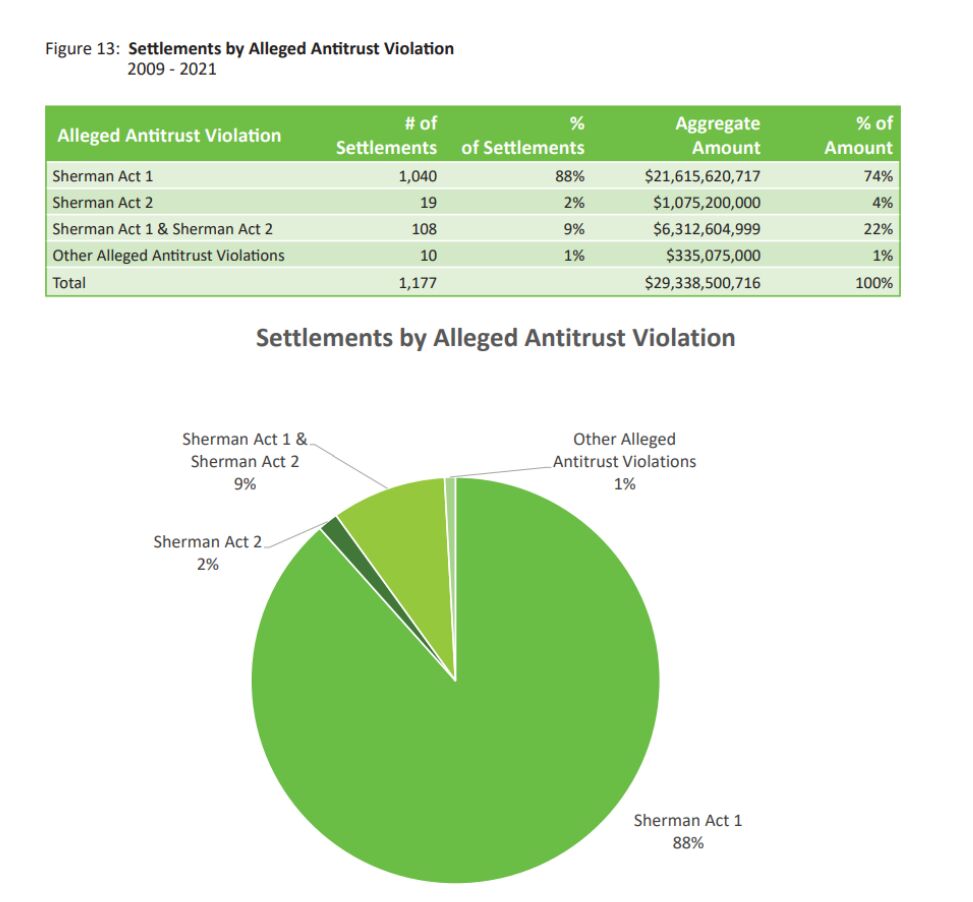

It is true that the majority of antitrust recoveries in federal court are brought under Section 1 of the Sherman Act.61 According to a study of private federal antitrust settlements between 2009 to 2021, approximately 90% of settlements occurred in cases brought under only Section 1, 2% of settlements occurred in cases brought under only Section 2, and 9% of settlements in actions pursuing both Section 1 and Section 2.62 However, when looking at the total amounts recovered in private federal antitrust cases, the spread is more balanced. Section 1 claims accounted for $21.6 billion in recoveries, or 74%, Section 2 claims accounted for over $1 billion, or 4%, and cases involving both claims settled for approximately $6 billion, or 22%.63Consider the following figure from the Davis and Kohles analysis:64

[Page 29]

Image description added by Fastcase.

Private enforcement of antitrust claims under Section 2, then, constitutes a meaningful proportion of antitrust recoveries and serves important public policy goals. Expanding the Cartwright Act to include single-firm monopoly conduct would be meaningful too.

V. CONCLUSION

Over a century ago, California enacted legislation to address anticompetitive concerted conduct, but not anticompetitive unilateral conduct. A lot has changed since then. Economists have learned about potential harms from monopoly power. Financial behemoths have formed that were unimaginable in the early nineteenth century. A sophisticated structure has developed for adjudicating state and federal antitrust claims. The moment may be ripe for California to enact a private right of action under the Cartwright Act for the unilateral abuse of monopoly power. We think there is a strong argument that it should.

——–

Notes:

1. Joshua P. Davis is a Research Professor at UC College of the Law SF and a nationally recognized expert in antitrust, civil procedure and legal ethics. He is a Shareholder and head of the San Francisco Bay Area Office of Berger Montague PC. Julie A. Pollock is an Associate in the San Francisco Bay Area Office of Berger Montague PC.

2. See Peter Valdes-Dapena, How California ended up in the zero-emissions driver’s seat, CNN Bus. (Sept. 6, 2022 6:34 PM), https://www.cnn.com/2022/09/06/business/california-emissions-regulations/index.html.

3. See, e.g., Office of Gov. Gavin Newsome, Governor Newsome Signs First-in-Nation Bill Protecting Children’s Online Data Privacy (Sept. 15, 2022), https://www.gov.ca.gov/2022/09/15/governor-newsom-signs-first-in-nation-bill-protecting-childrens-online-data-and-privacy/.

4. See, e.g., State of California Dept. of Justice, California Consumer Privacy Act (CCPA) (May 10, 2023), https://oag.ca.gov/privacy/ccpa.

5. Roth v. United States, 354 U.S. 476, 505 (1957) (Harlan, J., dissenting).

6. See Press Release, Office of Gov. Gavin Newsome, ICYMI: California Poised to Become World’s 4th Biggest Economy (Oct. 24, 2022), https://www.gov.ca.gov/2022/10/24/icymi-california-poised-to-become-worlds-4th-biggest-economy/

7. Id.

8. California v. ARC Am. Corp., 490 U.S. 93 (1989).

9. Id.

10. See, e.g., Darush v. Revision LP, No. 12-cv-10296, 2013 WL 1749539, at *6 (C.D. Cal. Apr. 10, 2013) (citing Mailand v. Burckle, 20 Cal. 3d 367, 377 (1978)).

11. CAL. BUS. & PROF. CODE §§ 16700-16770.

12. Clayworth v. Pfizer, Inc., 49 Cal. 4th 758, 772 (2010) (citing John M. Landry & Kirk A. Hornbeck, One Hundred Years in the Making: The Cartwright Act in Broad Outline, 17(2), J. ANTITRUST AND UNFAIR COMPETITION SECTION ST. BAR OF CAL. 7 (2008)).

13. Landry & Hornbeck, supra note 12, at 7-8

14. Id.

15. Id. at 7 (citing Trusts Go "Bust" In Just One Week, L.A. TIMES (May 16, 1907)).

16. While the Cartwright Act resembles Section 1, judicial interpretation of the statute by California state courts has not always mirrored that of the Sherman Act. The California Supreme Court has held that the Cartwright Act was not modeled after the Sherman Act, and thus interpretation of the Sherman Act is influential but not probative of the Cartwright drafters’ intent. Therefore, the breadth and range of the Cartwright Act has been viewed differently from that of the Sherman Act in many respects. See Aryeh v. Canon Business Sols., Inc., 55 Cal. 4th 1185, 1195 (2013) ("Interpretations of federal antitrust law are at most instructive, not conclusive, when construing the Cartwright Act, given that the Cartwright Act was not modeled on federal antitrust statutes but instead on statutes enacted by California’s sister states around the turn of the 20th century." (citing California ex rel. Van de Kamp v. Texaco, Inc., 46 Cal. 3d 1147 (Cal. 1988)); see also Cianci v. Superior Court, 40 Cal. 3d 903, 920 (1985) ("[W]e have observed that the Cartwright act is broader in range and deeper in reach than the Sherman Act.")

17. Pac. Gas & Elec. Co. v. County of Stanislaus, 16 Cal.4th 1143, 1147 (1997).

18. Am. Express v. Italian Colors, 570 U.S. 228 (2013).

19. Robert Bork and Richard Posner are notable examples of influential scholar-judges.

20. See, e.g., Standard Oil Co. of N.J. v. United States, 221 U.S. 1, 52 (1911) (the "evils which led to the public outcry against monopolies" include "(1) [t]he power . . . to fix the price and thereby injury the public; (3) [t]he power . . . of enabling a limitation on production [sic]; and (3) [t]he danger of deterioration in quality of the monopolized article which it was deemed was the inevitable result of the monopolistic control over its production and sale").

21. Gustavo Grullon, et al., Are U.S. Industries Becoming More Concentrated?, 23 REV. FIN. 697 (2019).

22. Philippon, Thomas, The Economics and Politics of Market Concentration (Dec. 2019), https://www.nber.org/reporter/2019number4/economics-and-politics-market-concentration.

23. See Grullon, supra note 21, at 698.

24. John M. Newman, Antitrust in Digital Markets, 72 VAND. LAW REV. 1497 (2019).

25. Id. at 1503.

26. Nitasha Tiku, How to Curb Silicon Valley Power-Even with Weak Antitrust Laws, WIRED (Jan 5. 2018 7:00 AM), https://www.wired.com/story/how-to-curb-silicon-valley-power-even-with-weak-antitrust-laws/.

27. Nikolas Guggenberger, Essential Platforms, 24 STAN. TECH. L. REV. 237 (2021).

28. See, e.g., Claire Kelloway, Farmers and Business Owners Testify to Harms of Lax Merger Policy (Mar. 31, 2022), https://www.foodandpower.net/latest/ag-merger-hearings-3-22.

29. Carl Shapiro, Antitrust in a Time of Populism, 61 INT’L J. INDUS. ORG. 714 (2018).

30. California ex rel. Van de Kamp v. Texaco, Inc., 46 Cal. 3d 1147 (1988) (holding that the Cartwright Act does not regulate mergers).

31. Id. at 1168.

32. Id.

33. Asahi Kasei Pharma Corp. v. CoTherix, Inc., 204 Cal. App. 4th 1, 4 (2012) (affirming summary adjudication for defendant).

34. SAMUEL M. CHANGET AL., CAL. HEALTHCARE FOUND., Examining the Authority of California’s Attorney General in Health Care Mergers, (Apr. 2020), https://www.chcf.org/wp-content/uploads/2020/04/ExaminingAuthorityCAAttorneyGeneralHealthCareMergers.pdf.

35. Many commentators have criticized the Court’s interpretation of the FAA. See, e.g., Myriam Gilles, The Day Doctrine Died: Private Arbitration and the End of Law, 2016 U. ILL. L. REV. (2016). Nonetheless, it will remain the law of the land for the foreseeable future.

36. W. Bradley Wendel & Joshua P. Davis. Complex Litigation Funding: Ethical Problem or Ethical Solution?, 74 HASTINGS L.J. 1459 (2023).

37. Antitrust "treble" damages capture much less than three times the harm that an antitrust violation actually causes, as described in Section III.A.

38. John M. Connor & Robert H. Lande, Not Treble Damages: Cartel Recoveries Are Mostly Less than Single Damages, 100 IOWA L. REV. 1997 (2015).

39. Bradley & Davis, supra note 36.

40. John M. Connor & Robert H. Lande, Cartels as Rational Business Strategy: Crime Pays, 34 CARDOZO L. REV. 437 (2012) (explaining that monetary sanctions even in cartel cases—the easiest antitrust cases to prosecute—are only 9 to 21% of what they should be for optimal deterrence).

41. Connor & Lande, supra note 38.

42. See generally Robert Klonoff, The Decline of Class Actions, 90 WASH. U. L. REV. 729 (2013) (discussing ways in which courts have made prosecuting class actions more difficult).

43. Am. Express Co. v. Italian Colors Rest., 570 U.S. 228 (2013).

44. Bell Atlantic Corp., v. Twombly, 550 U.S. 544 (2007).

45. In re Rail Freight Fuel Surcharge Antitrust Litig., 934 F.3d 619 (D.C. Cir. 2019) (holding that class certification was inappropriate where 12.7% of absent class members were uninjured); In re Asacol Antitrust Litig., 907 F.3d 42 (1st Cir. 2018) (suggesting that class certification may be inappropriate if a class contains uninjured members and plaintiffs must rely on declarations or affidavits to determine which class members were injured); In re Hydrogen Peroxide Antitrust Litig., 552 F.3d 305, 316 n. 14 (3d Cir.2008); but see Olean Wholesale Grocery Cooperative, Inc. v. Bumble Bee Foods LLC, 31 F.4th 651 (9th Cir. 2022) (en banc) (holding that courts may certify classes containing uninjured members and approving practical approaches to establish common issues predominate for purposes of certification); see also Joshua P. Davis & Eric L. Cramer, Antitrust, Class Certification, and the Politics of Procedure, 17 Geo. Mason L. Rev. 969 (2010) (explaining ways in which courts have made class certification more difficult, particularly in antitrust cases); Joshua P. Davis & Eric L. Cramer, Of Vulnerable Monopolists?: Questionable Innovation in the Standard for Class Certification in Antitrust Cases, 41 RUTGERS L. REV. 355 (2009) (explaining ways in which courts have made class certification more difficult, particularly in antitrust cases).

46. Matsushita Elec. Indus. Co., Ltd. v. Zenith Radio Corp., 475 U.S. 574 (1986).

47. Connor & Lande, supra note 38 at 1998. The article focuses on settlement of antitrust cases. That is appropriate given that the vast majority of legal actions are resolved through settlement. See, e.g., Marc Galanter & Angela M. Frozena, A Grin without a Cat: The Continuing Decline & Displacement of Trials in American Courts, 143 DAEDALUS 115 (2014).

48. See, e.g., Mid-West Paper Prod. Co. v. Cont’l Group Inc., 596 F. 2d 573 (3rd. Cir. 1979) (denying standing to umbrella purchasers).

49. Robert H. Lande, Are Antitrust "Treble" Damages Really Single Damages, 54 Ohio State L. J. 115 (1993).

50. The lower bound should be calculated by multiplying the lowest percentages—20% times 33%—and the higher bound by multiplying the highest percentages—67% times 50%. The results range from about 7 to 33%.

51. Connor & Lande, supra note 40.

52. JOSHUA P. DAVIS & ROSE KOHLES, CENTER FOR LITI. AND COURTS, UNIV. L.S.F., 2021 ANTITRUST ANNUAL REPORT: CLASS ACTIONS IN FEDERAL COURT, at 16.

53. Robert H. Lande & Joshua P. Davis, Comparative Deterrence from Private Enforcement and Criminal Enforcement of the U.S. Antitrust Laws, 2011 BYU L. Rev. 315; Robert H. Lande & Joshua P. Davis, The Extraordinary Deterrence of Private Antitrust Enforcement: A Reply to Werden, Hammond, and Barnett, 58 Antitrust L. Bull. 173 (2013).

54. 15 U.S.C. § 2.

55. Standard Oil Co. v. United States, 221 U.S. 1, 52 (1911) (the "evils which led to the public outcry against monopolies" include "(1) [t]he power . . . to fix the price and thereby injury the public; (3) [t]he power . . . of enabling a limitation on production [sic]; and (3) [t]he danger of deterioration in quality of the monopolized article which it was deemed was the inevitable result of the monopolistic control over its production and sale.").

56. Sherman Act Section 2 Joint Hearing: Welcome and Overview of Hearings Hr’g Tr. 25, June 20, 2006 (Barnett) (identifying as "a major harm of monopoly" the possibility that a monopolist may not feel pressure to innovate); Sherman Act Section 2 Joint Hearing: Refusals to Deal Panel Hr’g Tr. 55, July 18, 2006 (Salop) ("Monopolists have weaker innovation incentives than competitors."); Peter C. Carstensen, False Positives in Identifying Liability for Exclusionary Conduct: Conceptual Error, Business Reality, and Aspen, 2008 WIS. L. REV. 295, 306 (2008) ("a monopolist has no incentive to support technological innovation that could undermine its dominant position in the market").

57. Joshua P. Davis & Robert H. Lande, Toward an Empirical and Theoretical Assessment of Private Antitrust Enforcement. 36 SEATTLE UNIV. L. REV. 1269, 1290 (2012).

58. See, e.g., C. Paul Rogers III , The Incredible Shrinking Antitrust Law and the Antitrust Gap, 52 U. Louis. L. Rev. 67 (2013); see also American Economic Liberties Project, What You Need to Know About Section 2 of the Sherman Act (Oct. 8, 2020), https://www.economicliberties.us/our-work/section2-explainer/.

59. Michael Carrier, The Rule of Reason: An Empirical Update for the 21st Century, 16 GEO. MASON. L. REV. 827, 828-29 (2009).

60. Professor Michael Carrier analyzed final judgments involving a rule of reason claim in federal court for a ten-year period from 1999 to 2009, and concluded that defendants won 221 or 222 cases. That result could be misleading because a very high percentage of cases settle before a final judgment, See, e.g., Marc Galanter & Angela M. Frozena, A Grin without a Cat: The Continuing Decline & Displacement of Trials in American Courts, 143 Daedalus 115 (2014), and most judicial rulings are likely to be final if defendants win, but not if plaintiffs win. If a court grants a motion to dismiss or for summary judgment, a defendant may well obtain a favorable final judgment. In contrast, if a court denies a motion to dismiss or for summary judgment, ruling for plaintiffs, the litigation almost always continues. In the vast majority of cases, successful plaintiffs survive in court until they obtain a favorable settlement. They very rarely receive a final judgment in their favor. As a result, Professor Carrier’s methodology eliminates almost every way plaintiffs would be expected to win. Professor Carrier is an excellent scholar, but on this one issue we think he has missed the mark.

61. DAVIS & KOHLES, supra note 52, at 17.

62. Davis & Kohles, supra note 52, at 17.

63. Davis & Kohles, supra note 52, at 17.

64. Davis & Kohles, supra note 52, at 16.

[Page 30]