Taxation

The Runoff Rundown: Enabling the Dividends Received Deduction for Dividends Paid by Captive Insurance Companies in Runoff

By Saba S. Shatara Reed Smith LLP and Zachary K. McDaniel Reed Smith LLP[1]

The comments contained in this paper are the individual views of the authors who prepared them, and do not represent the position of the California Lawyers Association or of the Taxation Section.

Introduction

Dividends paid by captive insurance companies are eligible for an 85 percent dividend received deduction (“DRD”) for qualified dividend amounts. What constitutes a qualified dividend is determined by the five-year average ratio of third-party premiums written by the captive insurance company to its overall profit. While this calculation is reasonably straightforward, the realities faced by captive insurers often prevent the application of the DRD to otherwise qualified dividends. This complication stems from captive insurers entering “runoff,” which is when they cease writing premiums. This may happen for numerous reasons, such as a restructuring, moving away from certain markets or products, merger, or simply the termination of business activities. A captive insurance company may wish to distribute its cash reserves to its ultimate owner at such a time; however, it must retain cash reserves in order to satisfy outstanding premiums. This is because insurance companies, even those in runoff, face risk-based capital (“RBC”) requirements to ensure they can fulfill their financial obligations to policyholders.

Because captive insurers are no longer writing third-party premiums the ratio to determine qualifying dividends changes annually, eventually hitting zero by the end of the fifth year of runoff. To the extent a captive insurer cannot issue dividends during that five-year period, any dividends it pays may no longer qualify for the DRD. This dramatically increases the tax costs of making a dividend and flies in the face of the legislature’s intent for this statute.

This paper discusses the history and basic functioning of the rules associated with the

DRD for dividends paid by captive insurance companies. It also addresses why runoff makes California’s unusual dividends received deduction framework even stranger. It then proposes a statutory amendment to remedy any inability to apply the DRD to qualified dividends paid.

Background

A History of the DRD for Dividends Paid from Captive Insurance Companies

Under the California Constitution, insurance companies are not taxed under the corporate franchise tax.[2] Instead, they are taxed based on the amount of gross premiums, less return premiums, received from business done in California.[3] Among the insurance-specific statutes stemming from this constitutional provision are unique rules covering when dividends may be deducted when computing taxable income.

California Revenue and Taxation Code (“CRTC”) section 24410 provides the rules governing the California DRD for captive insurance companies. The current CRTC section 24410 was created with the intent of remedying the legislative gap left by Ceridian Corp. v. Franchise Tax Board, 85 Cal.App.4th 875 (2000).[4] Prior to Ceridian Corp., CRTC section 24410 only allowed DRD for companies domiciled in California and even then only allowed the deduction for dividends determined to be paid from income from California sources[5] The Ceridian Corp. court found both the domicile and income-based restrictions on DRD unconstitutionally discriminatory against interstate commerce and struck them down.[6] As a result of this decision, companies receiving dividends from insurance companies adopted the position that 100 percent of these dividends were deductible, while the Franchise Tax Board (“FTB”) argued none of the dividends were deductible.[7] The California Legislature enacted Assembly Bill 263 with the specific purpose of finding a middle ground where a portion of the dividends were subject to DRD.[8] The Legislature’s reasoning addressed the facts that while a 100 percent DRD allows for taxpayers to avoid California franchise tax through ownership of an overcapitalized insurance company,[9] denying all deductions would have a negative effect on California’s economy.[10] Assembly Bill 263 attempted to balance these factors in a manner tailored to insurance companies, which do not otherwise qualify for DRD under California law.[11]

The Mechanics of the DRD for Dividends Paid From Captive Insurance Companies.

CRTC section 24410 generally provides that a corporation that owns 80 percent or more of each class of stock of an insurer is entitled to an 85 percent DRD for qualified dividends received from that insurer. However, California (1) disallows the 85 percent DRD under CRTC section 24410(d) for dividends attributable to premiums received or accrued by the insurance company from a member of the insurances company’s commonly controlled group; and (2) limits the amount of the dividend that qualifies for the DRD to the total amount of dividends received from the insurer, multiplied by the insurer’s “qualified dividend percentage.” The qualified dividend percentage is determined under CRTC section 24410(c) and is generally calculated based on the amount of the net written premiums for all the insurance companies in the commonly controlled group for the preceding five years over the total income of the insurance companies in the commonly controlled group, including premium and investment income, for the preceding five years. This ratio is then evaluated against an “applicable percentage” described in CRTC section 24410(c)(4)(B)—70 percent in 2025.[12] Should the five- year average ratio exceed the applicable percentage, the qualified dividends percentage is 100 percent.[13] If the ratio is less than the applicable percentage and greater than 10 percent, the qualified dividends percentage is the five year average net written premiums for that taxable year over the applicable percentage times the five year average total income for that taxable year.[14] If the ratio is equal to or less than ten percent, the qualified dividends percentage is zero.[15]

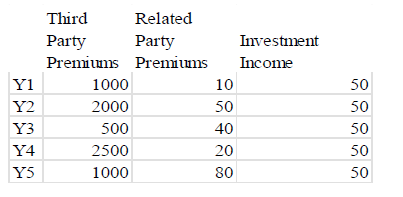

In practice, this works as follows. This scenario has the captive insurance company (CapCo) writing more than 70 percent third party premiums in the following amounts:

(Fig. 1)

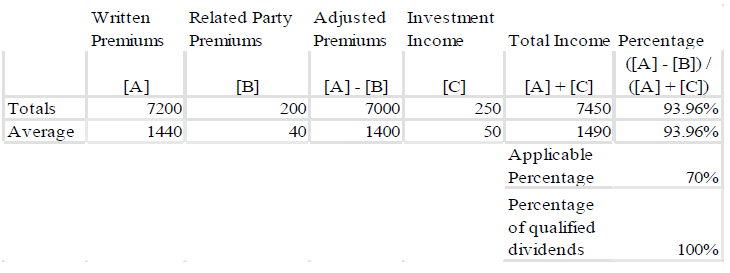

The calculations occur in a three-step process. First, the qualified dividend percentage is calculated. The qualified dividend percentage is the five-year average of written premiums less any related party premiums (the “adjusted premiums”) over total income expressed as a percentage.[16] If that percentage is greater than 70 percent, all dividends are qualified. If that percentage is less than 70 percent but greater than 10 percent, a percentage of dividends equal to the adjusted premiums over total income is qualified. If the qualified dividend percentage is less than 10 percent, no dividends are qualified.

Thereafter, the example of the calculations for the qualified dividend percentage for CapCo are as follows:

(Fig. 2)

Because more than 70 percent of premiums are written to third parties, 100 percent of dividends are qualified.

The next step is to calculate the dividend eligible for DRD.[17] Because premiums written to entities in the control group are not eligible for DRD, the percentage of premiums attributable to the control group must be removed from the total cash distribution as ineligible. Continuing with the example above, and given a proposed cash dividend of $1,000:

| Total Net Written Premiums | 7200 |

| Net Written Premiums – 3rd Party | 7000 |

| Net Written Premiums – Received From Control Group | 200 |

| Percentage of Premiums Attributable to Control Group | 3% |

| Total Capco Cash Distribution | $ 1,000.00 |

| Dividends Not Eligible for DRD | $ 27.78 |

| Dividends eligible for DRD | $ 972.22 |

(Fig. 3)

A total of $972.22 is eligible for DRD.

Finally, the total insurance dividend received is multiplied by the qualified dividend percentage and the 85 percent DRD allowance for a final DRD amount:

| Percentage of Ownership of Dividend Payor | 100% | |

| Total Insurance Dividends Received | <A> | $ 972.22 |

| Qualified Dividend Percentage | <B> | 100% |

| DRD at 85% of Qualifying Dividends | <A> x <B> x 85% | $ 826.39 |

(Fig. 4)

The total DRD on a $1,000 distribution from CapCo is therefore $826.39.

Risk-Based Capital Requirements

As described above, the mechanics of this calculation are significantly impacted because insurance companies (even those in runoff) face risk-based capital (“RBC”) requirements to ensure they can fulfill their financial obligations to policyholders.[15] The RBC requirement is a statutory minimum level of capital that is based on two factors: (1) an insurance company’s size; and (2) the inherent riskiness of its financial assets and operations.[19] That is, the company is required to hold capital in proportion to its risk. RBC is intended to be a regulatory standard and not necessarily the full amount of capital that an insurer would need to hold to meet its objectives.[20] Accordingly, the requirement to keep sufficient cash to satisfy this proportion of financial obligations typically exists for many years after an insurance company ceases to write premiums—until the expiration of the remaining held policies.

Problem Presented and Proposoal

Captive insurance companies in runoff are often required to retain a large amount of earnings and RBC from third party premiums that, pursuant to CRTC section 24410 subsections (c) and (d), could be subject to the 85 percent DRD if distributed while the insurance company was not in runoff. Based on a strict reading of CRTC section 24410, a distribution made while an insurance company is in runoff for more than five years may not be eligible for any DRD. This is because the qualified dividend percentage is eventually reduced to zero due to a lack of written premiums—third-party or otherwise—for the previous five years. The lack of premiums means the numerator of the qualified dividend percentage (the net premiums written) is zero. Thus, a dividend paid by a captive insurer under these circumstances would not be entitled to the DRD and would therefore be subject to California franchise tax, even if a DRD would have been available for at least a portion of this dividend if a distribution was made immediately upon the captive insurance company entering runoff.

Essentially, absent the requirement of California’s insurance laws to hold cash for years after ceasing to sell premiums to meet its RBC requirements, the captive insurance company would have been able to utilize the 85 percent DRD on all distributed premiums obtained from unrelated third parties. Thus, the legislative intent allowing the DRD under CRTC section 24410 is frustrated by the practical requirements of the California Insurance Code.

The solution to this problem lies in amending CRTC section 24410 to account for a captive insurance company’s premiums and income from the five years prior to entering runoff to ensure the DRD a company receives matches its business profile. Should the captive insurance company exit runoff and begin writing premiums again, each succeeding year post-runoff would remove the earliest year preceding runoff from consideration until five years have passed.

Rationales In Support of Amendment

The following section sets forth some of the reasons to adopt the proposed change to CRTC section 24410 to effectuate the utilization of the DRD for dividends paid from captive insurance companies.

Ensuring CRTC Section 24410 Conforms with the Legislative Intent Given Business Realities of Captive Insurance Companies

As noted above, CRTC section 24410 was initially a protectionist statute designed to incentivize insurance companies doing business in California by only allowing DRD to California domiciled insurance companies’ California income.[21] After this version of CRTC section 24410 was struck down as unconstitutional in Ceridian Corp., Assembly Bill 263 was adopted to permit application of the DRD for insurance company dividends to encourage these entities to do business in the state.[22] The text contained within Assembly Bill 263 clearly indicates an intent to allow insurance companies to utilize DRD for the sake of California’s economy, even at the expense of tax revenue.[23]

In enacting Assembly Bill 263, the Legislature carefully weighed this interest again the fiscal impact of a broad DRD in this context and, ultimately, designed a framework to allow a meaningful DRD for dividends paid by insurance companies. Like the previous version of the law, the current iteration of CRTC section 24410 bases the proportion of qualifying dividends on the amount of economic benefit that insurance company provides California without discriminating against interstate commerce. Specifically, it rewards insurance companies for writing third-party premiums and encourages economic growth in this sector.[24] Deductions are generally a matter of legislative grace[25] thus, the Legislature could have passed legislation ratifying the FTB’s post-Ceridian Corp. position that no dividends paid by captive insurance companies are eligible for DRD. However, in adopting CRTC section 24410 which sets forth a system for calculating DRD eligibility based on the captive insurance company’s premium writing, it is clear the Legislature wanted to permit this DRD and support the activity of writing third-party premiums in the state.

Thus, given that captive insurance companies in runoff are sometimes unable to issue dividends within the five-year period contemplated by CRTC section 24410 due to RBC requirements, this application of CRTC section 24410 frustrates legislative intent and undermines the goal of encouraging this activity within the state. Therefore, a fix is therefore needed to ensure CRTC section 24410 functions as intended with respect to these entities.

Accounting for the Runoff Period Also Ensures Qualified Dividends Are Accurately Reflected.

Another reason to amend CRTC section 24410 is that, by using a five-year average ratio of third-party premiums to overall profit to determine what proportion of dividends are qualifying, there is the potential that qualified dividends may be over-represented. For example, if a captive insurance company in runoff for five years issues a single third-party policy in year six, this may result in a greater portion of its dividends being eligible for the 85 percent DRD, if the captive insurance company’s business model prior to entering runoff did not follow a high- third-party premium model. Given that premiums generally make up the majority of income from insurance companies, runoff—where no premiums are written—means a substantially reduced income for an insurance company.[26] One premium written at the end of a period with minimal income could result in the ratio of premium income to all income in the past five years exceeding the 70 percent mark and qualifying all dividends for 85% DRD. This result does not comport with the Legislature’s intent for establishing the ratio for qualified dividends from captive insurers.

Notably, the FTB has been granted authority under CRTC section 24410(f)(3) to prescribe regulations necessary to provide for the applicable ratio for those amounts subject to the DRD, “the inclusion or exclusion of items of investment income to prevent distortion causing significant reduction in those ratios.” This provides the FTB with the authority to address this scenario and prevent a result that would frustrate the purpose of the legislatively prescribed deduction. However, this imposes an administrative burden on the state to identify and actively remedy distortion through the regulatory process. As such, a legislative fix to account for runoff would both protect taxpayers’ access to the DRD and would protect the interest of the state in ensuring the appropriate measure of qualified dividends based on the captive insurance company’s business activities in the state.

Correcting CRTC Section 24410 to Account for Runoff is Consistent with and Reinforces the RBC Requirement

Lastly, to make a distribution of retained earnings, an insurance company in runoff must obtain permission from the California Department of Insurance to ensure there are sufficient funds available to pay out premiums. The RBC requirement was put into place largely to safeguard those with outstanding insurance premiums. However, this requirement has the unintended consequence of limiting access to the DRD for qualifying dividends, for the reasons discussed above. Accordingly, there is a tension between the safeguard of the RBC requirement and the desire of the captive insurer to pay dividends at the earliest possible time. Correcting CRTC section 24410 to account for the runoff period and the RBC requirements may cure this tension and can reduce the need for captive insurers to seek to make dividends at the earliest possible instance. This could help to reinforce the purpose of the RBC requirement and protect the interests those with outstanding premiums.

Considerations for Implementation

The primary consideration in enacting this change to CRTC section 24410 is the potential revenue impact of greater DRD use, though the authors do not attempt to measure this impact here. However, for the reasons discussed above, the proposed change (1) is consistent with the legislative intent behind permitting a DRD to apply for dividends paid for by captive insurancecompanies; (2) mitigates the risk of the qualified dividends being over or under reflected if the status quo persists; and (3) reinforces the policy rationales behind the RBC requirement.

Conclusion

By amending CRTC section 24410 to use the years prior to and succeeding a runoff period in calculating DRD, the Legislature will ensure the law is applied fairly, equally, and in the manner envisioned by the original drafters. The current structure of the law allows for distortion and results in the law not operating as intended.

1The comments contained in this paper are the individual views of the authors who prepared them, and do not represent the position of the California Lawyers Association or of the Taxation Section.

2Cal. Const., art. XIII, § 28.

3Cal. Const., art. XIII, § 28.

42004 Cal. A.B. 0263, § 6(a)(1).

5Ceridian Corp. v. Franchise Tax Board, 85 Cal.App.4th 875 (2000)

6Id.

72004 Cal. A.B. 0263 § 6(a)(3).

82004 Cal. A.B. 0263 § 6(a)(4).

92004 Cal. A.B. 0263 § 7(a).

102004 Cal. A.B. 0263 § 6(a)(4).

112004 Cal. A.B. 0263 § 6(a)(2).

12CRTC § 24410(c)(4)(B).

13CRTC § 24410(c)(1).

14CRTC § 24410(c)(2).

15CRTC § 24410(c)(3).

16CRTC §§ 24410(c)(4)(A); (d)(2); (e)(1 – 3).

17CRTC § 24410(d)(1).

18See generally California Insurance Code §§ 739-739.12: Article 4.1. Risk-based Capital For Insurers

19NAIC Risk-Based Capital, available at https://content.naic.org/insurance-topics/risk-based- capital#:~:text=The%20RBC%20requirement%20is%20a,in%20proportion%20to%20its%20risk.

20Id.

21Ceridian Corp. v. Franchise Tax Board, 85 Cal.App.4th 875 (2000) see also CRTC § 24410 (1968).

22See Assembly Committee on Revenue and Taxation, AB 263, Aug. 17, 2004 at 4 (“The author intends this bill to … stimulate investment in California.”).

23See id. (noting both the potential for economic loss and the potential increase in capital investment in California.).

24See California Senate Floor Analysis on AB 263, 2003 – 04 Leg. Sess. at [2] (this bill “[p]hases out he amount of allowable deduction based on the ratio of premiums earned to total income earned . . . [t]his phase out is designed to limit the tax benefits of corporations which overcapitalize . . . insurance subsidiaries . . . even though the insurance subsidiaries write few, if any premiums.”).

25New Colonial Ice Co. v. Helvering, 292 U.S. 435, 440 (1934)

26Elizabeth F. Vieyra & Tim Law, Insurance companies in run-off, THE POLICYHOLDER PERSPECTIVE (Nov. 10, 2021), https://www.policyholderperspective.com/2021/11/articles/insurance-coverage/insurance-companies-in-run- off/